Third-party fintech API integration outsourcing provides a strategic advantage to the ever-evolving future of digital finance. These third-party fintech API platform-dependent firms are on average 35% faster to market, and their development costs are 42% lower, according to Gartner.

Beyond the hype, this essay reveals why third-party APIs are vital for fintech innovators, what usually happens during integration, and how one might solve these problems. Outsourcing can open up more scalability, performance, and security.

What is a third-party API in Fintech

A third-party API in fintech is essentially a readymade link allowing your system to access specialized financial services without having to create them from scratch. These APIs let software easily incorporate fraud detection tools, payment gateways, banking data, or communication channels by acting like virtual bridges. Businesses could use APIs from reputable providers to speed product development and provide dependable financial experiences rather than trying to reinvent the wheel. Fintechs leveraging outsourced API integration typically reduce development cost by 30-50% while accelerating compliance readiness by several months.

Third-party fintech API integration outsourcing is strategically becoming more popular as companies turn to outside professionals to effectively deploy these APIs. This guarantees swifter go-to-market as well as less internal burden, therefore enabling fintech businesses to stay agile by concentrating on their main products.

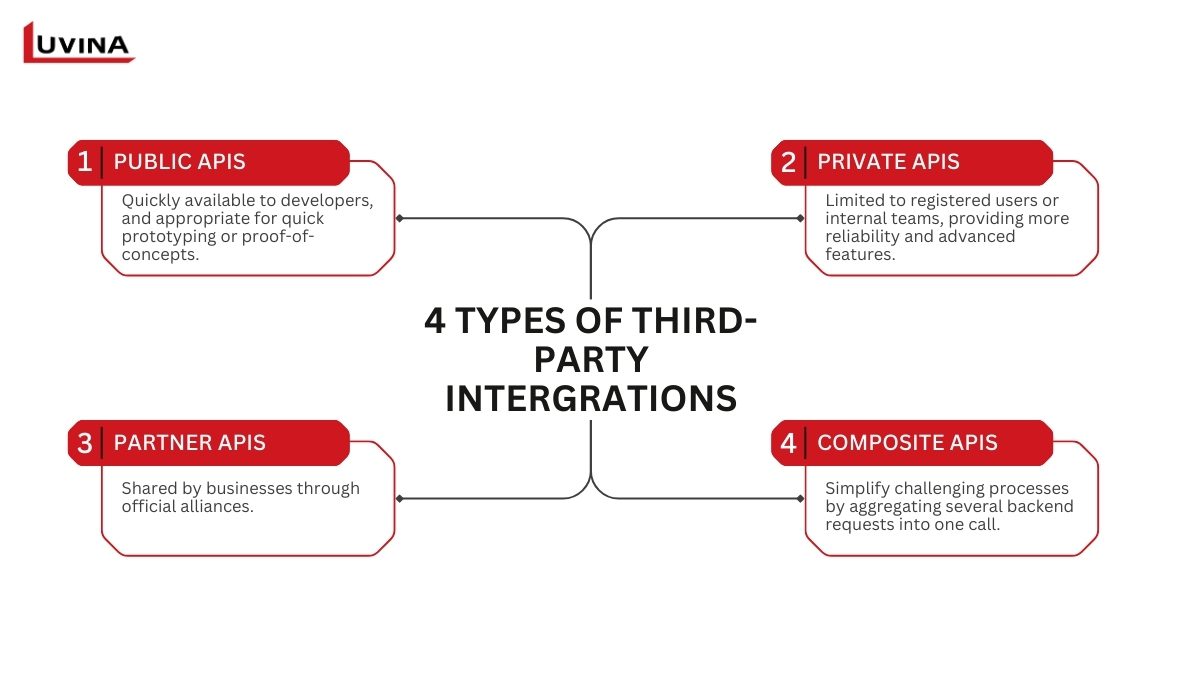

Knowing the many kinds of APIs and their particular use cases is essential in the larger scene of fintech API & platform integration:

- – Public APIs: Quickly available to developers, and appropriate for quick prototyping or proof-of-concepts. Public APIs usually have service limitations or rate limitations applied.

- – Private APIs: Limited to registered users or internal teams, provide more reliability and advanced features under a contractual agreement.

- – Partner APIs: Shared by businesses through official alliances, partner APIs help with white-label integrations, cobranded goods, and revenue-sharing models.

- – Composite APIs: Composite APIs simplify challenging processes, including multistep transactions or a unified dashboard, by aggregating several backend requests into one call.

Why APIs matter now in Fintech

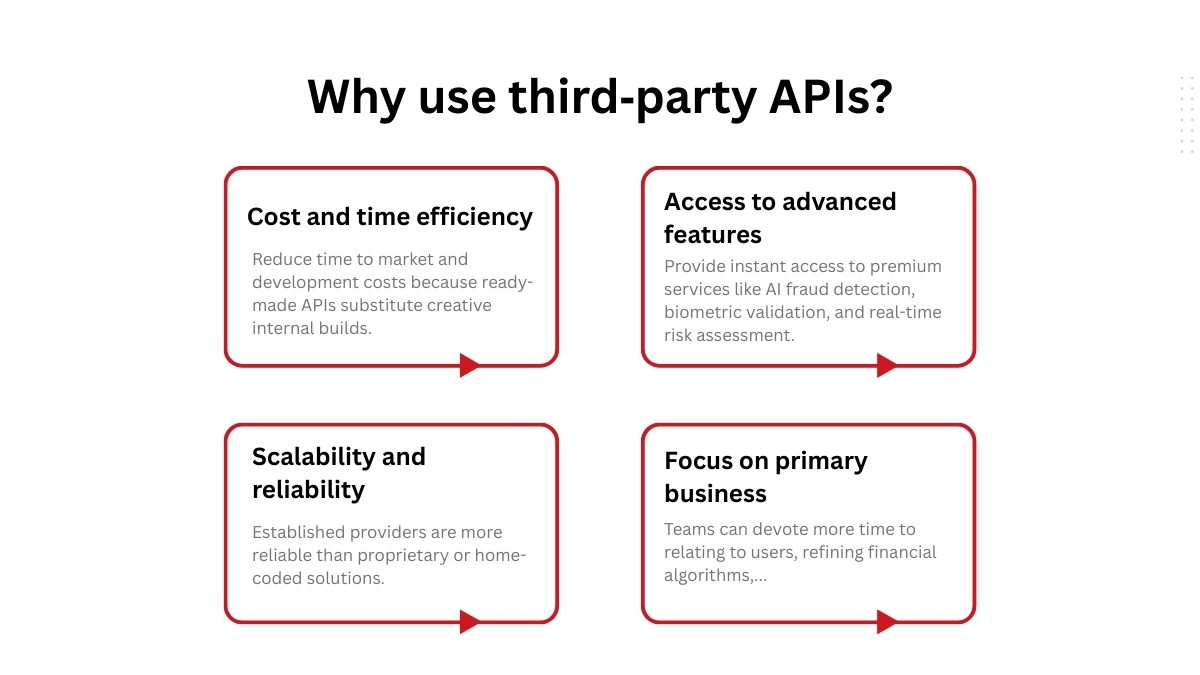

Through wise integrations, businesses can speed development and lower risk instead of spending months creating everything internally. Third-party fintech api integration outsourcing, in this sense, presents itself as a workable answer with obvious corporate benefits:

- Cost and time efficiency: Ready-made APIs reduce time to market and development costs because they substitute creative internal builds. Third-party fintech api integration outsourcing allows fintechs to align ambitious plans while in a budget-friendly manner.

- Access to advanced features: APIs provide instant access to premium services like AI fraud detection, biometric validation, and real-time risk assessment. For instance, plaid api integration outsourcing for fintech allows smooth banking data aggregation without significant infrastructure investment.

- Scalability and reliability: Established providers are more reliable than proprietary or home-coded solutions. Consequently, partners provide enterprise-grade infrastructure to ensure uptime and handle traffic spikes. This reduces the burden on internal systems while guaranteeing scalability and reliability.

- Focus on primary business: Teams can devote more time to relating to users, refining financial algorithms, finding unique product enhancements, etc. If we use commodity providers to outsource commodity items, such as compliance upgrades and security patches.

Finally, accepting APIs and using third-party fintech API integration outsourcing helps fintech innovators to grow more quickly, access best-in-class capabilities, and remain concentrated on what creates a long-term competitive edge.

How Luvina can help

In fintech, every API connection is also a compliance and security risk. Without a strategy for scalability and updates, integrations can quickly become liabilities. Luvina helps clients avoid these pitfalls while accelerating growth. At Luvina, we combine 20+ years of system integration experience with deep domain knowledge in financial platforms to help fintechs turn API ecosystems into competitive advantages. For a Japanese fintech client, Luvina integrated Plaid API and fraud detection APIs within 8 weeks, enabling them to onboard 5,000+ users securely within the first quarter.

Our services include the entire lifetime of fintech API & platform integration:

- Consultation & strategy: Our specialists conduct thorough workshops to learn your company’s demands, assess vendors, and select the most beneficial API partners for long-term expansion.

- API vendor selection & ecosystem management: Helping you choose, negotiate, and manage the right mix of third-party APIs (payments, KYC, data aggregation, fraud detection).

- Custom integration solutions: We create custom API interfaces for payment, identification verification, data gathering, and fraud detection so you may provide sophisticated features without having to reinvent the wheel.

- Compliance & security assurance: End-to-end support for regulatory standards (PCI DSS, PSD2, GDPR, local banking compliance), encryption, and audit readiness.

- Scalable, secure architecture: We use cloud native infrastructure to provide resilience, encryption, and compliance, and your system will be very scalable.

- Legacy system integration: Bridging APIs with existing core banking or ERP systems, minimizing disruption while modernizing your tech stack.

- Monitoring and optimization: Our real-time dashboards, automated tests, and alerts empower our team to discover and address performance challenges before they reach your customers.

- Ongoing maintenance & updates: Continuous alignment with provider changes, legislation, and security requirements.

When deciding between building APIs internally and outsourcing, it’s important to compare the trade-offs in terms of cost, speed, and scalability. Below is a quick comparison:

| In-house API Integration | Outsourcing API Integration | |

| Cost | High upfront costs | Lower initial cost, predictable pricing models. |

| Time-to-market | Slower (requires building expertise internally) | Faster (leverages vendor’s ready expertise and resources) |

| Expertise | Limited to internal team skills and experience. | Access to specialized experts with cross-industry knowledge. |

| Scalability | Harder to scale quickly | Easily scalable |

| Maintenance and updates | Handled by the internal team, adds to the long-term workload. | Provided by vendor, including patches, version updates. |

| Compliance and security | Internal responsibility, requires strong governance. | Vendor ensures compliance with industry regulations & best practices. |

Using tested delivery methods (including sprint planning, architecture design, and safe sandbox testing,…), we guarantee every integration is dependable and meets regulatory requirements. Selecting third-party fintech API integration outsourcing with Luvina gives you a partner able to turn sophisticated API systems into viable business value.

Prepared to hasten your fintech expansion? Get in touch with Luvina right away to turn your API integrations into a competitive edge.

FAQ

How long does it typically take to integrate a fintech API?

Depending on the complexity of the API, breadth of capabilities, and your system readiness, it typically takes a few weeks to a few months.

What infrastructure or preparation is required before API integration?

You will need API management tools, safe data storage, a steady backend environment, and thorough documentation of current systems.

How can I ensure compliance when integrating APIs?

Collaborate with suppliers adhering to industry norms (PCI DSS, GDPR, PSD2, etc.) and undertake frequent security inspections as well as compliance audits.

Do outsourcing vendors provide maintenance and API updates after integration?

Yes. Most suppliers provide continuous support, surveillance, and version upgrades to maintain interface security and match provider changes.

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter