Generative AI in finance and accounting is changing the way organizations assess cash, develop strategies, and make decisions. Picture this. A CFO is reviewing a forecast that has the ability to change in real time, auditors can identify anomalies before they get worse, and accountants dedicate more time to analysis of strategy instead of reconciling spreadsheets. This is a present-day reality made possible by generative artificial intelligence, not the work of science fiction.

This article focuses on the implications of generative artificial intelligence within finance and accounting functions. Whether you are a decision-maker influencing your company’s growth, an accountant, or a financial analyst, understanding how to leverage this technology could provide the benefits of speed and intelligence to build a more resilient financial future.

Why Generative AI matters in Finance & Accounting?

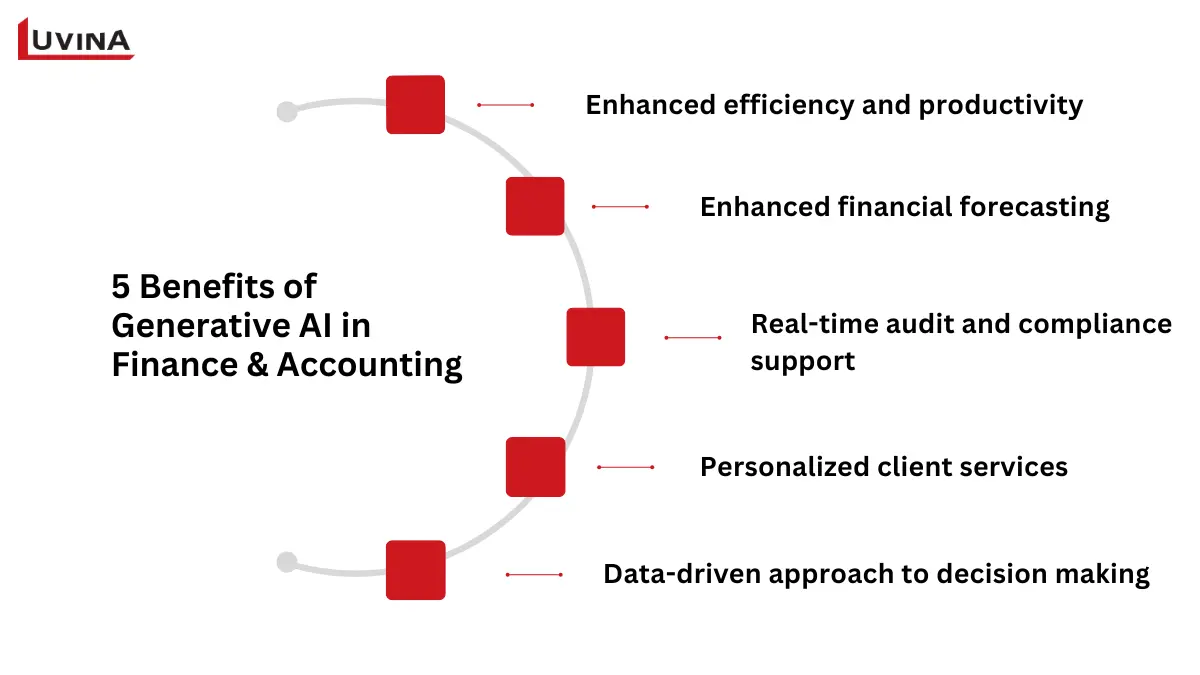

Generative AI in finance and accounting allows minutes of work with higher accuracy and strategic worth, which formerly took hours of manual data gathering, reconciliation, and reporting. This is why generative artificial intelligence in finance and accounting is quickly becoming indispensable:

Enhanced efficiency and productivity: Enables teams to spend more time focused on strategy and analysis considerations versus repetitive clerical-type activities like data entry, report writing, and invoice creation.

Enhanced financial forecasting: Alter a limited set of historical data presumptions based on more complete historical data and predictive models to obtain enhanced estimates of trends, revenue, and cash flow to improve forecasts.

Real-time audit and compliance support: Continuously monitor transactions to detect any irregularities, errors, and potential fraud while continuously monitoring compliance within an array of changing regulatory frameworks.

Personalized client services: Powers intelligent chatbots and virtual assistants that support immediate delivery of results.

Data-driven approach to decision making: Changes complex data into actionable insights, thereby allowing finance teams to provide leadership with a more transparent, timelier, and more strategic recommendations.

Core use cases of Generative AI in Finance

The application of generative AI in finance and accounting is changing how corporations process data, assess risk, and support strategic decision-making. As generative AI in finance has matured, its applications have expanded. It now spans reporting, compliance, performance management, and scenario modeling at a strategic level.

Fundamentally, generative artificial intelligence in finance enables companies to work with more accuracy, agility, and vision. The following are major application examples showing how this technology is transforming the financial department:

| Applications | Descriptions |

|---|---|

| Automate financial reporting | Create full reports from financial data in minutes, reducing manual work and improving consistency. |

| Summarize complex documents | Turn long reports or statements into short, clear summaries for quick review. |

| Monitor transactions in real time | Spot unusual activities or signs of fraud instantly by checking all transactions automatically. |

| Generate predictive scenarios | Forecast future results and market changes to support smarter planning. |

| Design financial models | Build simple models to test different investment or budgeting options. |

| Enhance compliance oversight | Keep track of rule changes and help teams stay compliant without manual checking. |

| Create market and customer insights | Guide corporate choices by examining customer behavior and market trends. |

| Optimize performance management | Automatically analyze findings to spot early problems and raise total performance. |

Core use cases of Generative AI in Accounting

Generative AI in finance and accounting enables quick and accurate management of accounting tasks rather than dedicating hours to verifying invoices, reconciling accounts, or compiling reports. Generative AI in accounting helps automate difficult workflows, improve precision, and provide real-time insights to every step of the accounting process by studying historical data and financial trends.

| Applications | Descriptions |

|---|---|

| Automate invoice processing | Automatically match invoices with POs to cut manual work and prevent errors. |

| Simplify bookkeeping | Faster transaction records, ledger corrections, and account reconciliation free up time for more advanced research. |

| Support expense reporting | Analyze expense reports to detect anomalies and prevent duplicate claims. |

| Assist in month-end closures | Automatically gather and confirm financial information to accelerate closing procedures and guarantee correct reporting. |

| Improve budget planning | To enable more precise and realistic budgeting, study past spending and market patterns. |

| Automate audit trails | Automatically track and record all financial transactions to increase transparency and compliance. |

| Manage accounts payable and receivable | To keep a good cash flow, process payments, track unpaid balances, and send reminders. |

| Generate tax insights | Examine financial data to recommend possible deductions and assist accountants in tax returns preparation more quickly. |

| Draft and review contracts | To ensure compliance and lower legal risks, establish and check standard contract terms. |

| Enable conversational finance | Real-time help to finance teams and replies to accounting-related questions using artificial intelligence-powered assistants. |

You can also take a look at our article A Complete Guide to Generative AI in Banking to have a more indepth view Generative AI applications in BFSI companies.

Technical & implementation considerations

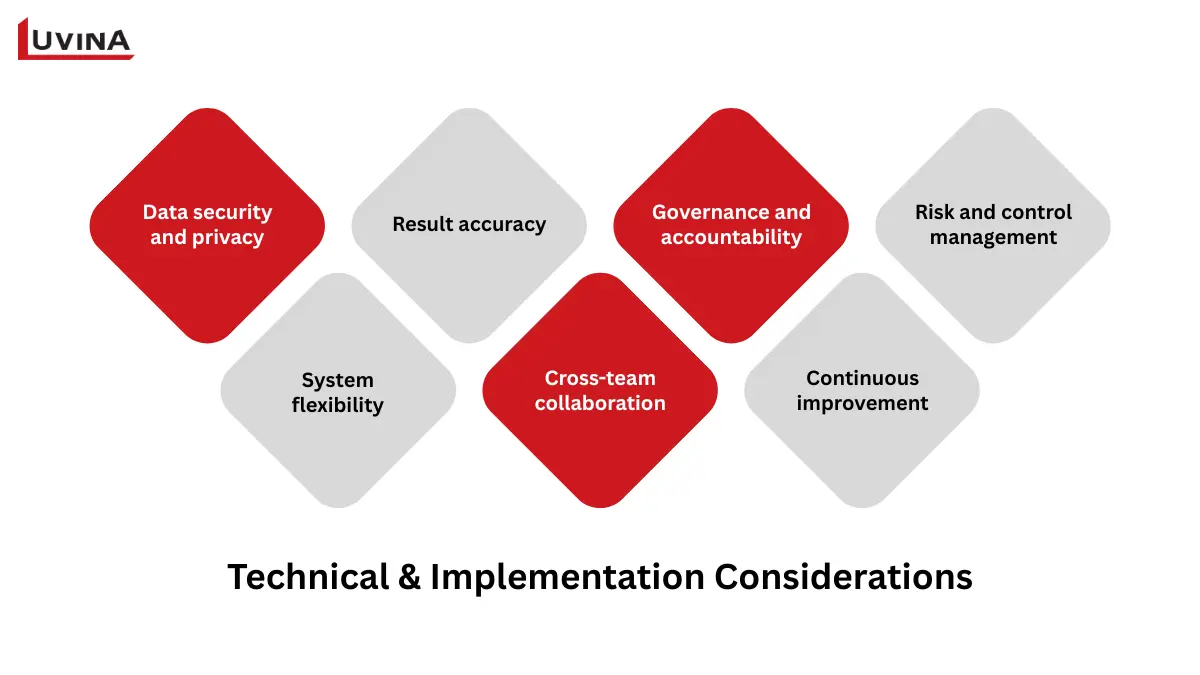

Implementing generative AI correctly ensures value and compliance. Organizations must first solve several technical and operational issues. Only then can generative AI in finance and accounting provide true value.

Data security and privacy: Secure financial data by using sufficient encryption, access control, and regular privacy audits. Train teams to exercise caution with sensitive data.

Result accuracy: Regularly confirm and authenticate artificial intelligence results under human control. Maintain reliability by using expert review and certified, clean data.

Governance and accountability: Keep simple approval processes for material generated by artificial intelligence. Guarantee for accuracy and compliance, every report or analysis has a human review layer.

Risk and control management: Within your current financial control structure, assess uses of artificial intelligence. Before total implementation, spot and reduce possible hazards.

System flexibility: Design infrastructure that enables future modifications and development of AI models will help system flexibility. Give retraining and scalability the top priority.

Cross-team collaboration: Early finance team alignment with other business units promotes confidence and adoption. Encourage communication to prevent misinterpretations of artificial intelligence ideas.

Continuous improvement: Make incremental improvements to systems, retrain models, and reskill workers regularly to stay ahead of change.

Risks, challenges & mitigation strategies

Generative AI in finance and accounting offers great promise. However, it also introduces new types of risk that must be carefully managed. To guarantee that artificial intelligence deployment improves rather than compromises their financial activities, companies need a forward-looking plan.

| Risks | Description | Solution |

|---|---|---|

| Data accuracy errors | Generate incorrect or inconsistent outputs due to flawed inputs or model limitations. | Implement validation checks and cross-verify data to ensure accuracy and reliability. |

| Data privacy and security | Expose sensitive financial or client data to breaches or misuse. | Encrypt datasets and conduct regular security audits to protect confidential information. |

| Bias & ethical issues | Produce biased insights that affect fairness or decision-making quality. | Review and retrain models with balanced data to promote objectivity and transparency. |

| Over-reliance on AI | Depend excessively on automated systems, reducing human judgment. | Combine AI insights with expert oversight to maintain balanced decision-making. |

| Lack of explainability (“Black Box”) | Provide results without clear reasoning, making validation difficult. | Adopt explainable AI frameworks to clarify model logic and build user trust. |

| Regulatory uncertainty | Operate under unclear or evolving compliance standards. | Monitor policy updates and align AI governance with current financial regulations. |

| Talent and skill shortages | Limited expertise in AI implementation | Invest in staff training, hire or partner with AI specialists, and establish internal AI competency programs. |

| Legal liability | Create confusion over accountability for AI-generated outcomes. | Define responsibility frameworks and include liability clauses in AI deployment policies. |

Selecting the appropriate implementation partner is absolutely critical to successfully address these difficulties. A reputable technology provider like Luvina provides not just technical know-how but also a thorough grasp of the financial and legal environment around generative artificial intelligence in finance and accounting. Having more than 20 years of experience providing digital transformation and automation solutions for worldwide companies, Luvina helps BFSI companies at every level of artificial intelligence adoption.

Contact Luvina today to get personalized consulting and implementation support.

Measuring success & ROI

Deloitte’s 2024 insights show that while 67% of companies have already incorporated GenAI into fundamental processes, 74% believe their initiatives satisfy ROI requirements. While initial return on investment may seem low because of installation expenditures, long-run advantages arise from increased productivity, efficiency, and innovation.

Companies should establish explicit evaluation models measuring both operational and strategic influence in order to determine the true worth of generative AI in accounting and finance. The following are important measures and indicators businesses can utilize to assess the return on investment and efficacy of generative AI in finance and accounting:

| Metrics types | Descriptions and examples | When to use |

|---|---|---|

| Model accuracy | Check if AI results are correct and consistent.Examples: accuracy rate, error rate, or precision level. | When testing financial forecasts, reports, or data generation. |

| Output quality | Evaluate if AI content is clear, relevant, and safe.Examples: readability, tone consistency, compliance checks. | When reviewing text-based reports or financial summaries. |

| System performance | Measure how well the AI system runs in real use.Examples: speed, uptime, and system stability. | When monitoring infrastructure or running large-scale operations. |

| Operational efficiency | Track how AI improves time and process performance.Examples: shorter processing time, faster reporting, fewer manual tasks. | When optimizing finance workflows or reducing workload. |

| User adoption | See how much employees and teams use AI tools.Examples: adoption rate, user feedback, repeat usage. | When assessing engagement and long-term usage. |

| Business value | Measure overall business impact.Examples: productivity growth, cost savings, revenue gains. | When calculating ROI and long-term business contribution. |

Future Trends & Emerging Research

Generative AI in finance and accounting will be a critical force in reconstructing processing, analysis, and using financial data for corporate gain in the years to come. Below is a summary of the key trends and research areas shaping its future:

AI copilots for finance teams: Real-time forecasting, anomaly detection, and variance explanation will increasingly enable financial teams’ AI copilots, hence increasing decision speed as well as accuracy.

Predictive and autonomous finance: Generative models will go beyond prediction to automated decision-making, therefore enabling systems to dynamically suggest investment strategies or budget allocations.

Customized financial services: Organizations will leverage artificial intelligence to deliver tailored advice, credit assessment, and investment options according to individual customer profiles.

AI-based fraud detection and cybersecurity: Advanced models using biometrics and behavioral analytics will continually aggregate and analyze threat detection and prevent fraudulent behavior before it occurs.

Timely awareness of financial realities: AI web crawlers and data modeling, always on, will continuously collect market and news, and consumer sentiment to provide real-time insights and information for risk management and strategic planning.

Responsible AI frameworks: Organizations will pay greater attention to developing sound governance, strategy, and policy for AI to ensure transparency in financial decisions, ethical use, and compliance with regulations.

As research progresses, the boundaries between traditional AI and generative AI in finance and accounting will blur, creating hybrid systems capable of both predictive precision and creative problem-solving. Leaders who invest early in generative AI and strong governance will stay ahead. They will lead the next wave of digital transformation.

Conclusion

Generative AI in finance and accounting is transforming how companies manage data, automate processes, and make informed decisions in these areas. We discussed its main uses in this essay, demonstrated how artificial intelligence increases accuracy and speed.

Finance teams need a defined roadmap, consistent data governance, and a reputable technology partner in order to unleash these advantages completely. Ready to enhance your financial efficiency with generative AI?

Contact Luvina for tailored implementation strategies and measurable results.

Resources

- https://cloud.google.com/transform/financial-services-banking-insurance-gen-ai-roi-report-dozen-reasons-ai-value

- https://www.deloitte.com/us/en/insights/industry/financial-services/generative-ai-financial-services-pioneers.html

- https://cloud.google.com/transform/gen-ai-kpis-measuring-ai-success-deep-dive

- https://otio.ai/blog/generative-ai-in-finance-and-accounting

- https://www.deloitte.com/se/sv/services/legal/perspectives/key-considerations-when-implementing-genai-in-your-organisation.html

- https://www.auxis.com/5-generative-ai-in-finance-and-accounting-use-cases/

- https://trullion.com/blog/the-future-of-generative-ai-in-finance-and-accounting/

- https://www.ibm.com/think/topics/generative-ai-finance

- https://www.bcg.com/publications/2023/generative-ai-in-finance-and-accounting

- https://medium.com/nerd-for-tech/demystifying-generative-ai-in-accounting-practical-insights-you-wont-find-elsewhere-be7ce32e106c

- https://www.tcs.com/what-we-do/industries/manufacturing/white-paper/transform-finance-accounting-generative-ai

- https://www.evolution.ai/post/generative-ai-in-finance-and-accounting

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter