If you require convenient and fast payment options, consider e-wallet app development. According to Statista, it was reported that 1.31 billion mobile wallet users were recorded in the year 2023 in the world, suggesting far greater growth compared with the previous years. Of these, one report by ResearchAndMarkets estimates the global digital payment market, which was valued at $10.18 trillion in 2024, will reach $32.07 trillion USD by 2033, growing at a CAGR of 13.59%. These figures are clear evidence that it’s time to say goodbye to cash payments and enter a whole new era of e-wallets. Start today with our comprehensive guide below.

What is E-wallet app development?

If you’re not sure what an e-wallet is, think of popular options like Venmo, PayPal, or Google Wallet. E-wallet app development is the process of creating digital payment apps that allow people to store, manage, and transfer money just using mobile apps, without the need for cards or cash. Additionally, e-wallet apps enable users to link their bank accounts, debit cards, or credit cards to digital payment apps for financial activities. In general, digital wallet development offers an efficient way to make fast and secure payments.

Types of E-wallet mobile applications

Currently, in the fintech industry, there are many different types of e-wallets or digital wallets. Each type is designed to serve different purposes depending on the needs of end users and businesses. Among them, the three types of e-wallets listed below are considered the most important.

1. Closed wallets

A closed wallet is issued by specific service providers that own a private network. These e-wallets do not allow transferring money to other wallets or bank accounts, nor can you withdraw money from the wallet. In other words, you can only use a closed wallet to make payments to a specific party. For example, KFC could create its closed wallet app for customers to use and make payments at KFC stores.

Retail stores or e-commerce platforms are often recommended for this type of e-wallet app development. Further, through this wallet model, that is, a closed wallet model, several brands and retailers can actually make more money. Examples of closed wallets are Starbucks Rewards, Amazon Pay, and many others.

2. Semi-closed wallets

A semi-closed wallet is a type of wallet that is authorized for issuance by providers, allowing users to conduct transactions within a network of participating agents through a digital payment app. Semi-closed wallets can be considered an advancement from closed wallets because they allow the user to pay at partner merchants and locations.

Any fintech company, financial institution, e-commerce business, or tech company sees a great business opportunity in Semi-closed e-wallet development. Examples of semi-closed wallets include Paytm, Google Play, and PhonePe, among many more.

3. Open wallets

The wallet that can be used everywhere, offering cool features like account management, withdrawing from an ATM, sending money, transferring funds to a bank account or other wallet, and bill payments, is known as the open wallet. The concept of open e-wallet app development is ideal for fresh fintech companies willing to earn billions in revenue. Popular examples of open wallets include Venmo, Apple Pay, MoneyLion, and many others.

Must-have features in an e-wallet application

When doing digital wallet development, you need to add some major features to your app, such as:

- – Personal expense management: It will allow users to manage their money and make wise choices.

- – Push notifications: Sends alerts as soon as the payment is completed.

- – Support chatbot: Automates customer service and basic questions.

- – Loyalty programs: Increases user interaction with the app.

- – Real-time analytics: Gives users detailed information about all past and current transactions.

Today, most digital wallet apps on the market have these basic features. To stand out from competitors, we suggest adding some advanced features when doing e-wallet app development:

- Biometric authentication: PINs and passwords are basic features for all digital wallets, but you can go further by adding features like face recognition, fingerprint scanning, or retina scanning.

- Multi-currency support: Increases global reach and provides a better experience, especially for travelers.

- Budgeting tools: Helps users track their spending and save money, improving productivity and the user experience.

- Integration with wearable devices (such as Apple Watch, Samsung, Smart Watch, etc.): This makes it easier for users to receive notifications and interact with their phones or approve payments through their smartwatches without touching the phone.

- Virtual card management: Let users add their credit or debit cards to the app without needing to carry the physical cards.

- E-commerce Integration: Offers seamless shopping experience to the users, thus viewing more money come digitally to the wallet.

What Are The Three Most Important Characteristics Of An E-Wallet?

The reason e-wallet app development is gaining a lot of attention from companies and why digital wallets are becoming so popular is due to 3 key characteristics: security, user-friendly interface, and acceptance.

Security is, of course, the basis of any digital wallet to make users’ financial information secure. For high security, during e-wallet software development, you need to provide:

- – Encryption: The data is to be encrypted in such a way that even if intercepted during transmission, unauthorized parties could not read it.

- – Two-factor authentication: Ensuring access to users’ digital wallets based on a form of authentication beyond a password.

- – Safe coding practices: To avoid vulnerabilities within the system and ensure various protections are set up to defend against cyber threats.

The second major attribute the digital wallet should carry is usability. A digital wallet with usability should be able to navigate easily, with an intuitive and clear menu, so that the user will be able to work in the application without needing a manual. Also, the wallet should facilitate seamless transactions, starting from bill payments down to money transfers, in an easy manner suitable for all users of different levels of technical levels.

The level of adoption is the third important characteristic of digital wallets. The level of adoption would include the following:

- – Merchant compatibility: Smooth integration with online and physical stores for better day-to-day use.

- – Cross-platform: From iOS and Android to even Web browsers, it works perfectly across multiple platforms.

- – Currency agnostic: Supports multiple currencies; hence, facilitating international transactions and allowing the user to manage their finances anywhere in the world.

Technical Architecture & Security Considerations in E-wallet App Development

Microservices Architecture for Scalability

Modern e-wallet app development increasingly adopts a microservices architecture to ensure scalability, flexibility, and system resilience. Instead of building a monolithic application, core functions such as user management, payment processing, transaction history, notifications, and fraud detection are developed as independent services.

This approach allows fintech companies to scale individual components based on transaction volume, deploy updates faster, and minimize system downtime—an essential requirement for high-availability financial applications.

Security, Compliance Standards & Data Protection

Security and compliance are non-negotiable in digital wallet development. An enterprise-grade e-wallet system must comply with international and local regulations such as PCI DSS, GDPR, ISO 27001, and region-specific fintech regulations.

Best practices include end-to-end encryption, tokenization of sensitive data, secure API gateways, and continuous security monitoring to protect users’ financial information and maintain regulatory compliance.

eKYC & Identity Verification Workflow

A robust eKYC (electronic Know Your Customer) process is a critical component of e-wallet app development, especially for semi-closed and open wallets. eKYC workflows typically include identity document verification, biometric checks (face recognition or liveness detection), and real-time validation against third-party verification services.

Automating eKYC not only helps fintech companies comply with AML/KYC regulations but also significantly improves user onboarding speed and experience.

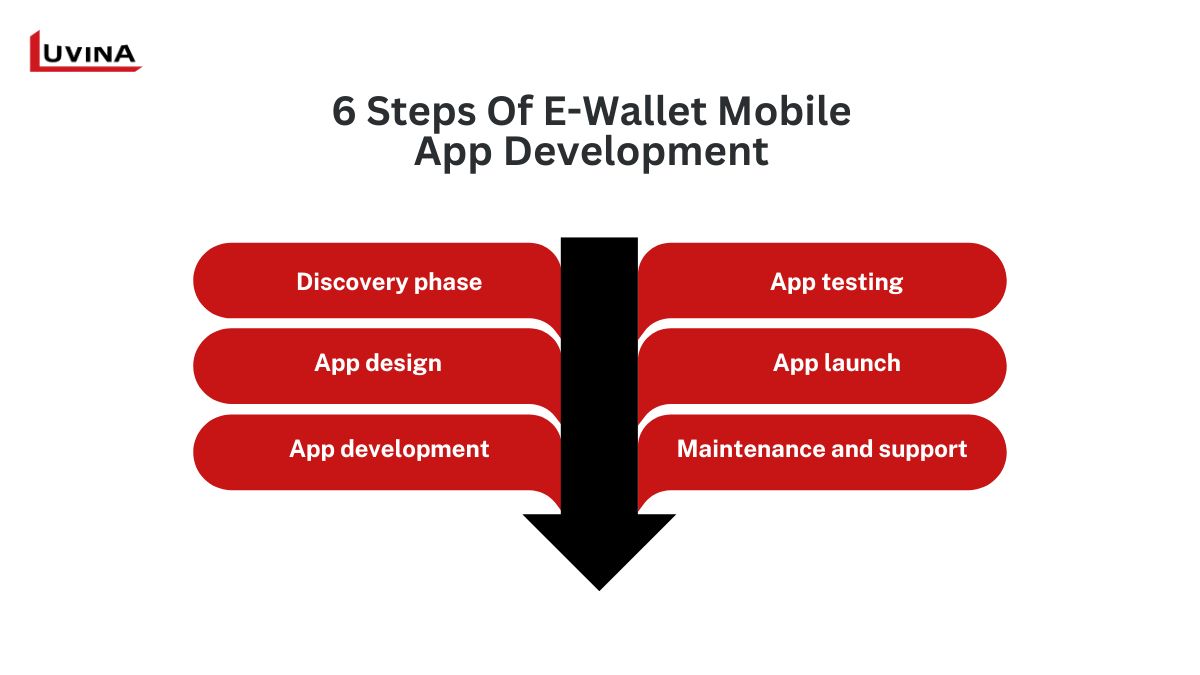

Step-By-Step Process for EWallet Mobile App Development

The e-wallet app development process usually includes several steps:

Step 1 – Discovery phase

The Discovery Phase is the first stage and is very important in the e-wallet mobile app development process. In this phase, you need to handle all research-related tasks—from market research and target user research to competitor research. The results from this research serve as the foundation for choosing features, building strategies, and developing other parts of the digital wallet app. This is why in-depth studies at this initial stage are paramount. Some activities to be done at the discovery stage include:

- – Market research: Do a complete market analysis to ascertain user preference and find out what gaps your e-wallet application can fill.

- – Competitor analysis: Competitor analysis would help you make your e-wallet app distinctive and not another duplicate in an overly saturated market.

- – Target audience analysis: understand the needs of your target customers and problems faced by them, and how your electronic wallet app can solve these problems.

- – Legal compliance: Fintech happens to be one of the most regulated industries on a global scale. Pre-development, make sure you comply.

- – Feature listing includes defining what the feature will be on an app based on targeted users’ personalities and recommendations. When you come to the selection of features, think about what really users need: “account management”, “tracking of transactions”, or unique features which will possibly differ from other apps.

- – Choose a development platform: In other words, decide if you are creating an Android app or developing an iOS app. You could also consider developing a hybrid e-wallet app to meet the needs of users on both platforms. Platform choice affects feature selection, development costs, and design.

Step 2 – App design

The design phase in the e-wallet app development process would provide a graphically appealing app that resonates with targeted users and is easy to use. On any e-wallet application, easy navigation and fluent experience are highly needed to retain the end-users. Your app needs to be navigable, accessible, and aesthetically beautiful, which you can do by performing the following:

- Select the appropriate design approach.

- Design wireframes and prototypes.

- Give much importance to the user experience while designing.

Step 3 – App development

This is the core, most technical, and time-consuming phase of digital wallet development. At this stage, you’ll need to work closely with developers, so maintaining a seamless communication channel with the development team is essential. Several tasks need to be handled during this phase, including:

- Choosing the technology stack: The first step in e-wallet development is selecting the technology stack, which is the set of technologies used to build the digital wallet app. Choosing the right tech stack is essential for performance and scalability. You should consider programming languages, frameworks, and platforms to ensure compatibility with the app’s features, security needs, and future updates.

- Building the team structure: After finalizing the technology stack, it’s time to hire a development team. For a large-scale digital wallet project, you’ll need a team that includes roles such as a project manager, UI/UX designer, mobile app developer, frontend developer, quality assurance specialist, fintech security expert, payment gateway specialist, and database expert. You may choose to build an in-house team or outsource the work.

- Frontend development: Now that the design phase is complete, it’s time to integrate the design into the e-wallet application. Different technologies, such as JavaScript, CSS, and React, are employed by front-end developers to bring the design to life and make it responsive by attaching it to the user interface for a smooth user experience.

- Backend development: The coding is done here. Backend development includes API integrations, setting up databases, and managing servers. This is usually the most time-consuming step because developers make secure connections between different parts. Any bugs or security gaps at this stage can make the entire platform vulnerable.

- Payment gateway integration: It is vital to include a payment gateway to make transactions possible in the e-wallet application. This has a great potential to consume time as the proper selection of a gateway, then proper integration would be required for a smooth end-user experience in case of transactions.

- Ensuring security: Security is a primary concern when it comes to financial applications. Introduce strong security measures in an application, like encryption and multi-factor authentication, in order to keep users’ sensitive information safe. Routine security audits and following the regulatory standards also play an important part in maintaining security.

Step 4 – App testing

Among all others, testing is the major activity carried out in e-wallet software development. Almost all the elements used in the e-wallet solution need to be tested multiple times so that bugs and loopholes can be traced to be fixed. The testing phase will further include performance, security, and user testing to check that the app is fully functional, secure, and smoothly performing.

Step 5 – App launch

Once the QA team checks the quality and assures that it meets all the standards, then it is time for the wide release. The deployment process for an e-wallet app depends upon the development platform. If you are launching on iOS through the App Store, then the process will be a bit complex and stringent compared to launching on Android or Google Play Store. In case your application is hybrid, you will need to follow the process for both. Whatever the platform, it takes at least a fortnight to go live and full-scale.

Step 6 – Maintenance and support

Although the e-wallet app development process is over, much remains to be done yet. Right after the app hits the market, maintenance and support services get officially started. Support services help fix common issues and prepare for some unforeseen incidents with the app. One thing to note here is that maintenance and support are not some step but rather a process, which tends to continue as long as your app is alive on the market.

Strategic Considerations for Successful E-wallet App Development

Build Custom vs. White-label E-wallet Solutions

One of the most important strategic decisions in e-wallet app development is choosing between a custom-built solution and a white-label platform.

White-label e-wallets offer faster time-to-market and lower initial costs, making them suitable for startups testing the market. However, they often come with limitations in customization, scalability, ownership of source code, and integration with existing fintech ecosystems.

In contrast, custom e-wallet development provides full control over architecture, security, branding, and future expansion. Although it requires higher upfront investment, a custom solution enables fintech companies to differentiate their offerings, comply with local regulations more effectively, and scale without vendor lock-in.

Monetization Strategies for E-wallet Applications

A well-designed e-wallet app is not just a payment tool but also a revenue-generating platform. Common monetization models include transaction fees, merchant commissions, premium subscriptions, value-added services (such as analytics or credit scoring), and partnerships with financial institutions or retailers.

Choosing the right monetization strategy early in the development phase helps align technical architecture, feature prioritization, and long-term business goals.

How does E-wallet app development cost?

The e-wallet app development cost depends on many factors, such as the features added to the app, the platform it will run on, the security measures used, and the location of the development team.

For instance, the development of a simple e-wallet app would cost from $15,000 to $30,000 and take some weeks or even months. At the same time, more complex applications with advanced features and enhanced security will cost more, up to $30,000-$70,000, and the development itself would take longer.

It’s hard to say just how much the development of an e-wallet app will set you back. For a more exact number, we encourage you to get in touch with a digital wallet development company and describe your needs for a quotation.

FAQ

How long does it take to develop an e-wallet mobile app?

Generally, building an electronic wallet mobile application can take from two to 12 weeks. The actual time will depend on the needs of the business and the complications of the app. You might need just a few weeks or a few months to develop a basic e-wallet app. But if you require a more complex design and advanced features, the development time will be longer.

Which industries can benefit from e-wallet app development?

Mobile wallet applications recently have gained significant momentum for different industries and started to reshape the view on how businesses operate with money and fund exchange. Specifically, companies involved in travel and hospitality, entertainment, banking and finance, e-commerce, retail, and food and beverage industries can present some significant benefits by supporting digital payments.

What platforms should an eWallet app support?

You can choose either between iOS and Android for e-wallet app development. But ideally, any mobile wallet application should be supported on multiple platforms out of accessibility and usability consideration of a wide range of users. This is the reason why we suggest cross-platform app development to meet the requirements of both platform users.

Conclusion

In conclusion, mobile e-wallet applications can greatly benefit multiple businesses. Digital wallet development is not a trend; it’s representative of the future in terms of financial transaction activities. Successful e-wallet app development requires not only robust technology and security architecture but also clear strategic decisions around customization, compliance, and monetization.

If you’re looking to develop a digital wallet app and are looking for support for creating a successful app, then hire a reliable e-wallet development company. In this respect, Luvina is considered one of the top 10 trusted software development companies in Vietnam and will always be your ideal choice. Equipped with more than 20 years of diverse experience in advanced application development, a team of over 750 experts holds immense knowledge about the whole development process.

Contact Luvina today to take advantage of modern technologies as a competitive edge and to start your e-wallet app development.

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter