While the trend of cashless and cardless transactions is at its peak, payment app development will become even more useful, giving customers the quickest way to send and receive their digital payments. When building a payment app, it is important to understand the essential features and potential challenges, grasp market trends, and follow the detailed steps to develop a successful app.

In the article below, let’s dive into all mobile payment app development aspects. This article will be a comprehensive and detailed guide if you are planning to create a mobile payment app for 2024.

Payment App Market Overview

With the development of the e-commerce industry, the trend of financial digitization and cashless payments has been amplified, leading to the increasing popularity of online payment solutions. The figures below clearly demonstrate this:

- The size of the P2P payment market is expanding fast – from $2.95 billion in 2023 to $3.4 billion-opening a promising future for the financial sector in 2024.

- Recent data published by Forbes reveals that more than 2 billion people already use mobile payment solutions. This represents a 25% increase from 2021 alone.

- The global mobile payment market is expected to reach $12 trillion by 2025, with the total value of digital payment transactions exceeding $14 trillion by 2029, at a compound annual growth rate (CAGR) of 11.08%.

These figures demonstrate the powerful market demand for convenient web and mobile apps capable of allowing speedy and safe digital payments. Therefore, the market of payment applications in the future will surely become a lucrative niche that businesses are only ready to step into by 2024 and further on. Embracing trends in payment app development is a revolutionary idea, not only for consumers but also for businesses.

Types of Payment Apps

4 main types of payment apps are currently gaining the most attention:

- Peer-to-Peer Payment Apps (eg. Venmo, PayPal, Cash App,…): P2P payment apps allow users to transfer money directly to each other via mobile devices, connected bank accounts, or credit cards. They simplify splitting bills and sharing costs without the need for cash.

- Mobile Wallets (eg. Apple Pay, Google Pay, Samsung Pay,…): These apps securely store card details, enabling both online and offline transactions. Mobile wallets allow users to store digital versions of payment cards on mobile devices and often support contactless payments in physical stores, online shopping, and transportation services.

- E-commerce Payment Solutions (eg. Stripe, Square,…): These apps are integrated with e-commerce platforms, allowing users to make direct purchases from businesses or retailers, providing a seamless checkout experience.

- Cryptocurrency Payment Apps (eg. Coinbase, BitPay,…): These enable payments using digital currencies like Bitcoin or Ethereum. Some cryptocurrency payment apps also offer features for buying and selling cryptocurrencies.

>> Also read: Best Fintech Apps

Key Features of a Successful Payment App

Payment app development is leading the charge in the financial revolution. The emergence of these apps simplifies basic transactions and is evolving into comprehensive financial management tools. What sets modern payment apps apart are their core features. Below are some key features we believe will make your app stand out from the ordinary:

| No. | Features | Description |

| 1 | Secure Transactions | With the features of end-to-end encryption, tokenization, and multi-factor authentication of secure payment apps, the security and protection of users’ funds are guaranteed. |

| 2 | Easy User Interface (UI) | Building an easy-to-use payment app with a simple and intuitive design, so that users can go through the options without much hassle. |

| 3 | Fast Transactions | During mobile payment application development, The money transfer facility of any application is required to be quick, reliable, secure, and easy to use. It is supposed to provide users with a seamless and easy experience; one would be able to send or receive money anytime from anywhere. Instant transfers with the least delay enhance user satisfaction to a great extent. |

| 4 | Multi-currency and Cross-border payments | Cross-border payment features support for international transactions in various currencies with minimal fees. |

| 5 | Integration with Banks and E-commerce Platforms | Seamlessly connect with financial institutions and third-party platforms, enabling users to make payments, transfer, and receive money with ease. |

| 6 | Notifications and Alerts | Notify users about updates, offers, failed transactions, and account activity. Keeping users informed and providing them with options to customize the type of notifications they receive ensures high satisfaction and loyalty. |

| 7 | Multi-Factor Authentication | Use one-time passwords (OTP), personal identification numbers (PINs), and biometrics to prevent misuse and block unauthorized transactions. |

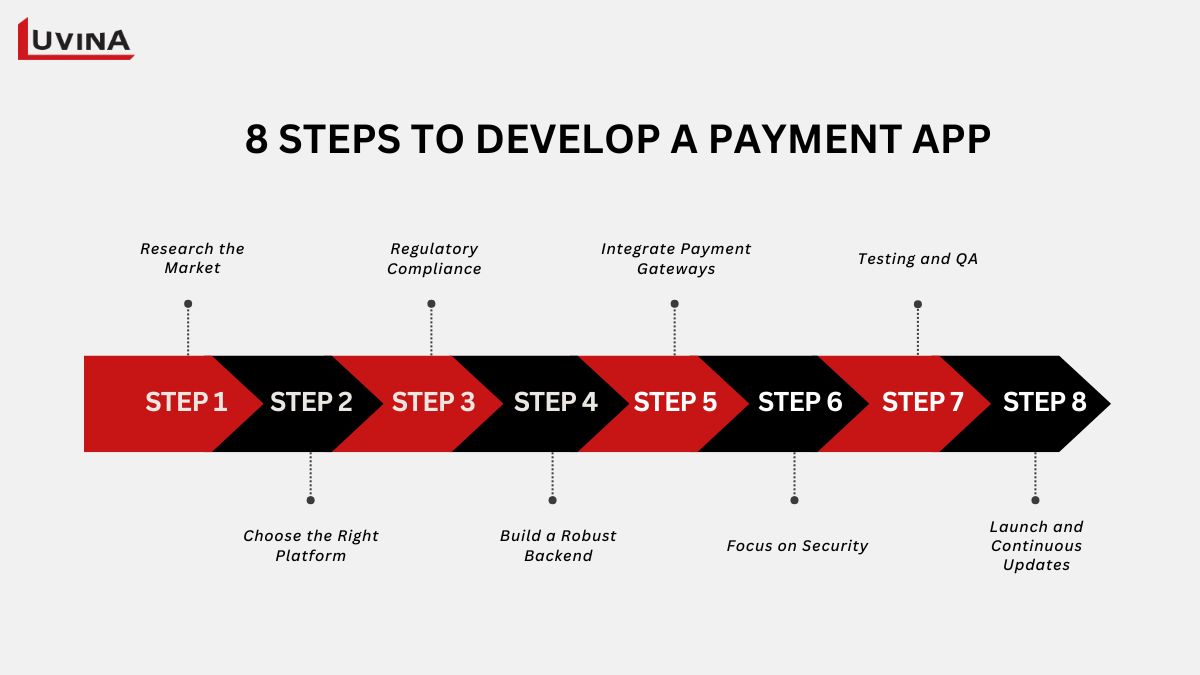

Steps to Develop a Payment App

Each business will have a unique payment app development process, but to ensure successful app creation, we recommend the following 8 payment app development steps:

Step 1 – Research the Market

During payment app development, understanding market trends and conducting thorough market research is crucial. Study the online payment industry, current trends, competitors’ apps, and user expectations. This phase allows businesses to identify unique selling points based on user needs and market gaps that your app can address.

Market research also helps you focus on key trends to build a standout digital product. Start by analyzing popular apps like Apple Pay, Google Pay, and PayPal to understand why users prefer them, then tailor your app accordingly.

Step 2 – Choose the Right Platform

The very foundation of mobile payment application development rests. on choosing the appropriate platform. While developing for iOS, Android, or both, consider compatibility, scalability and security as deciding factors. Be it native, cross-platform, or hybrid, the choice of technology stack has to be aligned with the long-run objectives of your app.

Step 3 – Regulatory Compliance

Ensuring regulatory compliance for payment apps is vital. Very often, the financial industries of different countries are highly regulated. Before launching, research the regulations applicable in your target region and make sure your app follows the law concerning GDPR, KYC, AML, PCI DSS, etc. Following financial regulations is not only a legal requirement but also gives users confidence in your platform.

Step 4 – Build a Robust Backend

The back-end is the motor that will keep your payment application going. This calls for a back-end system that will handle scalable transactions efficiently, manage user data, and also communicate with APIs outside of it. A well-designed backend ensures that the app keeps running along without a hitch, even at high transaction volumes.

Step 5 – Integrate Payment Gateways

During the payment app development process, choose a payment gateway that suits your app’s requirements and supports the payment methods you offer, such as credit cards, e-wallets, and bank transfers. The more flexible your payment gateway integration, the more convenient the app becomes for users, increasing its reach.

Step 6 – Focus on Security

Security should be integrated into every aspect of the development process. Implement encryption, tokenization, and fraud detection, and comply with industry standards, performing regular security audits. Adhering to these standards is mandatory to meet legal requirements, build user trust, and strengthen app security.

Step 7 – Testing and QA

Testing is an essential step in payment app development. Conducting thorough testing will help you identify any errors or issues that need fixing before launching the app. To ensure the app works correctly, you can use both manual and automated testing methods. Test the app carefully across multiple devices, networks, and scenarios, fixing any problems or errors if they arise. Security testing and certification should also be performed to guarantee data safety and compliance with security standards.

Step 8 – Launch and Continuous Updates

Confidently launch your payment app, but keep an eye on any potential issues. During this phase, you need to closely monitor metrics and user feedback to spot any problems. Even if you’ve fixed all known issues before the launch, you must continue updating the app to keep up with user preferences.

Regularly communicate with developers to update or add features to meet market demands. If you manage updates and maintenance well, you’ll provide the best user experience right from the start. Offering promotions or special deals can also help attract and retain users.

Security Challenges in Payment App Development

The development process of any app will face many challenges, and payment app development is no exception. In a highly regulated industry like finance, where companies are responsible for handling sensitive data, common challenges are often related to payment app security.

1. Data Encryption

Not paying enough attention to security measures can create vulnerabilities, putting users’ sensitive data at risk of being compromised. To fix this, businesses must protect sensitive information by using advanced encryption techniques, secure authentication protocols, and conducting regular security checks. It’s also important to keep security standards up to date.

2. Fraud Prevention

Personal information and sensitive financial data stored in online payment apps are highly susceptible to fraud attacks. This can be a major barrier for users who want to store large amounts of money in payment apps. To create a mobile payment app, developers need to use fraud prevention in payment app methods, such as machine learning and real-time monitoring.

3. Regulatory Compliance

The financial sector is one of the most heavily regulated industries and is directly overseen by governments. Therefore, any new feature added to the app must comply with all existing laws and regulations, such as international financial standards like PCI DSS, GDPR, KYC, AML, etc. Additionally, digital transaction regulations can vary by region, so businesses must always stay updated with the latest rules and ensure the app complies with local laws, especially when it involves cross-border transactions.

4. Identity Verification

Weak or poorly implemented user authentication methods can reduce the security of user accounts and transactions. To prevent this, payment app development should include the implementation of strong KYC protocols to verify users and prevent identity theft.

5. Multi-factor Authentication (MFA)

Credential leakage is a significant challenge in mobile payment app development, and using multi-factor authentication can be an effective way to prevent this. MFA for payment apps typically involves a combination of passwords, payment cards or phones, and biometric methods like fingerprint, voice, and facial recognition.

Future Trends in Payment App Development 2025

A number of transformative trends are seen to shape mobile payment app development in both 2024 and 2025. Such would be critical not only in driving the platforms but also in shaping new standards for user expectations.

- Biometric Authentication: Biometric means of fingerprint scanning, face identification, voice recognition, and even iris scanning have come into use for better security and fraud prevention. Biometric payments will keep users’ funds secure while providing smooth and seamless transaction experiences.

- AI-powered Fraud Detection: With the help of AI in payment apps, users will manage their finances better. When you create mobile payment apps, AI and machine learning can work together to detect suspicious activities and prevent fraud in real time. AI is also used for predictive analytics in payment apps, offering savings recommendations, investment opportunities, and spending habit analysis based on users’ transaction histories.

- Voice-activated Payments: The voice payment trend has finally materialized with the growing trend of smart home devices and virtual assistants. Integrating this into the mobile payment application development will grant the users the ability to make transactions and check account balances through voice commands.

- Contactless Payments: This is a result of increased development in NFC-based and QR code-based systems for paying for anything. In the years 2024 and 2025, contactless payments will increase more profoundly, forming one of the leading trends in payment app development. Furthermore, it will come out with better transaction security. Striking a balance between security and the user experience is very important, considering that adding too many steps for authentication will reduce the user experience. transactions, and keeping them frictionless.

- Decentralized Finance (DeFi): DeFi in payment systems will be among the leading trends in the financial industry. The integrated use of solutions for decentralized finance in a payment application will provide users with more control over their assets and access to a wide range of financial services, from lending to borrowing to staking directly through mobile applications.

FAQs

What is Payment App Development?

Payment app development is the process of creating software that facilitates electronic transactions and money transfers between individuals, businesses, or organizations. These payment apps securely store payment information, allowing users to initiate transactions through various channels.

What are Technologies Used in Payment App Development?

There are many modern technologies currently being used that will be used to optimize the payment software development process. These include machine learning and artificial intelligence, NFC (Near Field Communication) technology, MST (Magnetic Secure Transmission) technology, and multi-factor authentication technology, among others.

How much does it cost to develop Payment App Development?

The cost of mobile payment app development can vary significantly based on the application’s complexity, features, the geographical location of the development team, as well as security measures and integrations.

To create a mobile payment app with limited features, primarily focused on peer-to-peer transactions, the estimated development cost ranges from $10,000 to $25,000. For intermediate payment apps, the expected development cost is between $25,000 and $70,000. For advanced payment applications that integrate numerous features with top-notch security and often incorporate machine learning and AI, development costs can range from $70,000 to $200,000 or more.

Benefits of Developing a Payment App

Payment app development is a smart move that enhances the customer experience, drives business growth, and helps companies keep pace with the ever-expanding online world.ndly, and efficient software solution that suits your operations.

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter