During the 4.0 era, new investors tend to prefer the role of managing investments on the go. That is why investment app development is in high demand nowadays and will presumably continue to increase even stronger. An investment app may become a highly prospective business idea, which we are going to prove in this article. Read on for an overview of the investment app development market, key considerations, and a detailed guide on how to create an investment app in 8 steps with quality.

Key Insight about the Investment App Market

Digitization has been changing everything related to our lives. And financial investments cannot be an exception. Several years ago, people needed special education and training to perform investments. However, these days, with only a smartphone and an investment app, anyone can invest and manage their finances quite effortlessly. The popularity of investment apps has brought people of all ages into the investment market. This ability to bridge the gap between users and profitable investments is the key reason behind the growing craze for investment app development.

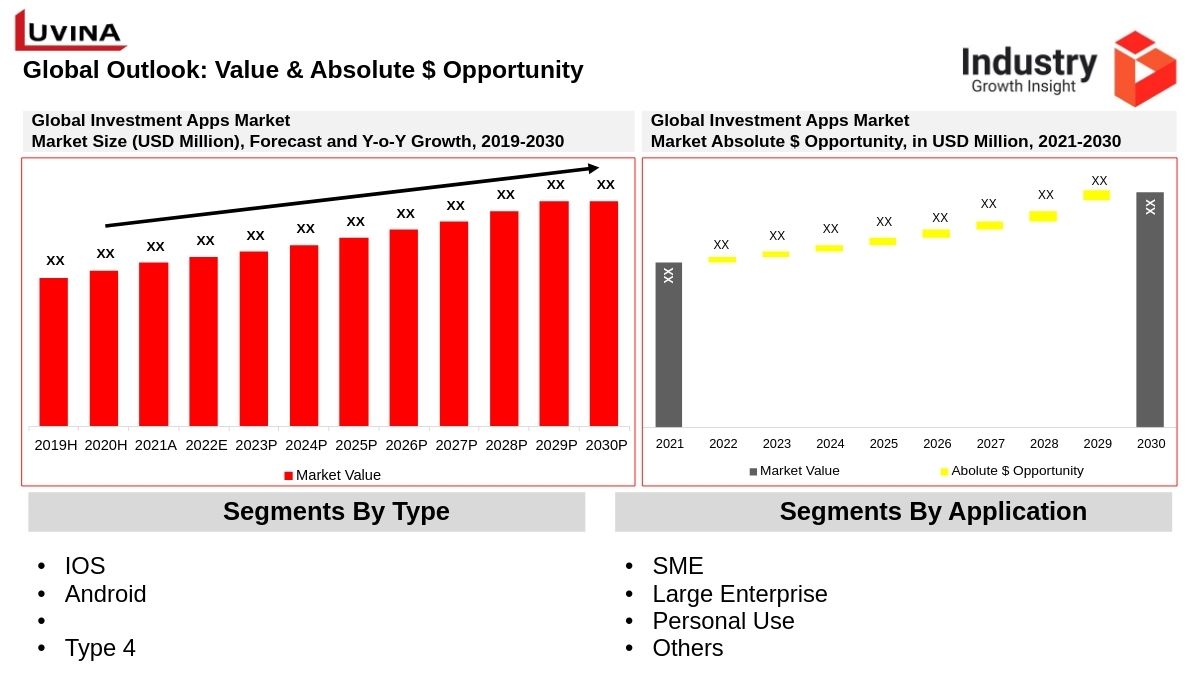

If you’re wondering whether to create an investment app as a business opportunity, the following statistics demonstrate the profitability of this type of app:

- – Searches for investment-related topics on Google increase by 115% annually.

- – According to Statista, the global market value of electronic trading is expected to grow from $8.7 billion in 2021 to $12.16 billion by 2028, with a compound annual growth rate of 5%.

- – At least 10% of people of all ages have used online investment tools in the past 12 months.

- – In a survey by Bankrate, 63% of smartphone users have installed at least one financial app, and 17% of these are standalone investment apps.

These statistics show that investment platform development is undoubtedly a promising business opportunity. While the current investment app market may seem crowded with a variety of apps, there remains significant demand for targeted solutions. Even without major innovations, you can create a popular investment app. This is because all modern solutions in the market have their imperfections. You can still provide a better user experience and fresh designs.

The market is still waiting for suitable online investment opportunities, and your task is to seize the chance to dominate the market with a brand-new investment platform.

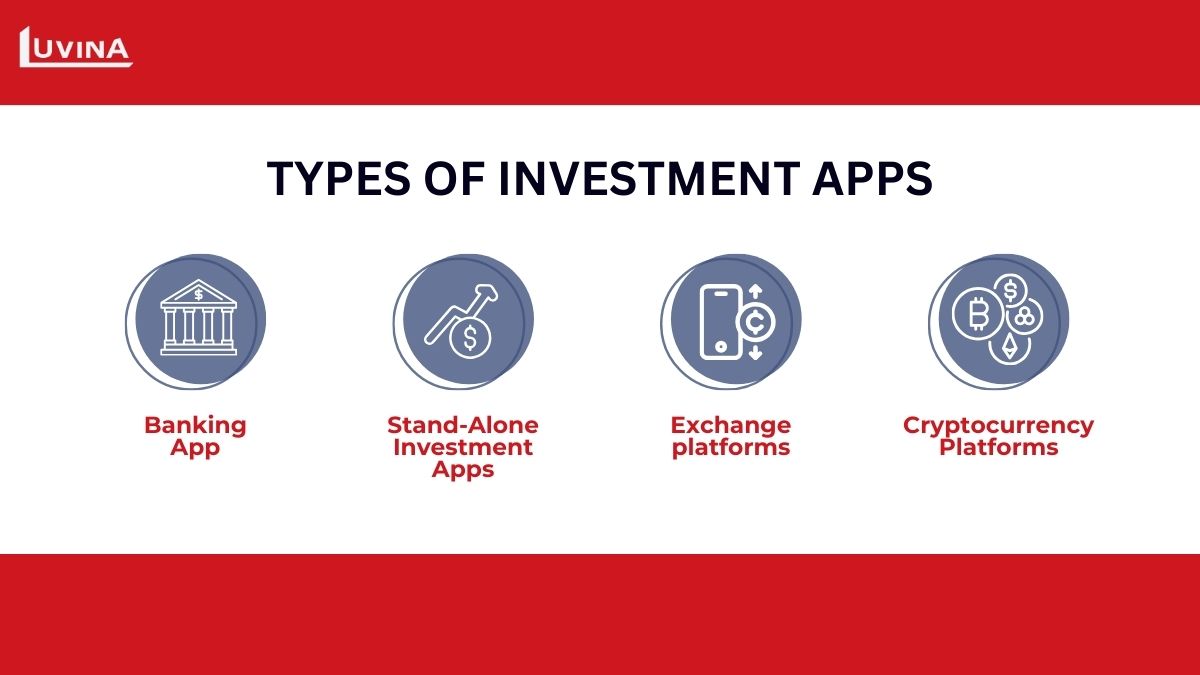

Types of Investment Apps

Investment app development is mainly aimed at providing a tool that will help the user manage his or her investment. Although all investment apps are operated through the same mechanism, they can be divided into different types based on the level of assistance they provide to the users.

1. Banking app

They generally do not offer any elaborate investment-related support to the users. Their scope is usually limited to providing the current stock prices, minimum purchase quantities, and other general advice regarding investment strategy. However, banking apps allow their customers to operate accounts, perform transactions, and arrange loans. Banking apps are mostly run by licensed financial institutions, which integrate different types of financial activities on a single platform to facilitate users in managing daily income and expenses and online investments with ease.

2. Stand-alone investment apps

As the name suggests, standalone investment apps are comprehensive solutions focused solely on investment activities. Standalone investment applications have a number of permutations that you may consider in investment app development, including:

- – DIY investment apps: enable users to manage their investments on their own.

- – Human advisor apps: offer online investment advice from human financial advisors.

- – Robo-advisor apps: operate users’ investments through automated algorithms with low or no human intervention, based on pre-set risk preferences and financial goals.

- – Hybrid advisor apps: Both robo-advisory features and human advisory services go hand in hand.

3. Exchange platforms

Exchange platforms are also widely used as investment apps. For example, if users want to diversify their portfolios by trading different types of assets, from stocks and bonds up to cryptocurrencies, then the exchange platform is for sure highly effective. In case you plan to develop an exchange platform with investment application features, add portfolio management, risk management, research tools, and market analysis functionalities.

4. Cryptocurrency Platforms

This category of investment applications solely focuses on cryptocurrency trading. Investors will be able to invest in cryptocurrencies and liquidate them using some other currency. For instance, Binance is one of the largest crypto exchange platforms, through which huge digital currencies are traded with advanced features to trade online.

Must-Have Features in Investment App Development

The feature that should help your app stand out from the crowd and give it a competitive edge is unique features. But before that, we would like to propose that the following are the basic features your investment app should include while investment app development:

| No. | Feature | Description |

| 1 | Registration and Onboarding | Users can register using their phone number, email, or other details. Then, add in document verification to validate such users. Once registered, users will be taken on a tour to navigate the highlights of the app and investment channels. |

| 2 | Profile Management | Facilitate the process of creating personal accounts with simplicity for users. The profile section shall include information like the investment portfolio, payment channels, personal information, and day-to-day and overall investment transaction results. |

| 3 | Money Management Tools | If you plan to create an investment app, include a robust money management tool. Since most users seek the best way to manage their funds, this tool should feature an interactive dashboard with savings and credit management options. Utilize interactive sliders, pie charts, infographics, and other visual aids. It should not only be visually appealing but also insightful, offering consistent updates on financial and investment activities to keep users engaged. |

| 4 | Trading Management | Provide real-time market data, quick transaction execution options, and additional features to streamline trading. |

| 5 | Security & Privacy Protection | Privacy and security in investment platform development are standard features. Therefore, try to incorporate robust IDPS against DDoS attacks, spam bots, Two-factor authentication, phishing protection, encryption, and much more. The more security you have, the better the experience. |

| 6 | Real-time Analytics | This feature offers users all the necessary information to make decisions and develop investment strategies. |

| 7 | Push Notifications | Investment apps should include real-time alerts and personalized reminders. Through this system, apps can notify customers about transactions, promotions, account status, and asset value changes. Users especially appreciate this feature in volatile markets like cryptocurrency. |

| 8 | Transaction Management | Investors want more transparency and insight into cash flow. Develop an investment mobile application that will help your customers manage their transactions: buying, selling, receiving money, and withdrawing of money, in one place and in a user-friendly interface. |

| 9 | KYC and AML Integration | Take the advice of legal experts to understand other information and regulations you have to address regarding KYC and AML compliance. |

| 10 | News and social feeds | Offer users the ability to subscribe to news about their favorite tools, companies, or industries, fostering a connection between users and your service while increasing the app’s value. |

| 11 | Virtual advisor | Integrate an AI-driven chatbot to improve customer experience. This may also be used to answer simple queries from users over their risk tolerance and suggest some nice investment opportunities or feasible strategies accordingly. |

| 12 | Customer support | Use either robotic support, human support, or a hybrid model, depending on your resources. Provide for live chat over the phone and email, and use social media platforms as main channels of communication. |

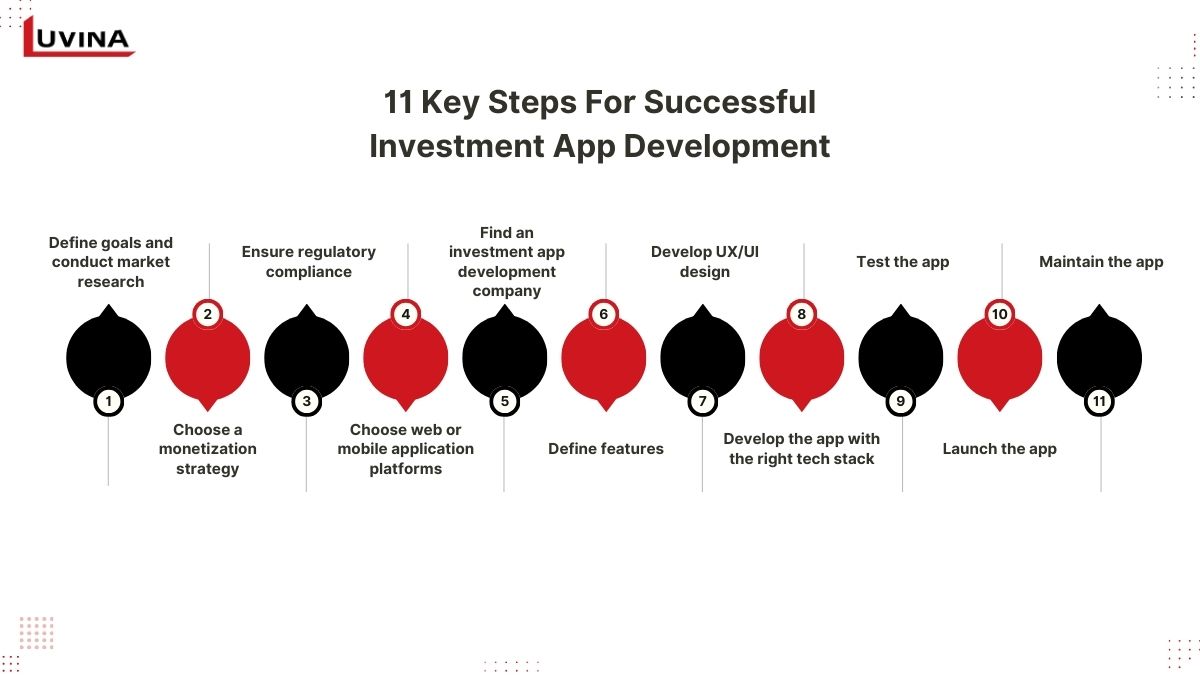

How to Develop an Investment App: Step-by-Step

In the race for investment app development, making your application multi-functional and user-friendly is necessary to keep your application in the pocket of its users. Below are the steps of the investment platform development process that could help you develop a powerful application that can keep you competitive in the market.

Step 1 – Define goals and conduct market research

Identifying your target audience and conducting market research are more important than you may think during the investment app development process. Before developing your app, try to work with competitors’ apps, study their business models, and analyze their key features. Heed special attention to how inconvenient and wrong these apps are, to avoid the same bad things in your investment app.

Step 2 – Choose a monetization strategy

Your chosen monetization approach must align with the business model, target audience, and value proposition of your app. Strike a balance between revenue generation and a smooth user experience, allowing users to enjoy your app without relentless ads or heavy charges. Here are a few common monetization approaches:

- Transaction Fees: For every purchase and sale of stock, there might be a small percentage of the money being charged. The standard rate for each transaction is 1% of the transactional amount.

- Subscription Model: Add value to your subscription-based models. For example, in-depth analytics, personalized financial advisories, or premium services are only provided to subscribers of paid plans.

- In-app advertising: Permit ads within the application for marketing various financial products and integration of value-added services within your application.

Step 3 – Ensure regulatory compliance

Regulatory compliance is an essential procedure for the investment platform development process. n addition to the registration of a stockbroker, you have to follow specific core regulations such as those laid down by FINRA and the Securities and Exchange Commission of the USA for the protection of investors and to maintain a fair and orderly market. Moreover, if you’re providing services to the Europeans, there comes into play GDPR or General Data Protection Regulation – pay greater attention to data privacy and security. Other than that, depending on your scope and location, there might be other regulations to investigate and follow.

Step 4 – Choose web or mobile application platforms

This is a key step in the process of creating an investment app. The most common options would be a web-based investing platform or mobile investment apps, each with certain advantages, suited for different kinds of user preferences:

- Web-based: Since this option enables users to access the application through a browser on their desktops or laptops, it is ideal for those who would want to analyze activities of investment in detail on large screens. This type will suit professional investors working with big tools and data.

- Mobile Applications: The development of investment applications in mobile gadgets aims at users who value convenience and accessibility, even on the go. You can create iOS investment applications for iPhone owners or Android investment apps for users of Android devices or its cross-platform solutions. While selecting the platform, think about your target audience, budget, and list of features you want to implement in your application.

Step 5 – Find an investment app development company

There are many factors to consider when choosing a partner to create an investment app. We recommend that our readers pay special attention to the portfolio and give preference to companies with experience in building mobile apps for investors on iOS and Android. The quality of services can be judged by reading references or testimonials of previous clients. These will give you realistic expectations for the app development services.

Step 6 – Define features

First, you have to determine whether you will be building an MVP or a feature-rich application. The advantage of creating an MVP is that it allows you to test the app before its launch and avoid unnecessary costs. However, if you’ve already validated your business idea, you can directly start building a full-featured investment app.

If you choose an MVP, the essential features to include are user registration and authentication, basic transactions, portfolio tracking, and security components. On the other hand, for a complete app, you should consider adding educational resources, virtual advisors, social elements, and advanced analytics to help users make smarter investment decisions. If you’re unsure about which features to include, you can seek support from development companies.

Step 7 – Develop UX/UI design

This is the step where your vision for the investment application begins to materialize. In this stage, professional designers work on the look and interactive parts of the app to ensure it’s appealing to your targeted audience. While working on investment app development, ensure the application is not only appealing graphically but also functional and user-oriented. Here are some tips for designing a user-friendly UX/UI:

- Intuitive Navigation: Use clear menus and icons to help users browse through the app with ease.

- Responsiveness: The app should support different screen sizes and device types. Readable fonts: The fonts used should be legible, with consistent typography throughout the app.

- Color Scheme: The color scheme should be in harmony with your target audience and consistent with your brand.

- Guidance and Terminology: This includes onboarding processes and explanations of terminology.

- Use communication styles that resonate with your audience.

You can also explore financial app design samples to understand the popular features that users expect.

Step 8 – Develop the app with the right tech stack

Fintech is that field that demands being on par with the latest trends in tech. Some of the notable technologies applied widely in this sector include Artificial Intelligence and virtual data rooms. During investment platform development, make sure you choose an appropriate tech stack that would satisfy users’ needs. The technology stack for an investment app might be changed for specific requirements; for example,

- Frontend development: Swift, Kotlin, Java, React.js

- Backend development: Java, .NET

- Data management: NoSQL, MongoDB, PostgreSQL; Cloud services: AWS, Microsoft Azure; Payment gateways: PayPal, Stripe; UX/UI design tools: Balsamiq, Figma.

Consider the integration of third-party solutions with the use of APIs for adding additional features and services to your application.

Step 9 – Test the app

Before launching, conduct comprehensive testing, which includes unit testing, integration testing, system testing, and usability testing, to ensure the application is reliable, secure, and user-friendly. During the testing phase, it is important that all functionalities of the app and its security protocols have to comply with financial regulations. Also, test the app under various conditions and across multiple devices.

Step 10 – Launch the app

Once all preparations and testing are complete, your app is ready for users. If it’s for Android devices, you can publish it on the Google Play Store, and if it’s for iOS devices, you can release it on the Apple App Store. Follow the specific guidelines and requirements of each platform to submit your app, which includes providing detailed descriptions, screenshots, and compliance with privacy policies.

Step 11 – Maintain the app

This phase of the investment app development process involves continuously improving the app after its launch. Pay attention to feedback from early users and update the app’s design and functionality accordingly. Additionally, regularly update and secure your app by conducting frequent security checks and penetration testing to identify and fix vulnerabilities. You should also be developing an incident response plan in depth, including communication strategies, prevention, and recovery processes during maintenance, in case of a security breach.

FAQs

What is an Investment App?

Investment apps are mobile apps that help both investors and experienced ones to keep track of the stock market and handle their investments. Such apps provide flexible and handy resources with minimal fees for their use, enabling their owners to grow their portfolios and save money.

How much does it cost to create an Investment App?

The average cost of investment app development ranges from $70,000 to $120,000. The exact figure depends on various factors, including the development team, geographic location, the variety of features, app complexity, and more.

What are the best examples of investment apps?

There are many powerful investment apps available in the market. Notable examples include:

- Betterment: Ideal for those who prefer professionally managed portfolios with cash management accounts. It offers management fees ranging from 0.25% to 0.40% of annual assets and allows users to set investment goals without requiring a minimum account balance.

- Acorns: Suited for investors who want automatic investments while spending without extra effort or for retirees who prefer hassle-free investing.

- Robinhood: The best app for active trading, offering zero commission fees and no minimum balance requirement.

Binance: A leading platform for cryptocurrency and NFT investments, known for its robust security system.

Related Posts:

- Fintech App Development: Comprehensive guide

- E-wallet App Development: An All-In-One Handbook

- Mastering Payment App Development

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter