Fintech companies in Vietnam are playing an important role in the fast growth of the country’s digital economy. With over 200 fintech companies in Vietnam, the sector is thriving and highly competitive. Market growth is ongoing and expected to reach $18 billion by 2024, with the fintech sector changing faces as people access financial services. Supported by its tech-savvy population, coupled with growing demand for digital solutions and also cashless transaction support from the government, the performance of the sector is excellent in various sectors like payment, lending, investment, etc. This article will discover the top 5 fintech companies in Vietnam that are in charge of reshaping the future of finance within the country.

List of Fintech companies in Vietnam

The top fintech companies in Vietnam are leading rapid transformations in the area of financial services. How many fintech companies in Vietnam are there? Statistics indicate an estimation of a number exceeding 200 different active fintech companies currently operating across the country. However, in the context of increasing competition, only the top companies can meet the needs of the tech-savvy population. Here is the list of fintech companies in Vietnam that are highly rated.

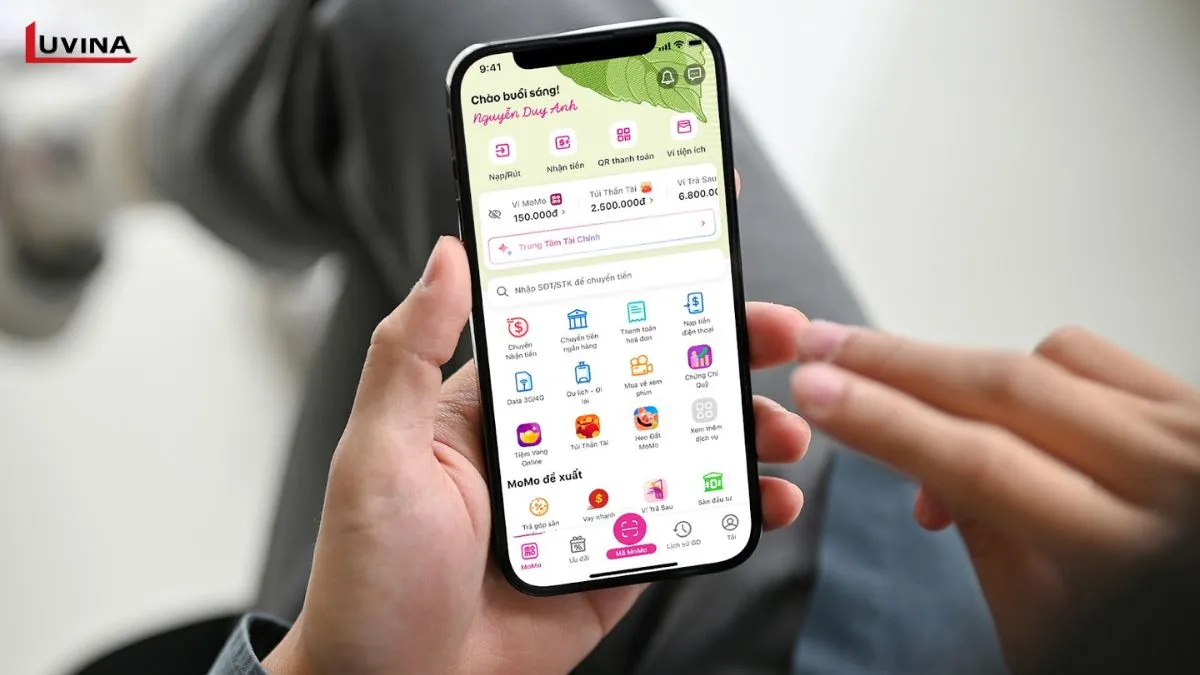

1. Momo

MoMo is a leading fintech company in Vietnam, offering a comprehensive digital wallet that enables users to make various types of financial transactions. Payment of bills and all fuel charges, transfers of money, and online purchasing come in all varieties of ways through the Momo application. Presently available on iOS and Android, it is now in the reach of millions.

Having such heavyweight investors as Goldman Sachs, Standard Chartered Bank, and Warburg Pincus strongly backing it, MoMo has grown to become one of the most trusted mobile payment solutions in the country, offering extensive services for both individual users and businesses alike.

- – Number of users: About 20 mil.

- – Key features: E-wallet transactions: Linked to phone numbers. Robust security

- – Key advantages: Wide user base and an extensive network with diverse service offerings.

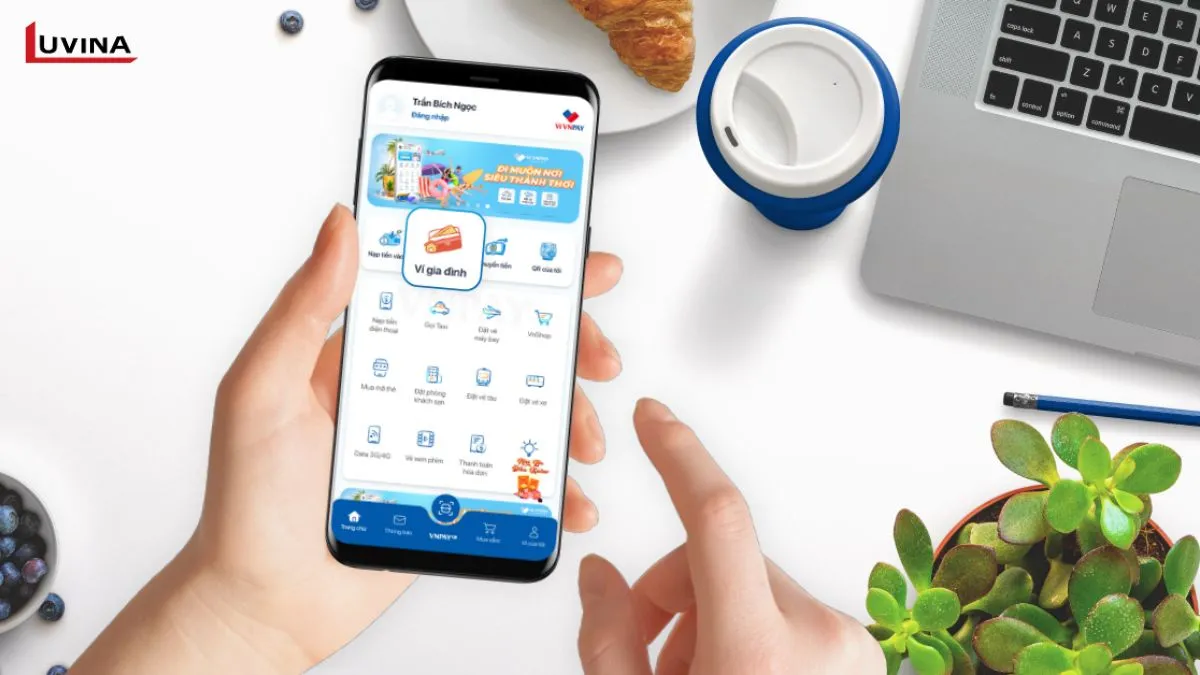

2. VNpay

One of the standout fintech companies in Vietnam, VNPAY is transforming the digital payment landscape with its comprehensive range of payment solutions. Created by Vietnam Payment Solution Joint Stock Company, the platform allows users to make smooth payments through the use of QR codes linked to banking apps or e-wallets. VNPAY has grown fast in partnerships across more than 30 banking apps and 6 wallets.

In 2019, the company received $300 million in funding from SoftBank’s Vision Fund and Singapore’s GIC. While the number of fintech companies in Vietnam is still growing, VNPAY is at the forefront of efficient and innovative digital payment services.

- – Number of users: More than 25 mil.

- – Key features: Quick payment; Online shopping; Bill top-up

- – Key advantages: Quick payment, convenience, safety, security, and many promotions

3. Finhay

Finhay is among the leading fintech companies in Vietnam, focusing on millennials willing to start investing. It allows users to invest in mutual funds with as little as VND 50,000, or around US$2, thus opening investment opportunities to a wide range of people. Finhay provides its users with tailored investment portfolios matching their risk appetite, hence flexible and user-oriented services. Portfolio tracking and rebalancing, including strategy formulation for investments, is done through an application on iOS and Android, and users can take responsibility for their financial futures through it.

- – Number of users: More than 2.7 million.

- – Key features: Micro-investing, Diverse investment options, Savings and insurance, Financial Education

- – Key advantages: Accessibility, simplicity, and focus on beginner-friendly financial management

4. Zalopay

ZaloPay is a fintech company in Vietnam belonging to ZION, a pioneering e-wallet that comes integrated with the leading messaging application in Vietnam: Zalo. This integration makes it easier for users to connect their payment cards for P2P transfers, make NFC- and QR code-enabled payments, and shop for anything they need online. By incorporating social networking with payment solutions, ZaloPay uses the tens of millions of active users on Zalo and enables users to handle all of their financial tasks through a service that they are already using daily.

- – Number of users: About 14 million.

- – Key features: Diverse payment methods; User information security; Multifunctional Zalopay QR;

- – Key advantages: Leverages a strong social media platform for user acquisition and engagement.

5. AirPay

Airpay (which was rebranded as ShopeePay) is a fintech company in Vietnam that offers integrated payment tools to enhance online shopping. Developed by AirPay Joint Stock Company, this e-wallet provides users with an easy way of paying online in digital ecosystems. Being part of a greater companion ecosystem that includes leading platforms such as Garena, Ocha, Foody, Now Delivery, and Shopee, Airpay offers users ease of transactions across these services, thus making it one of the most favorite online shopper payment solutions in Vietnam.

- – Number of users: About 20 mil.

- – Key features: Payment links; Multi-currency support; Secure transactions

- – Key advantages: Collaborates with major e-commerce platforms, boosting transaction volumes.

Summary

Given the rise of Vietnam in the world fintech landscape, the leading fintech company in Vietnam has become a driver of change with innovative solutions. These companies enhance the financial ecosystem of the country and position it as a leader in Southeast Asia’s fintech sector. It is expected that the names in this list will continue to dominate the Vietnamese fintech industry for years to come. In order to be among the leading fintech companies in Vietnam, businesses have to invest in technology and security, improve user experience, and use consumer behavior data to personalize services and build trust with consumers.

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter