Consumers today expect more than doorstep delivery. They demand a smooth, hassle-free payment experience. For commercial entities to compete and survive in this highly competitive environment, e-commerce payment gateway integration is an imperative initiative to facilitate ease of transaction, free of cash, while widening international visibility.

In this tutorial, we’ll take you through the basics of payment gateways, their workings, and the method to successfully implement one in your e-commerce site.

What Is a Payment Gateway in E-commerce? (+ How It Works)

A payment gateway acts as the digital bridge between your online store and your customers’ banks, allowing for secure transactions. Simply put, it’s the tool that lets shoppers safely pay for goods on an e-commerce website with payment gateway features, using credit cards, digital wallets, or bank transfers.

Better-known examples of online payment gateways include Stripe, PayPal, Razorpay, and Cashfree. They all come with extra functions such as detection of fraud, real-time analysis, and support for several currencies that one needs to maintain a modern-day online store.

To understand how a payment gateway fits into the bigger picture, it helps to know how a payment gateway differs from other components. A payment gateway is primarily responsible for securely collecting and transmitting customer payment data from your website to the processor, making it the first point of contact in an online transaction.

In contrast, a payment processor handles the actual transfer of funds between the customer’s bank and your business, while a merchant account is where those funds are temporarily held before being deposited into your main business account. The key difference is that the payment gateway acts as the secure interface between your store and the payment system, ensuring data is captured and passed safely for processing.

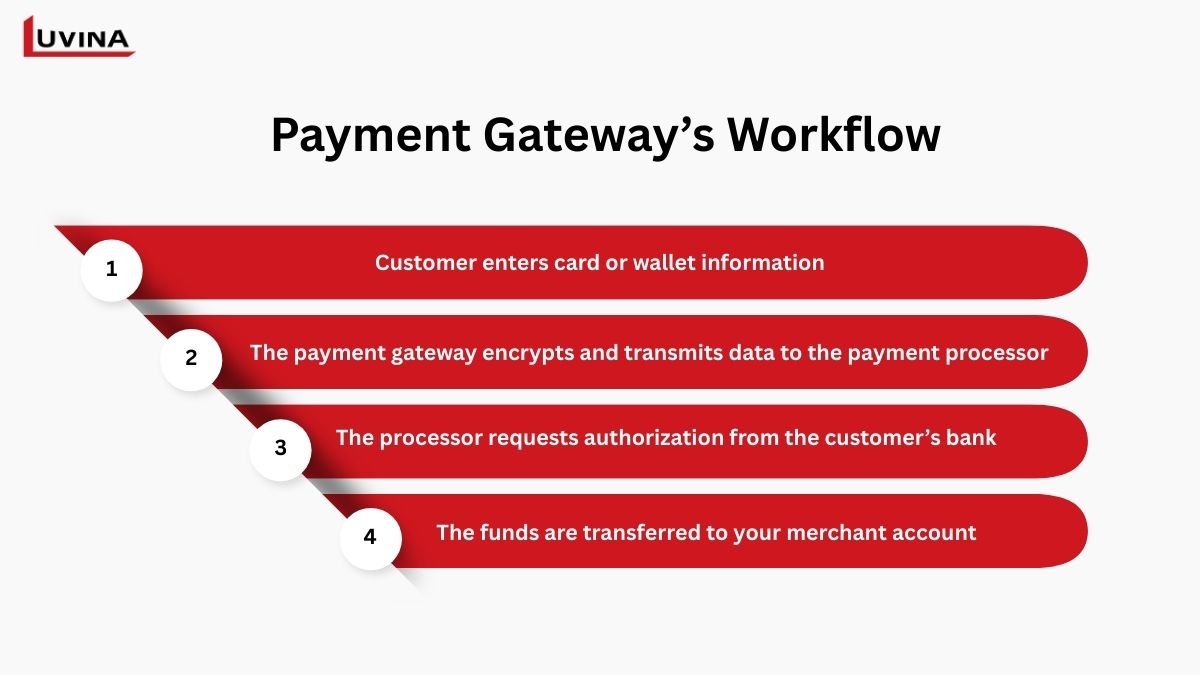

Here’s a basic flow of how a payment gateway works:

- – A customer enters their card or wallet information at checkout.

- – The payment gateway securely encrypts and transmits this data to the payment processor. Most gateways rely on HTTPS (TLS encryption) to securely transmit payment data, preventing man-in-the-middle attacks during transit.

- – The processor requests authorization from the customer’s bank.

- – Once approved, the funds are transferred to your merchant account, and the customer receives confirmation.

E-commerce payment gateway integration ensures that your store provides a seamless and safe shopping experience. It reduces manual effort, protects sensitive data, and builds customer trust.

3 Types of Payment Gateway Integration Explained

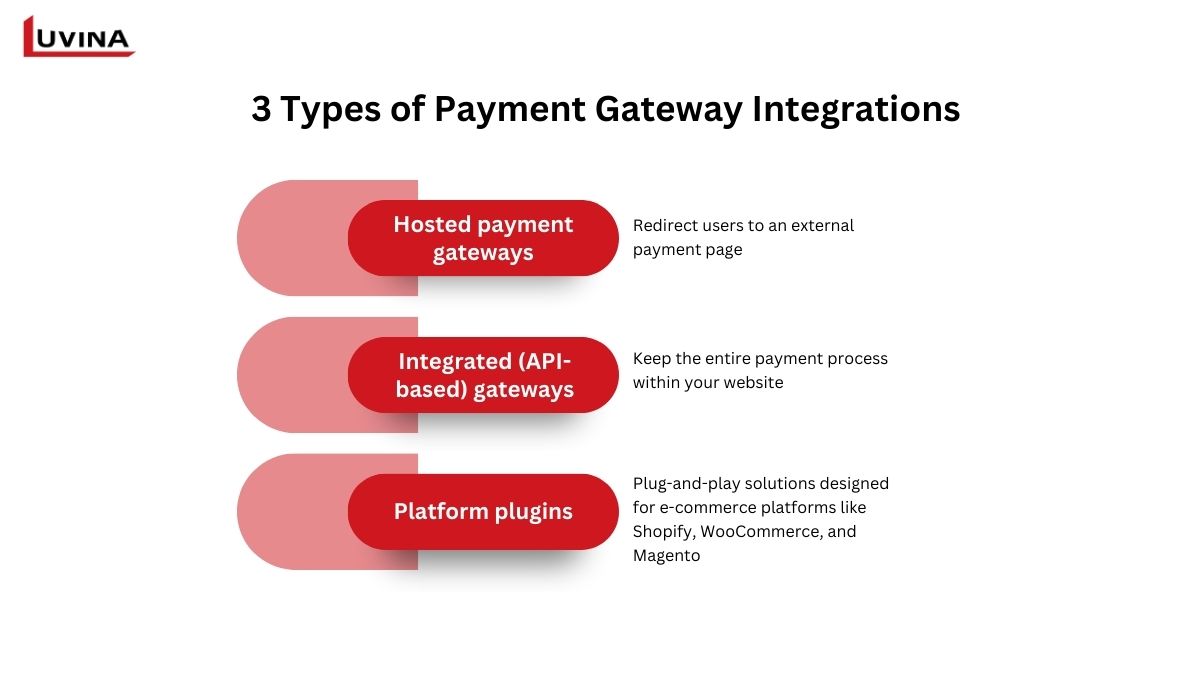

There are 3 primary types of e-commerce payment gateway integration. Each offers unique benefits in terms of control, user experience, and setup complexity.

- Hosted payment gateways redirect users to an external payment page, such as PayPal, to complete transactions. They’re easy to implement and offer strong security, but the redirection may disrupt the checkout flow.

- Integrated (API-based) gateways hold the whole payment process on your site, and they give you a seamless, branded experience for the user. While this option gives you maximum control, it also requires greater technical resources and security compliance obligations.

- Platform plugins are plug-and-play e-commerce platform plugins for Shopify, WooCommerce, and Magento. They allow for fast deployment with minimal setup, making them ideal for small businesses or entry-level operators.

Step-by-Step: How to Integrate a Payment Gateway into Your E-commerce Website

E-commerce payment gateway integration is not merely choosing a provider–there’s planning and careful action at play. Follow us along below, and we’ll walk you through the most critical considerations to install a payment gateway successfully on your web shop.

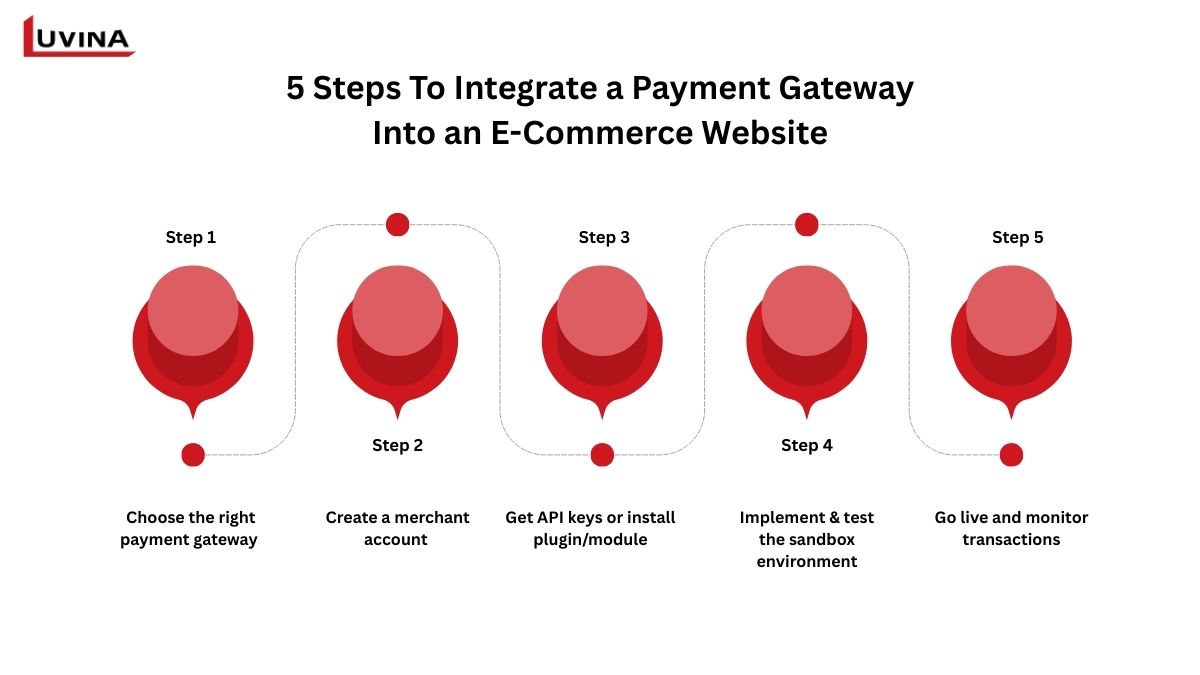

Step 1 – Choose the right payment gateway

The initial step in creating an e-commerce website with payment gateway functionality is to choose the most fitting payment gateway. The use of a compatible gateway ensures easy integration, enhances overall performance, and boosts customer satisfaction.

To ensure an informed selection, factor in such considerations as your target market’s geolocation, projected transaction volume, and desired payment methods. Also, look at reviewing each gateway provider’s transaction cost, payment diversity supported, level of security, and its supportability with your existing e-commerce website.

Step 2 – Create a merchant account

Before you pay online, you may need to set up a merchant account with your preferred payment gateway provider. It is a buffer area between the customer payment and deposit to your business account. Setting up an e-commerce website with a payment gateway has never been easier using services like Stripe or Razorpay.

Registration would usually require completing a Know Your Customer (KYC) procedure by filling out information including business name, business address, banking details, and official records, to establish your business identity. With this approval, key credentials like a merchant ID that are used in linking your gateway to your e-commerce site are forthcoming. Protect these details as secret and for immediate access to specific team members alone.

Step 3 – Get API keys or install plugin/module

Once your merchant account is set up, the second step in integrating payment gateways into e-commerce is connecting your site to the gateway system. This is usually a case of retrieving API keys—special credentials that enable secure communication between your site and the payment provider’s servers. On Shopify, payment gateways are integrated either through Shopify’s built-in payment partners or via custom apps using Shopify’s Payments API and webhooks.

Step 4 – Implement & test the sandbox environment

Having finished setting up for your e-commerce payment gateway integration, it’s now time to make sure everything works as it should. Depending on your selected gateway and platform, this will differ.

Some platforms, such as Shopify or WooCommerce, provide easy plugins, while others need to be installed manually through code. Once the integration is in place, use the provided “sandbox” or test environment to simulate transactions. By doing this step, you’re ensuring payments are being processed properly without using real money, so everything is ready for a smooth live launch.

Step 5 – Go live and monitor transactions

After having tested your payment gateway successfully, it’s time to go live and accept real money. Your buyers should now safely make transactions on your site. Nevertheless, it is best to constantly check on transactions to observe that everything goes smoothly. Think about data security every time by using encrypted connections, and secure APIs, and taking care to comply with PCI-DSS standards in case you are handling sensitive payment information.

Pro tips:

- – Run multiple payment failure modes in regular testing to find potential problems before they reach the customers.

- – Ensure PCI-DSS compliance, either by self-hosting securely (if storing/transmitting card data) or using PCI-certified third-party gateways to offload the compliance burden.

Top 6 Payment Gateways for E-commerce

An efficient payment gateway will assist in making online store transactions secure and easy, reduce cart abandonment rates, and improve the overall shopping experience. Some of the best eCommerce website payment gateways that you can use are mentioned below.

| Payment gateway | Ease of integration | Fees | Currency support | Recurring billing |

| Stripe | Easy | 2.9% + 30 cents.Additional: 0.5% for manually entered cards, 1.5% for international cards, 1% for currency conversion | Supports 135+ currencies | Supports recurring billing. No separate fee for recurring billing |

| PayPal | Easy | 2.59% + fixed fee. Additional fees for international transactions | Supports 25 currencies | Supports recurring billing. No separate fee for recurring billing |

| Razorpay | Easy | 2% per transaction, 3% for international cards | Supports Indian Rupees (INR) and international payments | Supports recurring billing |

| Cashfree | Easy | 1.95% + GST for payments via cards and net banking | Supports INR and over 100 foreign currencies | Supports recurring billing. No specific fee for recurring billing |

| Paystack | Easy | 1.5% + ₦100 for local transactions, 3.9% + ₦100 for international transactions | Supports several African currencies | Supports recurring billing. No separate fee for recurring billing |

| Authorize.Net | Moderate | 10¢ + daily batch fee 10¢. Subscription fee: $25/month | Supports many international currencies | Supports recurring billing. Charges a $25/month subscription fee for recurring billing services. |

Stripe—Best for global scalability

Stripe offers an advanced payment solution to web stores, subscription companies, and marketplaces. It can be easily integrated with Shopify and WooCommerce platforms and can process payments in 46 markets, making use of over 135 currencies. The e-commerce payment gateway integration also enables in-person payments using Stripe Terminal. With built-in fraud protection using its Radar software, Stripe offers secure transactions with multiple payment support, such as digital wallets and Buy Now, Pay Later.

PayPal—Popular with international customers

PayPal is an easy-to-install and well-known payment gateway ideal for small, new businesses. Without setup fees or contracts, it is ideal for new online businesspeople. It streamlines the checkout process using its One Touch feature while ensuring security. Located in over 200 countries and supporting 25 currencies, PayPal processes credit cards, PayPal accounts, Venmo, and even cryptocurrencies, which is very helpful for international customers.

Razorpay—Top choice in India

Razorpay is a popular payment gateway in India with a seamless e-commerce payment gateway integration and simple setup. It supports a range of payment modes like credit/debit cards, UPI, wallets, and EMIs, and is hence apt for local businesses. Simple integration, quick onboarding, and advanced security measures of Razorpay, including PCI DSS Level 1, ensure secure transactions. It also provides customizable settlements and allows merchants to offer promotional offers for specific banks through its dashboard.

Cashfree—Fast onboarding for Indian startups

Cashfree is a popular payment gateway platform in India, often used by e-commerce websites and startups. It offers over 180 payment options, including UPI, credit/debit cards, EMIs, wallets, and net banking.

Cashfree offers a fast settlement cycle, with payments credited in 24 to 48 hours, offering convenient business cash flow.

Paystack—Excellent for African markets

Paystack, founded in 2015 and acquired by Stripe in 2020, is well known for its easy integration and developer-friendly API, allowing businesses of all sizes to accept various forms of payments, from credit/debit cards, bank transfers, and mobile money. Paystack ensures fast settlements, with payments settled the following day. Its ease of use and stability make it a favorite among Nigerian startups and growing businesses.

Authorize.Net—Good for U.S. enterprise needs

Authorize.Net is an ideal solution for U.S. businesses that require multiple payment options. It supports virtual terminals, POS, and recurring payments, making it suitable for both online and in-person transactions. With its easy setup and reliability, it also offers advanced features like customer information management and recurring billing; and supports a wide range of payment methods, including credit cards, digital wallets, contactless payments, and eChecks.

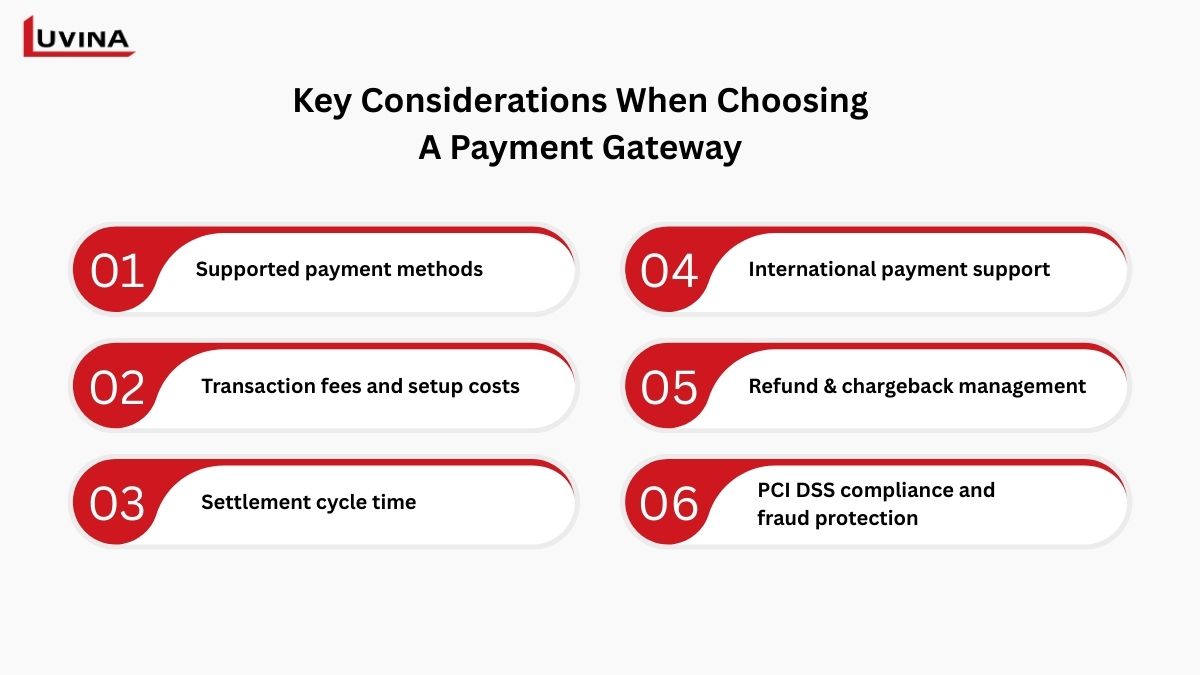

6 Key Factors to Choose the Best Payment Gateway

Choosing the right payment gateway is crucial for smooth payments and a user-friendly experience. Your decision will impact fees, integration into your online shop, and security. These are the most crucial things to remember:

- Supported payment methods

An efficient payment gateway should provide multiple modes of payment such as credit/debit cards, digital wallets, and Buy Now Pay Later (BNPL) options. This is convenient and flexible for your customers.

- Transaction fees and setup costs

Compare transaction fees, setup fees, and any unexpected charges like currency conversion or monthly fees. Ensure that the gateway has transparent prices, and opt for flexible pricing plans according to your business size and sales volume.

- Settlement cycle time

Settlement time is the time taken for processing the money and moving it into your account after making the transaction. Choose a payment gateway that has a clear display of its processing timelines and settles quickly, especially if you have the need to access money very quickly.

- International payment support

For global connectivity, select a gateway that supports multi-currency payments and foreign exchange payments. Consider currency conversion charges and whether your gateway allows you to withdraw profits in multiple currencies.

- Refund & chargeback management

It is worth choosing a payment gateway that features robust refund and chargeback control capabilities. Chargeback notifications, dispute management application, and fraud protection capabilities will help prevent losing money and avoiding risks to your merchant account.

- PCI DSS compliance and fraud protection

Ensure that the gateway is PCI DSS compliant to provide safe protection of sensitive customer information. Also, make sure fraud protection features like real-time monitoring of transactions and machine learning-based algorithms to identify suspected transactions, which protect your business as well as customers.

Why Choose Luvina for Payment Gateway Integration Services?

Luvina is a trusted IT solutions provider with extensive experience in e-commerce development and e-commerce payment gateway integration. We specialize in helping businesses implement secure and efficient payment systems tailored to their unique needs, ensuring smooth transactions and a seamless customer experience.

Our services include:

- – Customized payment gateway selection: We work closely with businesses to identify the most suitable payment gateway for their specific market.

- – Seamless integration across platforms: Luvina excels in integrating payment gateways with various e-commerce platforms such as Shopify, WooCommerce, Magento, or custom-built websites. Our team ensures that these integrations are smooth, efficient, and optimized for both performance and security.

- – PCI-DSS compliance and data security: Security is our top priority. We ensure that your payment gateway integration meets PCI-DSS standards, providing a secure environment for your customers’ sensitive data. Our team follows the best practices for encryption and secure transactions, giving you peace of mind while keeping your business protected against fraud.

At Luvina, we not only provide payment gateway integration in e-commerce but also offer continuous support and updates to ensure your payment system remains secure and functional.

With our expertise, your online store will have a reliable, secure, and user-friendly payment system that enhances both your operational efficiency and customer satisfaction.

Conclusion

A payment gateway allows you to accept payments from customers, and it can impact customer experience, transaction efficiency, and even business growth. We hope the article above has helped you better understand e-commerce payment gateway integration, how to integrate a payment gateway into your e-commerce website, and how to choose the right payment gateway for your business.

At Luvina, we specialize in providing secure and efficient payment gateway integrations tailored to your specific needs. Don’t let payment processing issues hold back your business. Contact us today to discuss how we can help you implement the best payment solution for your e-commerce platform.t perfectly fits your learning environment. Contact us today and let us together shape the future of learning.

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter