As Japan finds itself at the intersection of tradition and innovation, its financial sector is undergoing a quiet but powerful revolution. At the heart of this revolution are the fintech trends Japan, which reflect both the country’s conservative regulatory ethos and its growing need for digital financial services.

In this article, we write about 7 significant trends propelling innovation in the fintech landscape of Japan and the opportunities and challenges fintech companies and investors can anticipate while entering the Japanese market.

The Fintech Market in Japan

Japan’s fintech industry is steadily evolving, with a market size of around USD 12 billion, relatively small compared to global giants like the U.S., but growing at a rapid pace. Japan’s fintech evolution has been bank-driven, attempting to improve traditional banking products rather than replace them, as in other Western economies.

Government initiatives such as the revised Banking Act and the opening of banking APIs have triggered innovation across digital payments and banking services. The fintech trends Japan are gathering momentum with initiatives to lessen cash dependency and drive 40 percent cashless transactions by 2025.

Japan’s finance, on its part, is collaborating closely with international peers in such areas as cybersecurity, KYC, and omnichannel engagement, in line with a broader trend of digital transformation in Japanese finance. Even though the country’s financial culture is conservative, these trends reflect a market teeming with unrealized potential and increasing openness to global fintech integration.

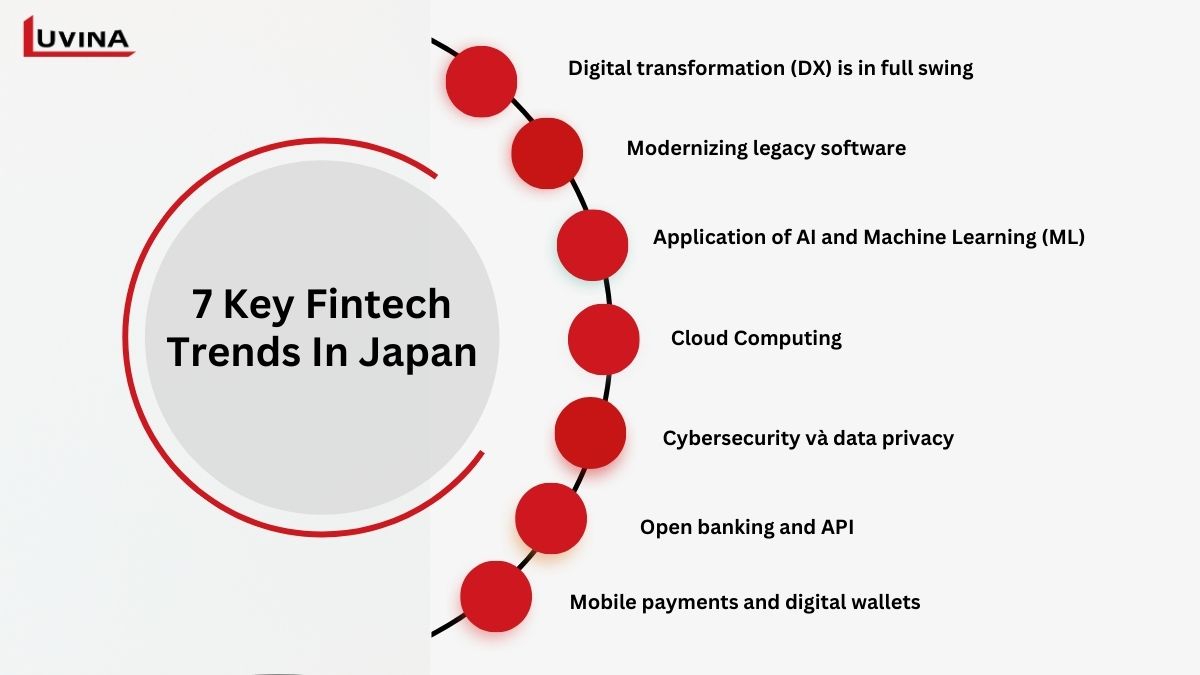

7 Key Fintech Trends in Japan

The fintech sector in Japan has been evolving at a rapid pace, driven by both local market dynamics and global influences. As the country moves toward greater digital adoption, Fintech trends in Japan are emerging in areas such as digital payments, banking transformation, and innovative financial services. Below are some of the fintech trends in Japan in 2025.

1. Digital transformation (DX) is in full swing

The digital transformation Japan banking is undergoing a fundamental transformation as incumbent financial players turn to new technologies to more effectively enable core businesses and customer interfaces. This transformation does not involve a question of obtaining new technologies but instead rather very fundamentally altering business models, customer approach strategies, and operational flows.

Japanese banks are rapidly improving their infrastructure by digitizing major financial processes and services such as payment systems, loan management, and transaction monitoring. At the same time, customer experience (CX) in financial services is also being improved. Japanese banks are applying technologies to offer personalized services and make customer interaction easier.

Moreover, automation and digitization are central to reducing costs and increasing operational efficiency. Through the automation of processes such as risk assessments, customer onboarding, and compliance checks, financial institutions and banks are not just reducing human error but also significantly reducing operational costs. This allows them to reinvest the funds in more value-adding services to the customers.

2. Modernizing legacy software

In line with fintech trends in Japan, the need for modernizing legacy systems in Japan’s financial institutions has become crucial. Traditionally, Japanese banks have relied on older software, which, while functional, has become inefficient and insecure over time. With the rise of digital finance and the demand for faster, scalable solutions, these legacy systems are no longer adequate to meet the needs of the industry.

To stay competitive, banks are investing in modernizing their legacy systems, shifting from outdated platforms to cloud-based, modular technologies that can better integrate with emerging digital tools like AI and blockchain. According to a recent report, 35% of Japanese banks are indeed making such modernizations as part of their digital strategies. These modernizations contribute to improving operational efficiency, velocity, and customer experience, considerations that are key in the fast-evolving fintech environment of today.

3. Application of AI and Machine Learning (ML)

The country’s financial sector innovation is being chiefly driven by artificial intelligence and machine learning as fintech trends Japan continue to develop.

Data analysis is one of Japan’s financial sector’s most important applications of artificial intelligence. AI systems can make wiser choices more swiftly than conventional methods by handling large volumes of financial information. This is particularly evident in AI in Japanese finance, where algorithms forecast market trends, analyze consumer activity, and generate customized financial goods matched to unique requirements. Furthermore, AI-driven credit score systems have changed the loan process by enabling quicker, more precise risk evaluations.

Machine learning is also being employed to better manage risks and fight against fraud. ML models that constantly analyze transaction data can spot trends suggesting possible fraud, therefore alerting banks and financial technology companies in real time. Moreover, transforming customer service is the advancement of artificial intelligence-driven chatbots and virtual assistants. These systems cut costs, improve general client satisfaction, and help manage everyday transactions and questions.

4. Cloud computing

To enhance flexibility and scalability and cut down on infrastructure expenses, financial institutions in Japan are fast embracing cloud technologies. Fluctuating client expectations and market conditions can be quickly scaled using cloud computing. It also lowers the need for costly onsite infrastructure, so financial businesses can distribute resources toward more strategic, customer-facing activities.

Moving to cloud platforms enables banks and fintech enterprises to make use of on-demand computer power, therefore improving customer experience and operational efficiency. The transition to cloud-based technologies in the financial sector does have difficulties, especially in terms of security and compliance.

Notwithstanding these difficulties, the Japanese financial technology industry’s cloud computing market keeps expanding; experts forecast a 30% compound annual growth rate (CAGR) from 2021 to 2026, which mirrors the rising faith in cloud technologies in the financial services sector.

5. Cybersecurity and data privacy

Fintech trends Japan are more and more aimed at guaranteeing strong protection against cyber threats in the finance industry as data privacy and cybersecurity worries grow.

Worried about data breaches getting out of control, businesses are looking for sophisticated security solutions using technologies including AI-driven threat detection, encoding, and multifactor authentication to reduce risk. With technology in Japan’s banking industry still embracing digital transformation, data privacy will become even more vital; fintech businesses can take advantage of this chance to develop secure, customer-focused products.

The government’s drive for more stringent privacy protections only serves to underline the expanding demand for cybersecurity solutions, which places Japan’s fintech sector in front of others in data protection and security standards.

6. Open banking and API

Open banking, through the integration of technology in Japan’s banking industry, has changed financial service delivery to create tremendous prospects for legacy banks and fintech startups to contend. Leveraging APIs has also become a pivotal aspect of helping create seamless, innovative financial products that seamlessly interface with existing systems of financial institutions.

As open banking picks up pace in Japan, the Japanese banking sector has now begun utilizing APIs to enable more dynamic collaborations and construct better customer experiences.

Notable examples include the collaboration of Japan’s megabanks—Mizuho, Sumitomo Mitsui, and MUFG—in 2017 to establish a global QR payment system and the launch of “Yoka Pay” in 2018 by Resona, Fukuoka, and Yokohama banks. These advances throw into prominence the growing importance of open banking and future innovation prospects by API integration in Japanese banking.

7. Mobile payments and digital wallets

Mobile wallets and digital wallets have become one of the leading fintech trends in Japan. Since the government of Japan is planning to achieve 40% of all payments being cashless by 2025, mobile wallet and digital payment solution usage have increased significantly. Cashless payments in 2020 accounted for over USD 36 billion, nearly four times the total in the previous year.

The clear regulatory framework around cryptocurrency and electronic payments has also helped propel the adoption of digital wallets in Japan. Japan led the way for digital currencies as of February 2021, with 27 exchange platforms approved.

Changes to Japan’s Banking Act have established a regulatory framework for electronic payment service providers, including PISP and AISP. Thanks to this legal certificate and strong governmental support for cashless transactions, Japan’s fintech landscape is among the most advanced in the world.

Opportunities for Fintech Business Leaders in APAC

Fintech trends Japan offer so many opportunities for fintech business leaders to succeed across the Asia-Pacific (APAC) region. Fintech startups and established companies will find an ideal environment in Japan, especially due to the increasing demand for digital financial services and the country’s strong emphasis on technology-driven banking solutions. Japan has various mobile payments, and the government is planning to increase cashless transactions by 40% by 2025, so fintech leaders can go into that opportunity space and launch products like digital wallets and a new payment transaction system tailored to the specific requirements of Japan.

Moreover, the ongoing digital transformation of Japan finance opened up a path for the adoption of bleeding-edge technologies such as AI, machine learning, and blockchain into Japan’s banking and financial services. It opens up opportunities for APAC-based fintech companies to partner with Japanese financial institutions to create intelligent credit scoring, fraud detection systems, and personalized customer services.

The focus on cloud computing and open banking, along with a relatively cryptocurrency-friendly regulatory framework, allows fintech companies to experiment and introduce new products with less friction. By leveraging strategic partnerships with local banks and fintech firms, APAC business leaders can harness these trends and strengthen their presence in one of the most sophisticated financial markets globally.

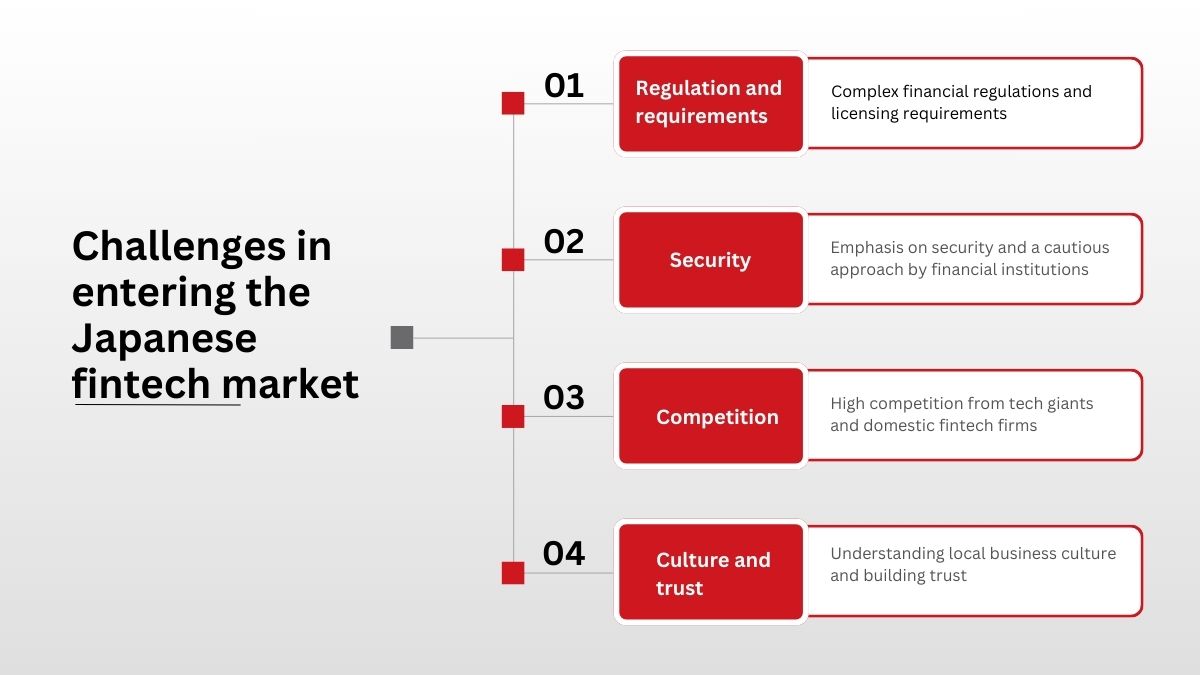

Challenges in Entering the Japanese Fintech Market

Fintech trends Japan have created a highly regulated and competitive environment, which foreign companies need to carefully navigate. The following are the main challenges and likely solutions for entering the market successfully:

- Complex financial regulations and licensing requirements

The financial market of Japan is regulated under complicated rules and stringent licensing protocols to be executed by foreign fintech companies.

To combat this, it is best to cooperate with local compliance experts who know the legal climate. Implementing elaborate compliance systems will also ensure business goes smoothly and keeps away future legal issues.

- Emphasis on security and a cautious approach by financial institutions

Japanese banks are very risk-averse and consider security above everything, which is a big barrier for fintech firms to collaborate or gain consumers’ trust.

Fintech companies are also required to demonstrate robust security habits and local regulation compliance. Gaining relevant certifications and having transparent disclosures towards data protection policies can help build confidence and trust in the market.

- High competition from tech giants and domestic fintech firms

The Japanese fintech industry is competitive, with international technology companies as well as indigenous fintech companies already existing.

To be different, fintech companies have to highlight a unique value proposition. Discovering underserved niches and delivering new features are able to set a new entry apart from the existing ones.

- Understanding local business culture and building trust

Gaining consumer confidence in new financial services can be challenging in Japan, as the market places a high value on trust and relationship-building.

Businesses must invest in understanding Japanese business culture and focus on long-term relationship building. This includes providing clear, transparent communication and ensuring that all interactions and services adhere to local expectations.

If you’re looking to expand into the Japanese fintech market or need assistance with navigating complex regulations and security protocols, contact Luvina today. With over 20 years of cross-border experience, Luvina possesses in-depth knowledge of financial policies across multiple regions, allowing us to adapt quickly to new markets.

Luvina’s talent pool includes over 300 fintech professionals in programming, and over 100 blockchain, AI, and other new technologies experts. We follow the practice of combining our expertise in the industry with technical proficiency to empower companies to prevent security threats and achieve maximum regulatory compliance.

We possess a solid understanding of the Japanese market and cultural nuances of its business community. Our company is comprised of Vietnamese and Japanese professionals who speak Japanese to facilitate free communication and to form long-term partnerships with local companies.

Conclusion

Japan’s fintech market offers immense potential for foreign companies seeking to expand and innovate within the financial technology space. By embracing challenges and aligning with fintech trends Japan, companies can establish themselves as trusted players in this competitive yet rewarding industry.

Are you ready to seize the opportunities within Japan’s thriving fintech market? Reach out to Luvina today and find out how our expertise can help you navigate the complexities of this dynamic sector and turn your innovations into success stories in Japan’s financial ecosystem.

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter