Typically, when customers use and purchase financial services, they do not put much thought into the particular use of financial products and services until something goes wrong (the service takes too long, it’s too confusing, or they’re unable to access it). This fact alone establishes digital transformation in finances as a strategic imperative, rather than just a vision of the future.

Through this article, we will define the concept of digital transformation in financial services, detail the reasons often attributed to why digital transformation will be pursued by the financial services industry, provide examples of successful digital transformation, and discuss current trends that will determine where the financial industry is headed.

What is Digital Transformation in Financial Services?

Digital transformation in finance is the act of applying digital technologies to improve operations and deliver more personalized customer experiences. In other words, the digital transformation means financial institutions break down data silos, modernize workflows, and redesign how customers interact with their services.

Digital transformation for financial services enables banks and financial institutions to stay competitive because its driver is always placing user needs at the center. This means understanding behaviors, removing friction in every touchpoint, and creating services that feel simple and consistent.

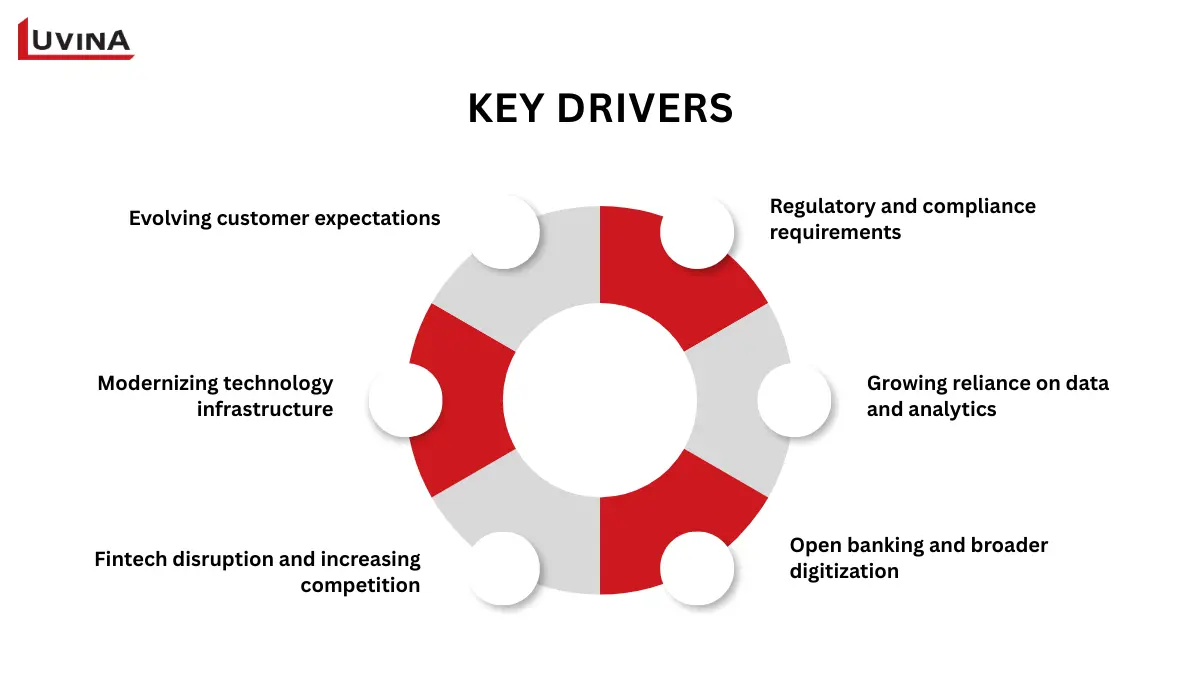

Key Drivers Behind Financial Digital Transformation

As technology advances at an increasing rate, combined with rising consumer demand for faster service delivery options among other things, the digital transformation in finance is driven by 3 major factors: consumer demand, competition and technology.

Evolving customer expectations

Consumer demand has shifted so significantly that they now require the same level of expectation regarding service delivery within their financial institution as they would with any other retail relationship. Therefore, financial institutions must look at their current digital interactions and redesign them according to consumer behaviour.

Modernizing technology infrastructure

To support improved efficiency, decreased reliance on manual processing, and increased capability for scalability as it relates to core banking functions, financial institutions are moving towards Artificial Intelligence (AI), automated processes, and cloud computing.

Fintech disruption and increasing competition

Fintechs are a key player in this digital transformation in finance, as they offer different models for service delivery than what has traditionally existed within the financial services industry and have accelerated digital transformation initiatives by driving financial institutions to accelerate their digital transformation efforts while simultaneously improving online interaction with customers.

Regulatory and compliance requirements

The introduction of regulatory and compliance requirements, such as the General Data Protection Regulation (GDPR), as well as Anti-Money Laundering (AML) regulations and cybersecurity standards, has all added to the complexity of financial services organisations’ ability to ensure they have effective data governance, automation of controls and accurate monitoring of sensitive data being collected from consumers.

Growing reliance on data and analytics

Since financial institutions increasingly rely on data analysis to develop their products, with advanced analytics in digital transformation in finance, it becomes possible to combine previously disconnected data sources into one complete view, thereby supporting improved decision-making and enabling more accurate risk assessment and new product development.

Open banking and broader digitization

Open banking, including the development of API-based ecosystems (the ability of software programs to communicate with each other) and the formation of fintech partnerships, provides financial institutions with additional opportunities to provide a greater breadth of services to their clients while supporting development and innovation through digital transformation in financial services.

Benefits & Value Created by Digital Transformation in Finance

Banks and financial institutions must re-evaluate their operations, service, and security ecosystems as digital channels become the default way consumers handle their money. The emergence of automation, artificial intelligence, the Internet of Things, and data-driven decision-making has moved digital transformation in finance from a long-term goal to a must. This change is generating fresh forms of value throughout the financial services landscape. The main advantages include:

| Benefit | Description |

| More client-focused services | When financial companies bring all their data together, they can actually tailor products to each client and even predict what they’ll need next. The digital transformation in financial services makes these personalized experiences possible. |

| Enhanced operational agility | With automation and cloud tools, teams skip the tedious stuff and move fast. Decisions happen quicker, and everything just runs smoother. |

| Easier regulatory compliance | Modern platforms take a lot of the pain out of compliance. They handle updates automatically, make reporting more accurate, and keep everything ready for audits. No more scrambling to meet the latest rules. |

| Faster customer growth | With a digital-first approach, open offers, and 24/7 access, it’s a lot easier to attract new customers. |

| Stronger security | Stronger security helps to protect sensitive data and lowers fraud risks across digital channels using sophisticated security systems. |

| Modernized investment banking | Data-driven systems and consolidated customer profiles allow more targeted, customer-led investment products made possible by digital transformation in finance to become modern investment banking. |

| Daily, real-time engagement | Mobile-first environments enable daily, real-time connection and secure, regular banking operations. |

Why is digital transformation necessary in finance?

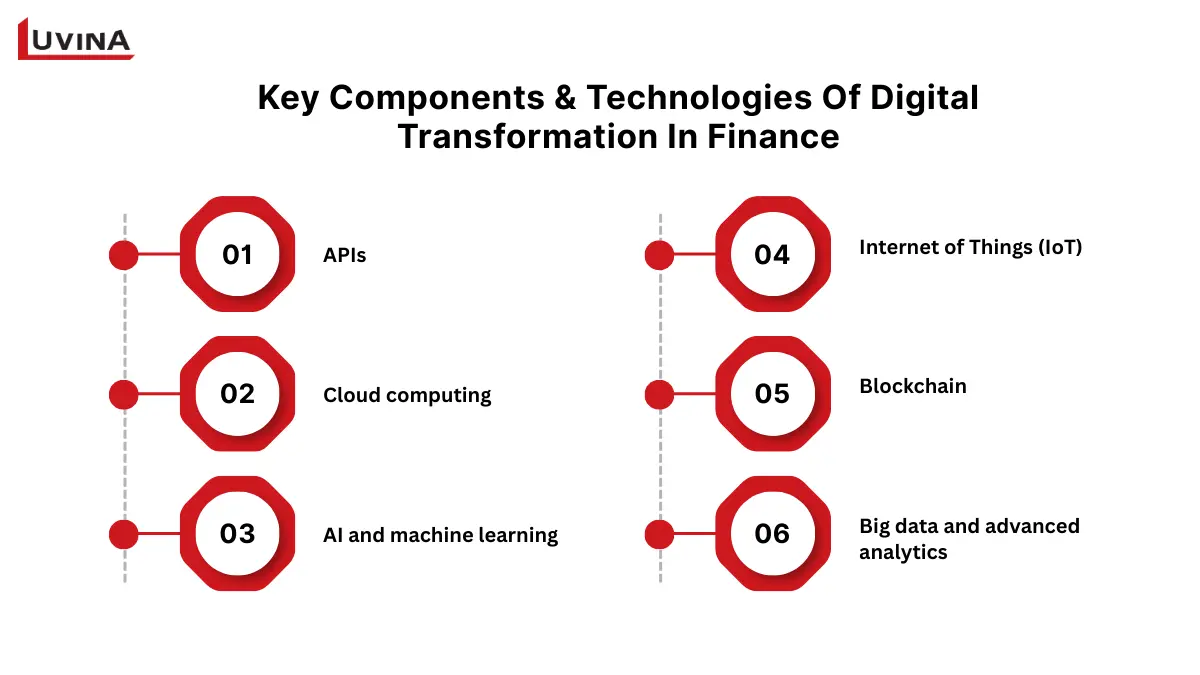

Core Components & Technologies Enabling Digital Finance

The technologies driving digital transformation in finance have evolved into the basis for long-term competitiveness as financial institutions quicken their move towards contemporary operating models. These main elements transform how data is utilized, service delivery, and banks’ scale innovation. Key technologies enabling this new digital financial ecosystem are:

The important components and technologies required as the finance industry goes digital

APIs

APIs let several systems communicate and share information without having to create features from scratch. APIs let banks link with fintech partners, quickly include new services, and produce customized digital products in a digital financial environment. By eliminating internal divisions, this connectivity accelerates institutional innovation.

Cloud computing

On-demand access to computing resources on cloud platforms enables banks to quickly scale operations and analyze financial information in real time. Through pay-as-you-go models, this supports advanced analytics, strengthens business continuity, and lowers IT expenses.

Modern digital transformation finance projects also need the flexibility offered by cloud-native systems, hence facilitating quicker product development and more robust system resiliency.

AI and machine learning

AI and machine learning have become the backbone of automating physical tasks, handling huge piles of data, and creating personalized customer experiences. Look at banks, for example. They lean on machine-learning models to spot fraud, analyze customer behavior, and predict risk. On top of that, they use AI chatbots to tackle basic customer service questions. These tools help organizations work more precisely and shift gears quickly when customer habits change, which is pretty much essential in digital transformation in finance.

Internet of Things (IoT)

Physical objects, including wearables, payment terminals, and mobile sensors, are linked financially through IoT. This connection makes it possible more safer authentication methods, real-time account interactions, and immediate contactless payments. IoT also offers fresh risk assessment and operational monitoring data points for banks.

Blockchain

Blockchain technology makes transactions safer, decentralized, and more transparent. Since you can’t tamper with it, people trust it more, settlements happen faster, and there’s less fraud. Banks tap into blockchain to speed up transactions, tighten up identity management, and stay on top of compliance. Because everything’s out in the open, blockchain is really changing how financial services work in today’s digital world.

Big data and advanced analytics

Data analysis within the financial services sector is achieved with the use of big data software tools, enabling the analysis of large volumes of transactions and simultaneously capturing market trends and behaviours at a broader scale. This results in improved insight to enable fraud surveillance, risk forecasting, customisation of offers, and improved organisational strategic decision-making.

Moreover, advanced analytics improves the customer experience and drives the global strategy of digital transformation in finance by converting raw data into usable knowledge.

Real-World Use Cases & Examples

Looking at how financial institutions utilize modern technology in reality clarifies its effect most clearly. These actual examples below show how new business models are being made possible and long-standing problems are being solved by digital transformation in finance.

Bunq – AI-powered fraud detection

Bunq applies AI and machine learning to evaluate each transaction and stop money laundering. Using Nvidia’s AI platform, its system reviews more than 500 parameters per payment – including timing, input speed, and transaction amount – to determine whether activity is legitimate. This data-driven approach strengthens fraud prevention and reflects the growing importance of digital transformation in finance in risk management.

Close Brothers – Robotic process automation in payouts

Close Brothers automates tasks for payment processing, formerly done manually by UiPath RPA. The machine gets papers, flags missing data, and gets final review files ready. This lets teams concentrate on more valuable tasks while lowering mistakes and delays brought about by people.

The bank currently uses the same automation framework across other business divisions to boost general efficiency by way of digital transformation for finance.

Monzo – Digital-only banking platforms

Monzo shows how mobile-first banks can provide entirely digital services with cheaper fees and user-friendly features. Straight in the app, consumers control expenses, create budgets, and use financial instruments.

The bank demonstrates how digital-only models keep driving digital transformation in finance toward more adaptable and accessible banking experiences as it expands into Europe and launches new products, including mortgages and pensions.

Citi – Global modernization through cloud and AI

Simplification of its worldwide technology infrastructure and use of sophisticated artificial intelligence tools form Citi’s transformation emphasis. More than 1,200 obsolete applications were retired by the bank, along with main systems transferred to Google Cloud to boost performance and scale.

Citi also uses artificial intelligence in internal processes by releasing tools to aid staff in searching policies and summarizing documents, as well as generative AI for large-scale automated code reviews. These initiatives show how sophisticated systems and current infrastructure enable major digital transformation in finance.

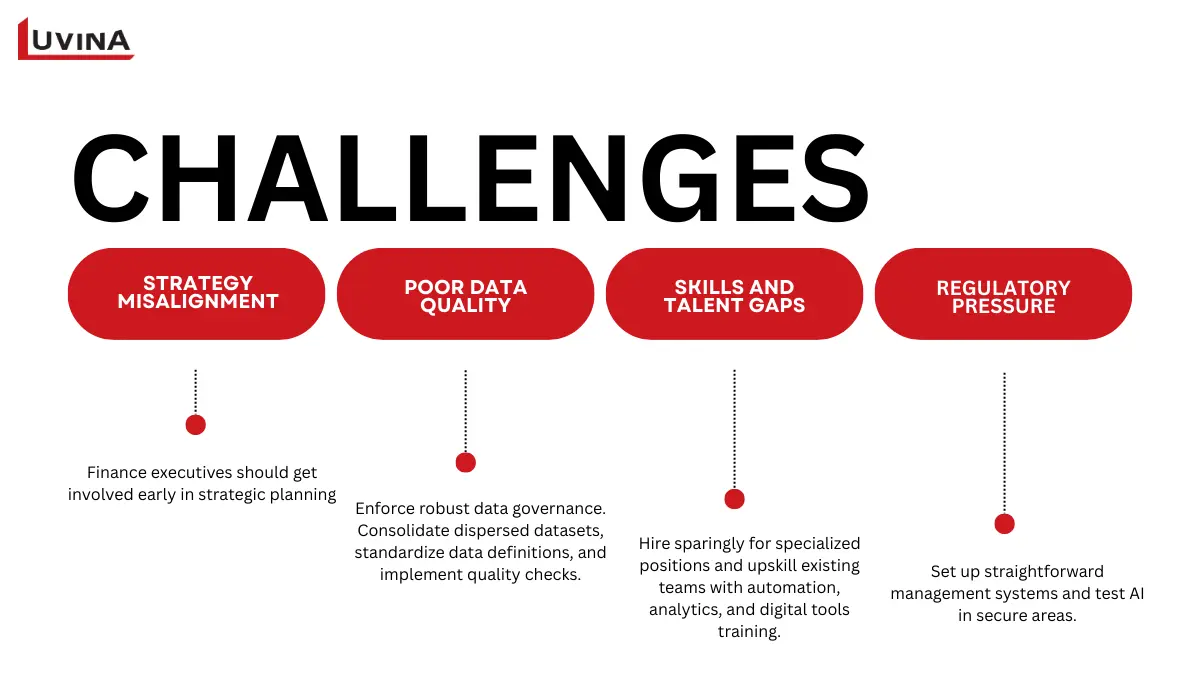

Common Challenges & Risks (Technical, Regulatory, Organizational)

Many financial institutions find in the digital transformation in finance that the most difficult challenges are mostly unconnected to technology. The real stress points arise from data, people, government, and regulatory complexity. Common challenges companies face, together with solutions, are presented below.

Challenges are inevitable when transitioning from legacy systems to new digital models

Strategy misalignment

A major challenge in digital transformation in finance is ensuring that finance initiatives match the organization’s overall direction. When finance teams automate processes for efficiency, but the broader company prioritizes customer experience, digital efforts create friction instead of value.

Solution: Finance executives should get involved early in strategic planning. This guarantees that investments complement the long-term objectives of the firm rather than work against them and helps digital initiatives meet company objectives.

Poor data quality

Low data quality can compromise all digital transformation of finance projects. Because finance gathers data from several sources, erratic or uncontrolled data lowers the precision of machine learning, forecasting, and AI models.

Solution: Enforce robust data governance. Consolidate dispersed datasets, standardize data definitions, and implement quality checks.

Skills and talent gaps

Many financial teams still have their structure built around compliance activities and manual reporting. But contemporary financial jobs demand the capacity to work with artificial intelligence tools, advanced analytics, and automated skills. This change can produce talent gaps that hold back digital transformation in finance.

Solution: Hire sparingly for specialized positions and upskill existing teams with automation, analytics, and digital tools training.

Regulatory pressure

As tech changes, banks have to deal with more complicated rules. New policies about AI, data privacy laws, and keeping up with global standards can be risky and hard to put in place.

Solution: Set up straightforward management systems and test AI in secure areas where you can watch who’s using the data, how the AI acts, and what it puts out.

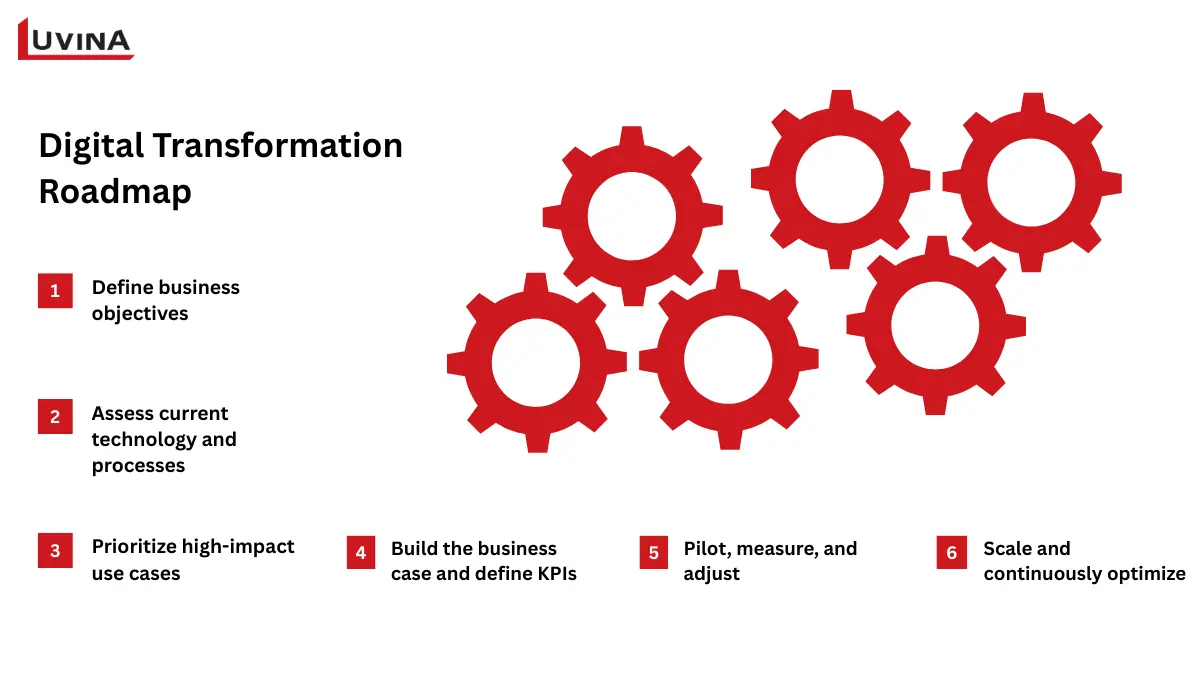

Digital Transformation Roadmap for Financial Institutions

Any financial institution trying to negotiate the rapidly changing terrain needs a clear roadmap for digital transformation in finance. The following steps will help banks and financial services companies move forward:

Financial digital transformation can be carried out following this process

Step 1 – Define business objectives

Every change starts with defined objectives. Institutions must define the technical and business results they want, including increased accuracy, quicker reporting, or better compliance.

Early setting of priority objectives helps teams stay in line and stop projects from straying off corporate objectives. Leaders define a focused direction that guides the whole digital transformation in finance journey as they perfect these aims.

Step 2 – Assess current technology and processes

A realistic understanding of the current environment is important. This includes listing all existing systems, evaluating how well each one supports strategic goals, and openly acknowledging where processes no longer fit the digital landscape. Documenting workflows across accounts payable, receivables, and financial reporting helps uncover bottlenecks, while cycle-time and error-rate measurements indicate where transformation will have the highest impact.

Gathering feedback from teams also ensures recurring pain points are captured, giving institutions a strong baseline for the broader digital transformation of finance program.

Step 3 – Prioritize high-impact use cases

Not all processes of digital transformation in finance plan deliver the same value, so banks should focus first on areas with high volume, heavy manual work, or significant compliance pressure. Common beginning points include expense management, reconciliations, and invoicing processing. Assessing these use cases by return on investment, implementation complexity, and alignment with corporate goals helps to find early momentum-generating projects.

Step 4 – Build the business case and define KPIs

Calculating predicted return on investment, payback period, and cost-per-transaction gains enables organizations to fairly defend their investment choices. Defining KPIs (cycle-time reductions, error-rate improvements, or compliance accuracy,…) creates accountability across the transformation and offers a constant approach to track development across the finance digital transformation roadmap.

Step 5 – Pilot, measure, and adjust

Teams may observe real performance, compare outcomes against KPIs, and solicit user comments by means of a small-scale implementation in one department or procedure area. Understanding from this phase helps to improve training, tweak configurations, and reinforce change management, therefore guaranteeing that the transformation grows more effectively.

Step 6 – Scale and continuously optimize

Once the pilot proves unambiguous worth, organizations can expand the solution to more divisions. Setting up a center of excellence guarantees that, as the implementation develops, best practices are consistent and good governance is preserved.

As digital transformation in finance is never a one-time endeavor, companies must often review KPIs, assess emerging technologies, including artificial intelligence and advanced automation, and continuously modify their strategy to maintain long-term performance and ROI.

Why Financial Institutions Should Consider Outsourcing/ IT Service Providers

The digital transformation in finance has never been more driven. Still, many financial firms are torn 2 ways: they have to maintain steady and compliant day-to-day operations while also quickly updating to be competitive.

Outsourcing turns more than a support choice – it becomes a strategic accelerator when internal teams are under pressure and legacy systems impede development. Working with seasoned IT service providers provides universities with the agility, know-how, and resilience necessary in this setting.

Outsourcing offers many benefits:

– Guarantees top-performing, safe, and stable IT infrastructure matching industry norms.

– Speeds market change adaptation and lowers time-to-market for fresh services.

– Improves cybersecurity stance by means of accredited, ongoing, updated security procedures.

– Reduces strain on internal teams, allowing them to focus on strategic core functions.

– Offers transparent cost structures that eliminate hidden internal IT expenses.

– Supports regulatory compliance by leveraging specialized external expertise.

– Provides immediate access to skilled professionals when facing complex projects or tight deadlines.

– Allows quick team scaling up or down – based on business needs.

– Lower operating costs than building and maintaining full in-house IT departments.

– By delegating certain tasks or milestones to outside specialists, it helps to lower delivery hazards.

As a trustworthy IT outsourcing partner with more than 20 years of experience, Luvina delivers IT outsourcing solutions built specifically for banks and financial service providers. Our services combine security, transparency, regulatory compliance, and operational efficiency. We’re here to enable financial institutions to stabilize their operations, eliminate technological bottlenecks, and create fresh avenues for innovation.

Outsourcing is the smartest way to leverage skilled talent

Ready to maximize your processes and speed change? Contact Luvina to discuss outsourcing options fit for the financial sector.

Best Practices & Success Factors

How finance companies handle change greatly affects whether the digital transformation of financial services works out. Those who follow these tips will become more skilled and confident in digital transformation in finance.

– Encourage new ideas and help teams adapt to new tech and market changes to go digital.

– Put money into a strong tech system that can grow, follow rules, stay secure, and expand digitally for the long haul.

– Work with fintech companies on digital transformation in finance to get expert help, new solutions, and faster action.

– Create natural, customized digital interactions matching evolving user expectations to emphasize customer experience.

– Keep learning, so employees stay updated on good practices, what’s happening in the industry, and new tech.

– Pick classes for leaders that improve their decision-making and digital know-how.

– Think about the Duke CFO Program for cutting-edge training in contemporary financial technology, big data, analytics, and digitalization.

Future Trends & What’s Next

New business models, consumer preferences, and new technology propel digital transformation in finance. Financial institutions should be aware of these main trends to stay ahead:

| Trend | Description |

| Data-driven and real-time finance | Finance based on real-time processed data from the cloud, big data management, and ready reports enables quick decisions, early detection of problems, and more precise insights. |

| AI and intelligent automation | Make employment easier, enhance fraud detection, and increase customer happiness through chatbots, machine learning, robotic process automation, and artificial intelligence. |

| Blockchain and decentralized finance | Along with smart contracts, blockchain and DeFi are speeding up international payments. Openness is promoted by them, too, as well as global accessibility. |

| Cloud, mobile, and IoT services | Banks are focusing on mobile apps, using cloud setups, and linking devices. This makes scaling easier, allows for more personalization, and improves how well things run. |

| Cybersecurity and financial inclusion | Better data safety keeps customers safe, while online tools help people in the gig economy and DIY platforms, pushing digital transformation for financial services. |

Some emerging trends in financial digitalization

FAQ

1. What is digital transformation in finance?

Digital transformation in finance is the use of digital technologies to improve operations and customer experiences. For example, banks use mobile apps and AI tools to streamline services and prevent fraud.

2. How can banks benefit from digital technologies?

Digital technologies help banks automate repetitive tasks, analyze customer data, and speed up transactions. They also make services more personalized and improve decision-making.

3. What are examples of digital finance?

Examples include online banking platforms, mobile wallets, robo-advisors for investments, blockchain for secure transactions, and AI tools that enhance customer support and operational efficiency.

Conclusion

This article has explored the key aspects of digital transformation in finance. Understanding these insights can help financial professionals identify opportunities, overcome challenges, and apply strategies that improve efficiency, enhance customer experiences, and drive long-term growth.

The key to success lies in strategic leadership, continuous innovation, and building a workforce ready to adapt to change.

Resources

- https://www.ibm.com/think/topics/digital-transformation-banking

- https://www.walkme.com/blog/digital-transformation-in-finance/

- https://imaginovation.net/blog/digital-transformation-in-finance/#key-digital-transformation-trends-in-financial-services

- https://www.financealliance.io/driving-digital-transformation-in-finance/#%3Cstrong%3Echallenges-and-risks%3C/strong%3E

- https://northwest.education/insights/finance/digital-transformation-in-finance-definition-examples-and-tips/#what-is-an-example-of-a-finance-transformation

- https://www.globalbankingandfinance.com/it-outsourcing-for-financial-services-companies-key-benefits/

- https://neontri.com/blog/digital-transformation-examples-banking/

- https://ramp.com/blog/finance-digital-transformation#5-step-roadmap-to-digital-transformation-for-finance

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter