Simplifying the management of money and financial assets has been a long-standing desire of humans, and fintech is taking this to a new level with the help of modern technology. However, the process of fintech app development is complex and demanding. In the article below, we will summarize and analyze everything you need to know about building a fintech app for those looking to create an outstanding financial application. If you want to equip yourself with the right information and knowledge to develop a quality app, start by reading this article.

What is Fintech App Development?

Fintech app development covers the road map of planning, designing, developing, testing, and launching any mobile or online application that offers financial services or technology solutions. Financial activities such as mobile payments, banking, investment management, and insurance have been easier with the help of fintech apps and other similar financial technology solutions. In this rapidly changing landscape of technology today, advanced technologies like blockchain, machine learning, and artificial intelligence further amplify fintech app development in terms of security enhancement and feature extension.

Currently, fintech app development companies offer various service options for developing these apps. For example, they provide customized fintech application development or the use of pre-existing templates. How you build a fintech app depends on your needs, timeline, and budget.

The global fintech market is currently experiencing explosive growth. While the market faced significant challenges during the pandemic, 2024 marks a notable resurgence. According to Forbes, investments in fintech reached $91.5 billion in 2021, nearly double the figure from 2020. The period from 2024 to 2032 is expected to see annual growth of 16.8%, with the fintech market projected to reach a massive value of over $917 billion by 2032. This figure is nearly 8 times higher than the initial level recorded in 2020 when the pandemic spread worldwide. Additionally, some surveys show that 78% of people under 40 say they will only continue using their traditional bank if it fully transitions to digital.

Efforts to accelerate digital transformation, combined with strategic partnerships between fintech, traditional financial institutions, and artificial intelligence, have been and will continue to drive major changes to familiar business models. These partnerships will bring new services and open up new opportunities. This is why there will be more funding related to fintech application development. With users and investors increasingly interested in this market, 2024 is an excellent time to begin your fintech app development journey.

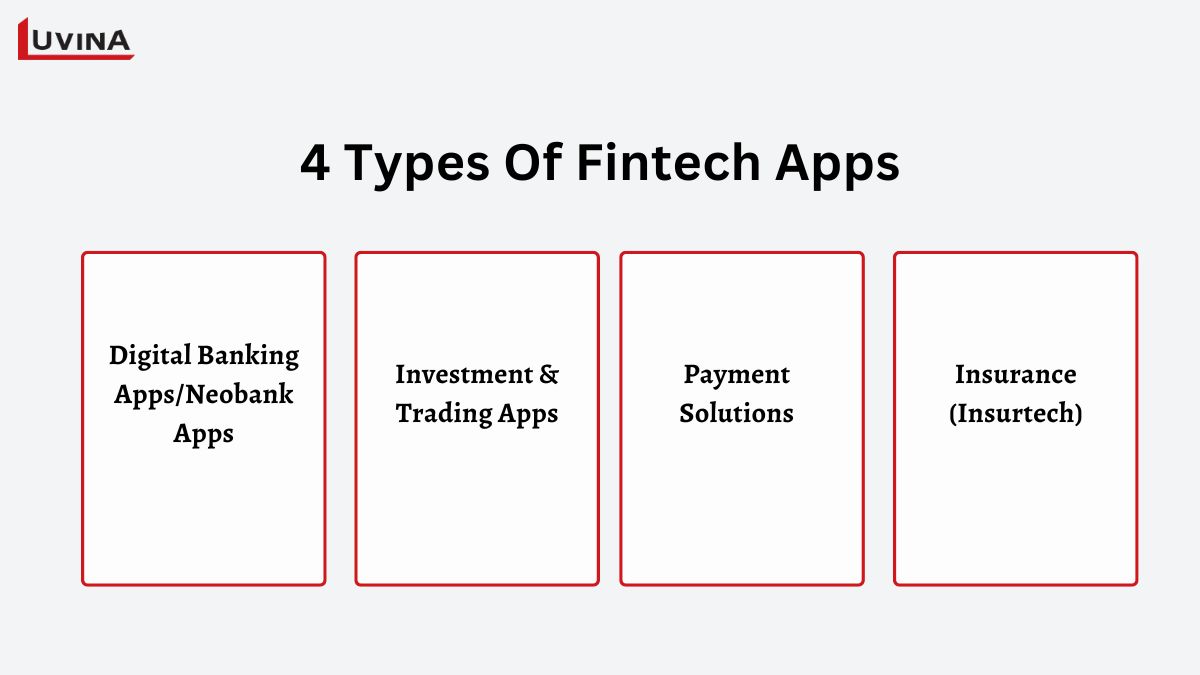

Key Types of Fintech Apps

Various kinds of fintech applications exist. Each fintech application provides different financial services to fulfill multiple users’ needs. Among them, the following four types are the most common.

Digital Banking Apps/Neobank Apps

These are lightweight apps with banking features provided by non-traditional digital banks. Digital banking app development caters to the unbanked population, such as immigrants, freelancers, and others, allowing them to perform financial transactions directly from their mobile devices. The main pros of such fintech applications are transparency and availability 24/7.

Digital banking applications allow users to maintain and operate bank accounts along with availing of financial services without personally visiting the branches. Users can do nearly everything that they would do in a traditional bank: from opening accounts, maintaining balances, and transferring money, and loans to even making mobile payments.

Investment & Trading Apps

Investment apps are also highly sought after by businesses opting for fintech app development. These apps provide various services: investment management, cryptocurrency trading, stock market transaction capability, and asset management systems. Using the investment and trading apps, users can buy stocks, and ETFs, and get investment recommendations as per their preference; all this can be done just sitting at your home.

Fintech application development for investment and trading platforms is considered one of the most important tools in democratizing the investment process. Applications of this category allow anyone, and not only the rich, to get access to investments and asset growth. The most significant benefit provided by this application category is that mediators are excluded in its operation, commissions are reduced, and the procedure of bids and transactions is simplified.

Within the modern technological paradigm, fintech mobile app development has acquired a different dimension of value with the introduction of robo-advisors for investment and trading applications. These have turned into automated brokers using AI and machine learning, which help users manage their portfolios, execute trade, evaluate financial situations, and make decisions.

Payment Solutions

Payment solutions such as P2P payment apps and mobile wallets are becoming increasingly popular as cross-border money transfers rise. These apps typically include essential features like transaction history and currency conversion, allowing them to process all transactions on behalf of fintech app development companies. In other words, payment solutions serve as intermediaries that connect payment service providers with customer payment information for web and mobile transactions.

The emergence of these payment solutions aligns perfectly with today’s e-commerce ecosystem, enhancing customer convenience. Additionally, these apps offer small businesses services related to debit and credit card transactions, as well as various other online payment methods.

>> Also read: Mastering Payment App Development

Insurance (Insurtech)

When building a fintech app, insurance applications are among the most popular types. These apps provide insurance services, policy management, and automated claims processing. Many InsurTech apps are currently available for property, auto, pet, and even life insurance. These applications not only help users manage claims and register for insurance more quickly but also provide insurance agents with a more accurate way to assess risks on-site and carry out transactions.

Today, the scope of insurance apps extends beyond simple functionalities. They are increasingly being integrated with Internet of Things (IoT) devices and smart wearables to better assess the risk profiles and lifestyles of individuals. Although it is a relatively new niche, the InsurTech market is growing rapidly.

Key Features of Successful Fintech Apps

To meet the needs of users, fintech apps typically need to include many functions with high accuracy. Among these, the following 3 features are considered essential for every fintech application. These are also the 3 features you should pay attention to when you build fintech app.

1. Security & Compliance

Fintech app development must ensure fintech compliance with security requirements, as financial applications handle sensitive user information and assets. Therefore, issues related to encryption needs, secure authentication, and adherence to industry regulations such as GDPR, and PCI DSS must be discussed from the early stages of the development process.

To ensure fintech security and fintech compliance when building a fintech app, developers often implement technologies such as blockchain, authentication encryption, biometrics, two-factor authentication, data masking, and various other security measures. For example, user funds must be securely protected with passwords or PINs, and transactions should be verified using one-time SMS codes or two-factor authentication. In general, fintech application development requires integrating advanced data encryption security protocols and simple, secure login processes.

2. User-Friendly Interface (UX/UI)

First impressions are always the most lasting, and this holds true for financial technology applications. Statistics show that 88% of users are unlikely to return to an app after a poor first experience. That’s why a user-friendly interface and quick accessibility are crucial features in fintech app development. Ensure that your login and integration processes are seamless, providing detailed guidance to create a positive impression from the start.

When designing a fintech application, it’s essential to make the interface customizable to meet individual user preferences. For example, some users may prefer a bright mode with a minimalist design, while others might prefer detailed interfaces with darker themes. To create a user-friendly application, consider the following requirements:

- Friendly interface: The interface should be simple enough for even non-technical users to navigate. Screens must be logically structured with clear, consistent icons and well-organized content for easy understanding. Your software should also function smoothly on both smartphones and tablets to attract a wider audience.

- Smooth user flow: Tasks like money transfers, bill payments, and investment transactions should be streamlined, avoiding unnecessary steps. Additionally, provides clear guidance to empower users in managing their finances.

- Features for accessibility: Include options such as compatibility with screen readers, customizable font sizes, and high color contrast to enhance usability for all users.

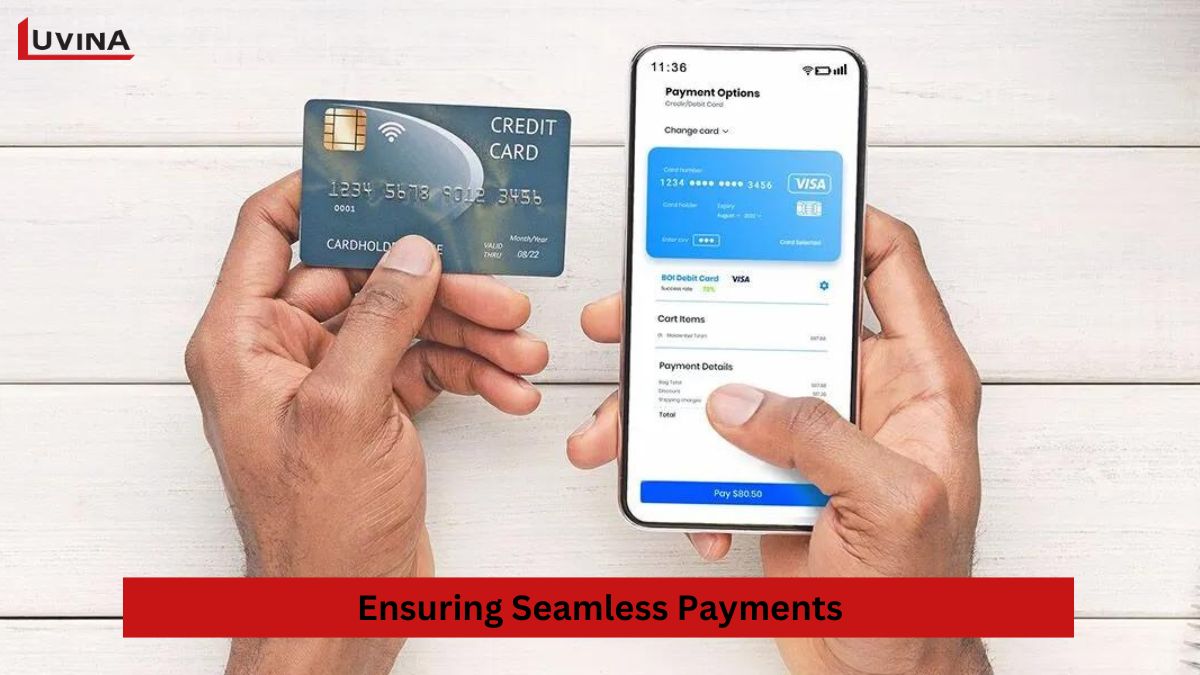

3. Payment Gateways & Integration

The majority of financial technology applications today revolve around payment processing. Therefore, integrating with payment systems, banking APIs, and other financial services in fintech app development is crucial. Applications must ensure that users can send, receive, or conduct transactions online quickly and easily.

To achieve this goal, the simplest approach is to integrate the application with third-party payment processors or directly through banking APIs. Each customer may have different payment preferences, so offering a variety of payment options—such as QR codes, digital wallets, and bank transfers—can significantly enhance user satisfaction and loyalty to the application. By catering to diverse payment methods, you increase the likelihood that customers will enjoy using your fintech app, ultimately leading to higher engagement and retention rates.

>> See more: Payment gateway integration services

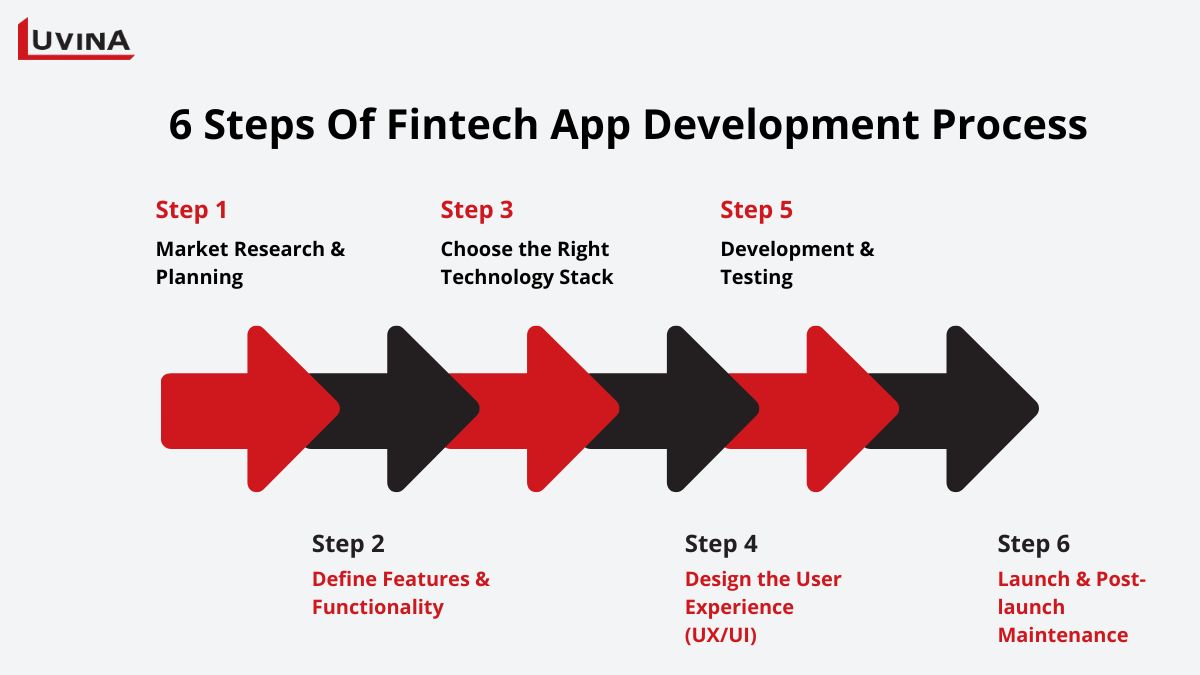

Step-by-Step Fintech App Development Process

The fintech app development process can vary based on the chosen development partner. However, the process generally consists of 6 fundamental steps:

Step 1 – Market Research & Planning

Before starting fintech app development, you need to conduct market research and planning to clearly identify the right segment, which will help you choose the type of financial technology application you want to implement. Conducting market research based on a specific segment and narrowing the survey scope will help companies allocate resources more effectively and understand the relevant aspects of developing financial technology.

In this step, market research will not only involve analyzing user needs but also updating the latest trends in the fintech industry, as well as identifying the challenges customers face and how your application can assist them. This is also the step where you need to analyze the target audience for your app. You should select the group you will focus on, choose some individuals from your target audience, and conduct short interviews to gain deeper insights into users, which will help improve your application.

Step 2. Define Features & Functionality

The next step in the fintech app development process is to identify the core features, security requirements, and integrations. This is where you should list core features and functions you would want in your application, based on the result of market research and target audiences from the first step. Selection of the features will be based on importance and feasibility. Such standard features will include account management, tracking of transactions, payment integration, and analytics.

Additionally, you may consider adding some advanced features to differentiate your application from competitors. However, the advice is not to overcrowd a financial technology application with too many features. Instead, focus on how to build a fintech app that is cost-effective and faster while still providing significant value.

Step 3 – Choose the Right Technology Stack

The next step in fintech application development is to choose the appropriate technology stack. You will need to select tools for building the backend, frontend, cloud infrastructure, and APIs. For example, there are various programming languages you can use to build and design financial applications. You can use core technologies like Java and Kotlin for Android or Swift and Objective-C for iOS if you want to develop applications for specific platforms.

You can also develop cross-platform applications where you write a single codebase for iOS and Android and save up to 60% of the total costs. Properly chosen technology for fintech app development will help your application be successfully developed and will save costs and resources.

Step 4 – Design the User Experience (UX/UI)

The goal of UX/UI design for fintech apps is to create an interface that is easy to use, user-friendly, and responsive. Customers typically value simplicity, transparency, and appealing visuals. Therefore, the fintech app must have a well-suited UX/UI design.

What you need to do is find reference materials, clearly outline your requirements and preferences to the design team, and regularly communicate with the UX/UI design team to create the most suitable design for the application.

Step 5 – Development & Testing

This is the most crucial step in fintech app development. It is about targeting agile fintech development with continuous testing for security and performance, including compliance. When it comes to building a fintech app, experts advise developing a Minimum Viable Product (MVP)—a simplified version of the app that includes the essential components.

MVP will be a perfect test of the idea in the real world. In case of poor performance of the application, you can easily abandon it or modify it without bearing many overhead costs. In case it becomes popular and well-accepted by target users, scaling will be easy, along with acquiring more customers and revenue with the least effort.

After developing the complete application, the next step in fintech application development is testing and trial runs. Thorough testing ensures that all aspects of the application are examined, helping you avoid potential bugs during operation. Most importantly, you must ensure that your fintech app functions smoothly across all mobile devices.

Step 6 – Launch & Post-launch Maintenance

The post-launch phase and ongoing maintenance involve several key tasks such as regular app updates, user support, and compliance checks. After launching your app, you’ll receive feedback from the initial users. Reviewing this feedback helps you identify weaknesses and offers suggestions on which features to add, remove, or modify. This is also the right time to consider scaling up if your fintech app shows signs of success. Select the best features, integrate them into updates, and fix any bugs to continually improve the app and enhance user experience.

Challenges in Fintech App Development

The development of any application comes with its challenges, and fintech app development is no exception, especially since finance is a sensitive field where all features must maintain high accuracy. Below are the 4 major challenges we believe businesses will face during the fintech application development process:

1. Regulatory Compliance

One of the biggest challenges in the process of fintech app development is compliance with fintech regulations. The financial industry is closely regulated by government laws, and now it is obliged for already existing financial companies to fit a lot of regulations such as GDPR, GLBA, wiretapping laws, AML (Anti-Money Laundering), PCI DSS, and many others.

When building a fintech application, there are several ways to ensure compliance with these regulations. For example, you can hire legal advisors or appoint a dedicated person or team to monitor regulatory updates. Adding such personnel to your team means the business will incur additional costs, but these expenses are certainly much cheaper than the maximum penalty of up to 20 million euros under GDPR.

2. Data Security

Fintech applications today must handle large volumes of sensitive financial and personal data, making fintech security challenges a top priority during development. Financial information is one of the key focal points that cyber attackers tend to hack into, trying to get access to and manipulate data in an unethical manner. This would ruin the reputation of a company, causing the violation of different regulations that pertain to data security. Therefore, an enterprise needs to integrate security features while developing a FinTech application to prevent unauthorized access to users’ data and theft of the same by fraudsters.

To mitigate potential breaches, a fintech app should include the following security features:

- Two-factor authentication

- Biometric authentication

- Encryption

- Notifications for account actions

In addition, conducting regular penetration testing is a highly effective way to ensure that hackers cannot compromise your app. It’s recommended to perform at least one penetration test annually and immediately after any major updates or new integrations.

3. Scalability

Scalability is another major challenge that businesses must address during fintech app development. No fintech solution is considered viable if it lacks scalability from the start. A fintech app must be able to support the business as its user base and transaction volumes grow.

A fintech app that cannot scale is an unsuccessful app

The financial services industry is highly competitive, with new products being introduced continuously. Therefore, fintech apps built without scalability and future adaptability in mind will quickly become obsolete. The good news is that scalability in fintech apps can be addressed using load balancing or cloud computing. Load balancing allows you to use multiple backend instances instead of just one, while cloud computing provides nearly unlimited scalability through the virtual servers of cloud service providers. Both methods effectively solve scalability in fintech apps, but cloud computing tends to be less complex.

4. User Trust

Customers in the financial sector are usually reluctant to switch from a familiar app to a new one, as fintech solutions often contain sensitive information. This is why launching and developing a new fintech app can be a challenging experience for startups, especially when they haven’t yet gained users’ trust. However, trust can be built over time. By demonstrating a strong commitment to security, privacy, and transparent communication, fintech apps can earn user trust and encourage app adoption. Once trust is established, businesses must maintain it by ensuring the ongoing safety of customer data and financial transactions.

Cost of Developing a Fintech App

Fintech app development costs depend on various factors such as the complexity of the app, the platform, post-development costs, and team size.

- App complexity: This is directly related to the number of features you want to include and the tech stack you choose. Additionally, if the app requires development services like blockchain or extra technologies like machine learning, integrating all APIs into a seamless application logic can increase the FinTech development pricing. In general, the more integrations needed, the longer the development time, and the higher the cost to build a fintech app.

- App platform: Development costs vary between web, mobile, or cross-platform apps. Even within the same category, costs can differ depending on the programming language or framework used.

- Post-development costs: These include expenses related to maintenance and support.

- Team size: Manpower costs go up when the number of development team members increases. Especially, the cost of the fintech app development team also varies in respect to the geographical location of the experts.

These factors make it difficult to estimate fintech app development costs, as the complexity of each software is different. However, we can still provide you with a reference price for fintech app development. On average, the cost of developing a fintech app ranges from $30,000 to $350,000.

If you are just starting your fintech journey, begin with a basic version of the app that includes just enough components to test your idea on the market. This approach will help you avoid unnecessary costs.

Top Trends in Fintech App Development

Based on the latest research and statistics, here are the fintech trends that are predicted to play a pivotal role in fintech application development:

- Blockchain and Cryptocurrency: Blockchain and cryptocurrency will no longer be limited to tech enthusiasts. The ecosystem for cryptocurrency and blockchain is continuously being explored for easier management and more efficient regulation. Analysts predict that blockchain technology will have significant potential in fintech application development due to its rapid growth and undeniable benefits. In 2024 and beyond, blockchain in fintech will make financial transactions on fintech apps much safer.

- AI and Machine Learning: AI in fintech and machine learning have been considered an acting catalyst because of their automated analysis and providing personalization of fintech apps to users’ needs. In the process of development, applying AI and machine learning in the development of fintech apps would make financial services more personalized, automate processes, and detect fraud much faster than before. Having AI and machine learning is like having a financial advisor, a detective, and a personal shopper all rolled into one single app.

- Open Banking: The rise of APIs and the open banking ecosystem will continue to grow. This trend will enhance security when sharing data between financial institutions and third parties, connecting more financial services and making these services more user-friendly.

- Voice-Enabled Transactions: Instead of manually performing tasks, voice technology in fintech apps will allow customers to execute transactions quickly and easily.

- Embedded Finance: Imagine your favorite non-financial apps and platforms suddenly offering embedded financial services. Businesses are increasingly ready to offer seamless financial experiences directly from their apps.

- RPA (Robotic Process Automation): Robots are the future in any field, and fintech mobile app development is no exception. RPA will support automating data entry, speeding up transactions, and reducing errors.

- Cloud Computing: Cloud computing is another future trend that cannot be overlooked in fintech app development in 2024. It is already widely used to improve the scalability of fintech apps. Additionally, the flexibility of cloud computing will enhance the adaptability of fintech apps, allowing financial professionals and users to access and control data from anywhere, on any device with an internet connection.

>> Also read: 9 Best Programming Languages for Finance, Banking, Fintech

Conclusion

The financial industry is rapidly evolving, and fintech app development will help businesses stay ahead in the competitive landscape. If you want to be one of the leading companies in developing fintech applications and shaping the future of the digital economy, partner with Luvina.

As a financial app development company with a team of over 750 experienced experts, Luvina is committed to helping you create the most suitable applications for your business. We focus on developing fintech solutions for a wide range of financial services, from payment processing and asset management to banking solutions. With extensive expertise and experience, we specialize in designing, tailoring, and creating customer-centric financial solutions. Contact Luvina today for a consultation!

Related Posts:

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter