Launching a fintech app without validation? That’s how nearly half of startups fail.

CB Insights estimates that 42% of new firms fail because there is no market need, a risk no banking, finance, or insurance (BFSI) company can afford. That’s why developing a Minimum Viable Product (MVP) demands the use of fintech MVP app development services.

We will examine what a fintech MVP app is, why it is so important, and how to create one step by step in this manual.

What is a Fintech MVP App?

Simplified version of a fintech application intended to offer just the basic functions necessary to address a major user issue, a Fintech MVP app is a simplified form. Unlike a prototype, it is fully functional and intended for real-world use by early adopters, enabling businesses to test ideas quickly and efficiently before committing to a full-scale launch.

Concentrating on the “must-have” features enables a fintech MVP to help businesses reduce start-up expenditure while still delivering real user value. It has two main goals: assessing whether there is even a market for the product, and getting actionable feedback from real users. These initial observations provide levers for the re-direction of the app, affirming that work moving forward is oriented toward users and aware of risk.

That’s why many startups and enterprises alike turn to fintech MVP app development services. These services are intended to enable companies in the cutthroat BFSI sector to validate ideas, speed to market, and react more flexibly to consumer demands.

Why You Need Fintech MVP App Development Services

Building a fully loaded app without validation is risky and often costly. That’s why more fintech startups and financial institutions are turning to fintech MVP app development services as a smarter, leaner way to bring their ideas to life.

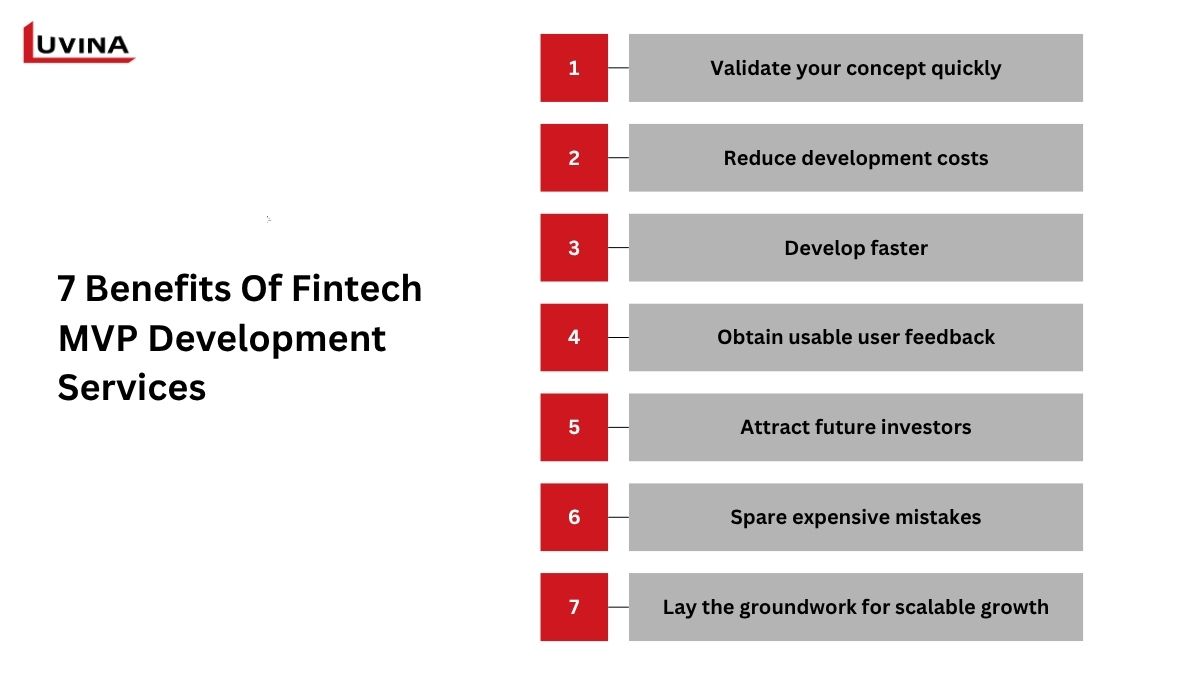

Here’s how these services can provide your fintech product a competitive edge:

- Validate your concept quickly: Before committing to full-scale app development, research your app concept with real users to ensure the right problems are being solved. You want to validate before you develop!

- Reduce development costs: Developing only the core functionality in stage one saves time, money, and resources. It also keeps your team focused on what really matters.

- Develop faster: You will be able to launch faster with a minimum version of your app and start getting momentum at the same time, while you iterate on the app in the background.

- Obtain usable user feedback: Usable user feedback allows you to make better decisions in later stages of development and, therefore, ensures that your app grows in the right direction.

- Attract future investors: A working MVP proves that your concept has traction and thus enhances your credibility in the eyes of venture capitalists and other stakeholders.

- Spare expensive mistakes: The earlier you can identify problems with mistakes, UX issues, or market misinformation, the less money you lose on scaling the errors.

- Lay the groundwork for scalable growth: Prepare the groundwork for scalable expansion: Develop a robust, user-tested base that is simpler to develop and adapt as your product grows and captures market share.

How to Build a Fintech MVP App

It is imperative to adhere to a disciplined development approach designed especially for financial services if one wants to guarantee success. That’s where fintech MVP app development services provide the correct balance of technological know-how and market knowledge.

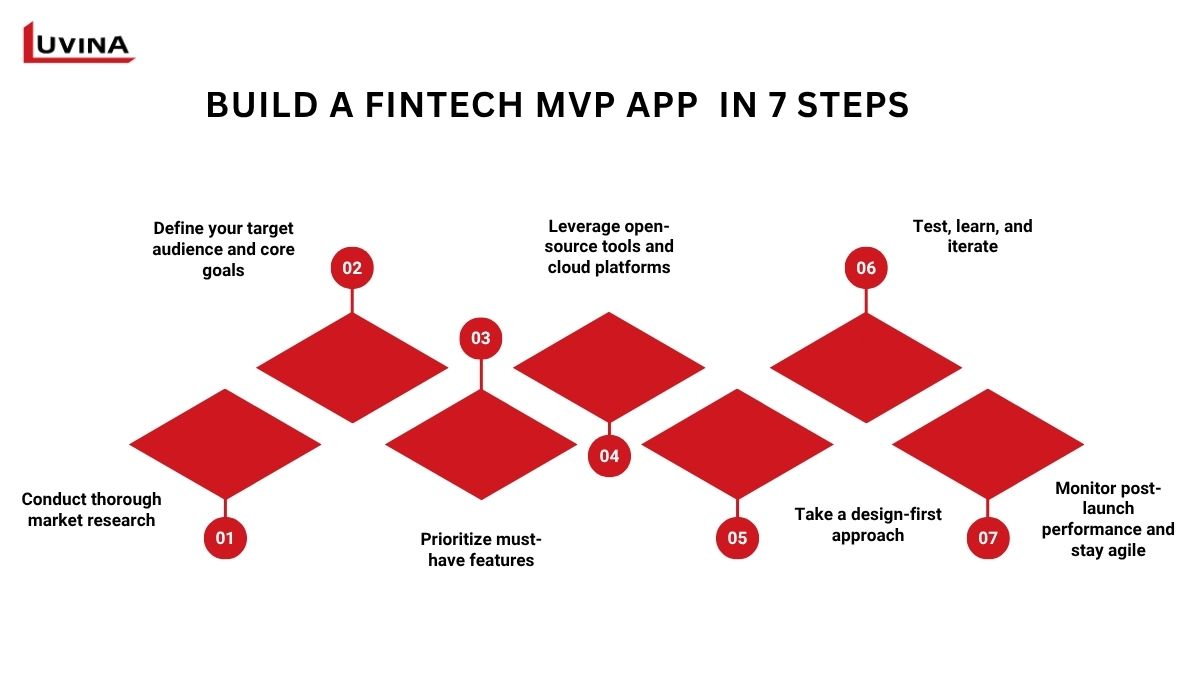

A road map for building a thriving fintech MVP app, step by step, follows:

- Conduct thorough market research

Start with an awareness of your market before you begin writing a single line of code. Find your target consumers’ actual pain spots by analyzing current fintech solutions and pointing out omissions. Collect information using user interviews, competitor audits, and surveys. This first step guarantees your MVP is constructed purposefully and satisfies actual market demands.

- Define your target audience and core goals

Identify who will be benefiting from your app and its purpose. Prioritizing certain features and measuring early iterations with an MVP will be clearer once you know your goals and have a better understanding of your user personas. Is there a plan to simplify peer-to-peer payments? Increase access to digital banking? Assist consumers in tracking spending?

- Prioritize must-have features

Concentrate only on the features that solve your users’ most pressing needs. Consider real-time warnings, transaction overviews, or simple account creation. Faster time-to-market is guaranteed when you use fintech MVP app development services to give top priority to high-value features while eliminating useless complexity.

- Leverage open-source tools and cloud platforms

Utilizing established open source libraries and frameworks with useful fintech features like authentication, encryption of data, and reporting gives you ways to save costs and increase speed. With cloud-based infrastructure, you can build on a pay-as-you-go basis and scale creatively.

- Take a design-first approach

Prioritize clean, simple UX/UI that lets consumers easily accomplish tasks and grasp financial information. Even a little product should offer a smooth user experience. Early integration of design thinking enhances participation and minimizes friction right from the start.

- Test, learn, and iterate

Your MVP may have limited features, but it should be working and operational. Perform extensive testing, including QA testing, before going live, including data security testing, usability testing, and performance testing. Then, you go live to a small group of actual users and collect feedback through in-app behavior tracking, interviews, and surveys. Use the data to build upon your product, prioritize updates, and proactively resolve pain points.

- Monitor post-launch performance and stay agile

The MVP launch is just the first step – use analytics tools (or analytical methods, if appropriate) to follow user engagement, conversion rates, and dropoff points. Allow for iteration by being open to making changes based on user feedback and changing market conditions. By working with fintech MVP application development services at this critical point, you ensure that your Android app is developing purposefully, moving from a lean MVP to a fully-featured fintech solution.

Luvina’s Fintech MVP App Development Services

At Luvina, we don’t just build apps. Long-term success for your fintech offering depends on the groundwork we provide. With over twenty years of experience as a reliable technology partner, we provide fintech MVP app development services that enable you to confirm ideas, shorten time to market, and scale with assurance. Focusing on performance, compliance, and usability, our staff offers end-to-end support. Here’s what distinguishes our services:

- Custom fintech app development: Tailor-made fintech solutions are created to fit your particular corporate needs. Our staff guarantees every function matches your growth strategy and user requirements, from the prototype to a scalable MVP.

- P2P lending platform development: Our knowledge covers sophisticated peer-to-peer lending solutions, including legal documentation and offer mechanisms, as well as smart loan matching, automated advisory tools, and compliance-ready characteristics.

- KYC platform integration: Streamline customer onboarding and compliance with AI-driven KYC integrations.

- Digital wallet solutions: Using low-code and no-code technology expertise, we create safe digital wallets that enable end-users to manage payments simply, hence fostering smooth transactions and better user involvement.

- Payment & money transfer apps: Custom-built to meet the requirements of a worldwide user base, our team creates simple, secure payment systems that enable multicurrency payments and cross-border transfers.

- MVP optimization and iteration: We go beyond the MVP launch. Luvina focuses on maximizing the performance of your MVP following release, therefore enhancing the user interface/UX, including critical elements, and guaranteeing your product is ready for scale.

Our dedication to partnership is what sets Luvina apart. We concentrate on producing ROI-driven outcomes, remaining transparent in our contacts, and reacting quickly to your changing company demands. We’ll inform you if we find no obvious road to value for your project. Since your success is most important to us.

Ready to turn your fintech idea into a working MVP? Contact Luvina to build, test, and scale with confidence.

>> Also read: Fintech application development company

FAQ

How does it cost for Fintech MVP Development?

The cost typically ranges from $10,000 to $200,000+, depending on feature complexity, tech stack, and development team rates.

>> Read more: How much does it cost to build a Fintech app?

How long does it take to build a Fintech MVP app?

On average, it takes 2 to 6 months, depending on the project scope and requirements.

Can I add more features after the MVP is launched?

Yes, adding features post-launch is part of the iterative development process to improve and scale based on user feedback.

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter