Regarding how rapidly the FinTech app industry is growing day by day, this is the right time to enter the market. In 2029, the value of the global fintech market will reach $608.35 billion, growing at a CAGR of over 14%. The following article will share one of the most concentrated aspects of FinTech app development: FinTech app development cost. We’ll be able to give estimations of the costs for the most widespread fintech application types that are already on the market and point out some tips on how to avoid unnecessary expenses while developing this highly promising app. Don’t miss out!

Estimate Cost of Fintech App Types

The fintech app development cost is not fixed because many factors create a major difference. Below is a fintech app development estimate for each of the most popular fintech app types within the market, ranging from banking and lending to investment, personal finance, and insurance apps.

| Apps’s Types | Descriptions | Estimated cost |

| Banking Apps | Through banking apps, users can do everything from creating accounts to applying for loans without needing to visit a bank branch. | $30,000 and $300,000 |

| Lending Apps | Lending apps allow customers to apply for loans through a digital channel, streamlining the loan process. | $50,000 and $150,000 |

| Investment Apps | Investment apps offer investment opportunities and a variety of other services. | $60,000 and $120,000 |

| Personal Finance Apps | Personal finance apps help users manage their finances seamlessly, allowing them to track income, monitor spending, create budgets, and stay on budget. | $50,000 and $300,000 |

| Insurance Apps | Insurance apps provide more affordable insurance policies with faster and simpler interactions. | $45,000 and $200,000 |

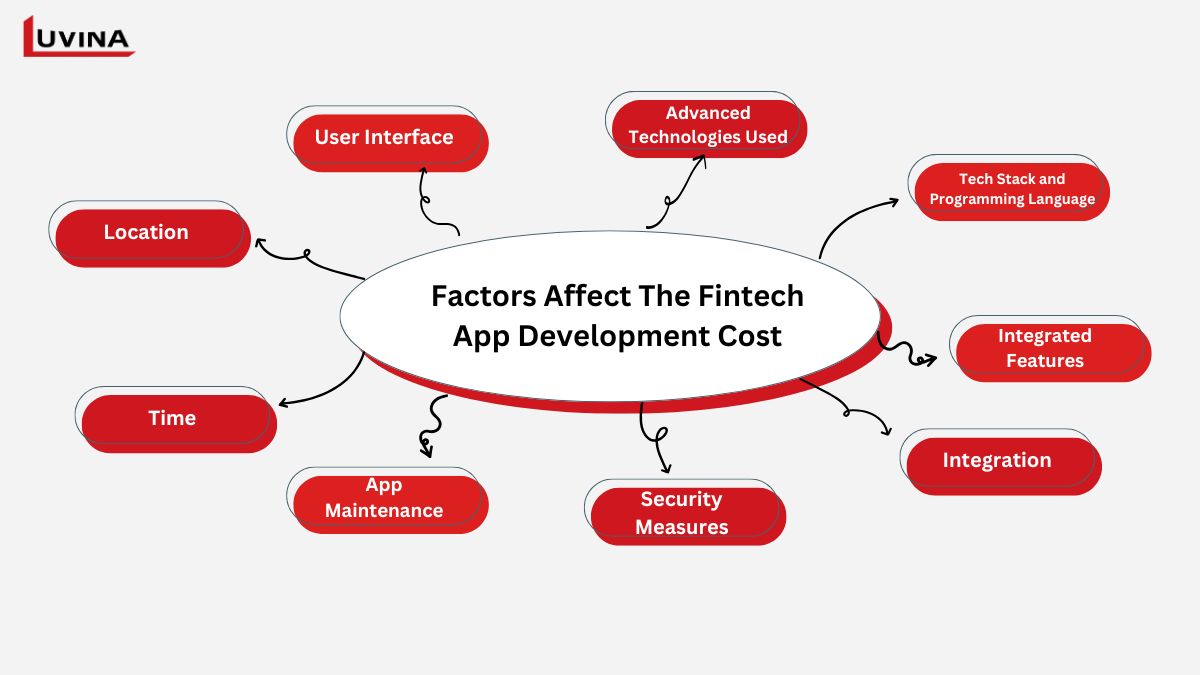

Factors Affecting the Cost of Developing Fintech App

It is very hard to determine how much it costs to build a fintech app because many factors and conditions can affect your project budget. Below are some factors that we believe will have a significant impact on fintech application development cost.

User Interface

A seamless fintech app design will help improve the user experience. That is why a fintech app needs to be built correctly, from the fonts to the choice of words and the appropriate use of white space to help users find the information they need quickly. Experts recommend that you invest significantly in designing user-friendly interfaces.

Location of the Development Team

Another important factor affecting the cost of developing a fintech app is the location of the development team, specifically the hourly wage of the group of specialists multiplied by the time they need to create the fintech app in a specific area. For example, in North America, the developers charge approximately $25 to $35 per hour, while in India it is about $20 to $25, and in Europe from $35 to $65. From these examples, one gets to conclude that working with development teams in India saves you some money as compared to having teams based in North America or Europe.

Time Needed to Develop the Fintech App

Time is also a core factor affecting the fintech app development estimate. The longer it takes to develop the app, the higher the cost. That is why fintech app development projects often focus on teamwork to develop as quickly as possible. The time required to build a fintech app depends greatly on how you want to develop the app. For example, a banking app typically needs at least 2,000 to 3,500 hours; a lending app from 2,000 to 2,500 hours; an investment app from 1,500 to 2,500 hours; personal finance apps from 1,500 to 2,500 hours; and insurance apps from 2,000 to 3,000 hours.

App Maintenance

When calculating the cost of developing a FinTech app, you must also consider maintenance costs because app development is an ongoing process. After launching the app, you need to maintain it regularly so that it can always operate effectively and provide the best experience for customers. Additionally, all features and functions of the app must be updated regularly to stay aligned with business needs. All maintenance-related tasks will increase development costs.

Advanced Technologies Used

The modern technologies used in your fintech platform to optimize functionality will also play a significant role in deciding how much it costs to build a fintech app. Some advanced technologies currently used in developing these apps include digital analytics, blockchain, and artificial intelligence. Each of these technologies will play a specific role in financial applications.

For instance, digital analytics will analyze the financial data of consumers and provide necessary insights; blockchain can enable the users to perform a transaction that is transparent and fast, which may take just a few minutes; and artificial intelligence has helped the fintech apps to include user-friendly chatbots or sophisticated financial planning tools to detect fraud and quickly process transactions.

Tech Stack and Programming Language

Another factor that affects fintech app development cost is the tech stack and programming language. Currently, there are three types of apps: native apps, cross-platform apps, and hybrid apps. Each type of app has a different tech stack and requires different costs.

Integrated Features

The number and complexity of integrated features in the fintech app will also impact the development cost. The more complex the features, the higher the development cost. For example, a fintech app with basic features typically costs between $20,000 and $50,000. However, an advanced fintech app can cost up to $150,000 to $500,000 to develop.

Security Measures

Financial applications will handle sensitive data. Therefore, security is extremely important. The level of security implementation also affects the cost of building a fintech app. For example, basic security will cost less and will integrate some features like user authentication and data encryption. Advanced security with higher costs will include multi-factor authentication, biometric login, and high-level encryption protocols for sensitive financial data.

Standard security costs between $10,000 and $30,000, while advanced security will range from $30,000 to over $100,000. Although this is a factor that significantly affects app development costs, experts recommend that you should not hesitate to invest in security features.

Integration with External Systems

If you want to integrate the app with external systems like bank APIs or third-party financial tools, you should be prepared to spend extra money. All integrations and customizations can increase development time and costs. Basic integration will cost between $15,000 and $50,000; moderate integration will be from $50,000 to $150,000; and complex integration with multiple systems will start at $150,000 or more.

How Much Does It Cost to Build a Fintech App?

Determining how much it costs to start a fintech company, or in other words, the fintech app development cost, is complex. In 2024, if you want to develop a fintech app, you should expect to spend between $50,000 and $300,000. As mentioned above, the exact figure will depend on various factors, including the scope and complexity of the app, time-to-market, and the location of the development partner, and maintenance costs. Additionally, the cost to build a fintech app will vary based on the pricing structure of each service provider.

The general time taken for developing a basic application is 4 months on average. Whereas the cost of simple applications, like personal finance or an e-wallet, can start around $50,000, more complex and advanced applications—like investment management or e-trading exchanges—will run between $200,000 and $300,000. This fintech development application estimate includes everything from design to development, testing, and ensuring that the application follows the standards of security and industry regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering).

Tips to Optimize Cost to Develop Fintech App

It is undeniable that being ready to invest in developing and implementing a fintech application will lead to a high-quality product. However, this does not imply you have no leeway regarding how to optimize your costs and still cater to your business needs. Read on for some suggestions from us on how you can achieve this:

- Prioritize the core features: Develop core features only for those that solve a certain problem. This way, you will not invest in features that are not needed. We recommend making MVP the minimum viable product to gather worthy feedback from its users to make future updates based on the users’ preferences.

- Leverage open source libraries and frameworks: Generally, mobile app development uses a lot of open source libraries and frameworks made available to the community, most of which come free of cost. These can save your fintech app development cost to a great extent.

- Outsource app development: Outsource the development of fintech applications from a reliable service provider. These companies can offer flexible collaboration models along with affordable pricing. This helps the companies to meet your requirements with a price structure that helps in saving a lot on development costs. More importantly, you will be assured about the quality of your fintech application if you choose an industry expert as your partner who is reasonable in their pricing.

How can Luvina help?

Luvina is the best candidate for a fintech app development company to collaborate on developing. We have extensive expertise and experience in creating robust financial software that fully meets all industry requirements and regulations. With 20 years in operation, Luvina has spent 15 years working for banks and continues to support major banks in Japan with system upgrades and FinTech development. This means we deeply understand the high accuracy and security demands of the finance industry.

Our experts at Luvina are skilled in creating high-quality applications and excel in addressing security challenges. From the start of our development process, we emphasize security to ensure your FinTech app meets the highest standards of data sensitivity and confidentiality. Just as a bank implements multiple security layers to protect its customers’ assets, we apply similar measures to guarantee the integrity and confidentiality of your application.

Additionally, with our offshore team in Vietnam – a top 5 country for affordable software development – you can save on fintech app development costs while still getting the highest quality applications.

Related Posts:

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter