In today’s ecommerce world, even a 1-second delay at checkout can cause friction, and friction costs money. A robust Magento payment integration is not just about processing transactions; it’s about maximizing revenue, minimizing abandonment, and delivering a localized, trusted customer experience globally.

This guide explains what Magento offers, what to watch for, and how to select the right approach for your business. This guide covers how payments function in Magento 2, examines integration approaches, assesses well-known gateways, and provides useful advice on creating a checkout flow that turns trust into purchases.

Payment Gateways and Their Role in Magento

In Magento payment integration, a gateway serves as the link between your Magento store and external financial networks, facilitating quick and secure card payments while protecting consumer information at every step.

Developers often choose between two methods of Magento payment integration. One is installing ready-made modules. The other is building custom solutions. These are tailored to the store’s audience and operational needs. Magento payment module development becomes crucial at this point.

A reliable payment gateway isn’t just technical plumbing. It directly impacts:

- Cart abandonment rates: up to 70% of users drop off if their preferred payment methods are not available.

- International revenue: global buyers expect local options (e.g., Alipay in China, iDEAL in the Netherlands).

- Trust & compliance: PCI-compliant setups reduce fraud and increase conversion.

Magento empowers you to optimize all three.

Best Payment Gateways for Magento

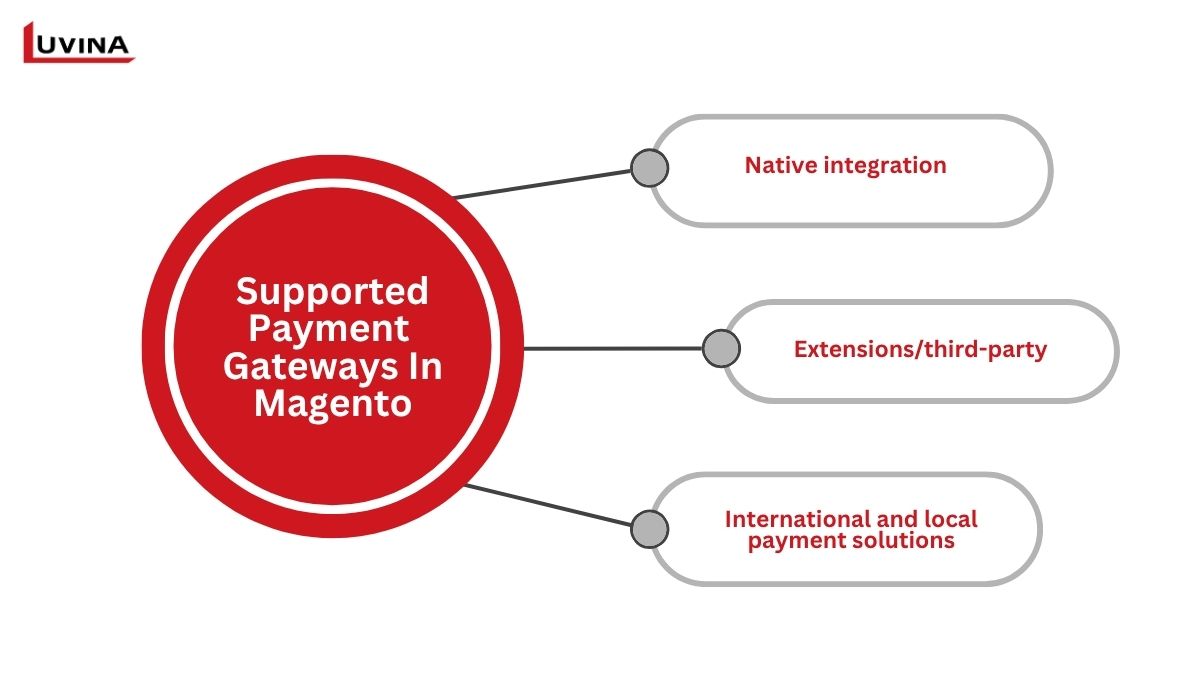

Choosing the appropriate payment gateway is important to guarantee seamless and secure Magento payment integration. With built-in support for significant gateways and the freedom to grow via third-party extensions, Magento offers both. Magento has you covered whether you’re seeking a more complex worldwide configuration or just a basic Magento credit card payment integration.

Among the most often supported and widely used Magento gateways are these:

- Native integration: Magento has built-in support for the major gateways, such as PayPal and Braintree, out of the box. Magento has these features built in, allowing store owners to deploy secure payment transactions quickly and with little configuration. For instance, while Braintree accepts both credit card and digital wallet payments to simplify the payment system without requiring extra modules, Magento PayPal integration makes it simple to offer Express Checkout and other PayPal services.

- Extensions/third-party: Merchants who want more flexibility (and because of the modular nature of Magento) are able to choose from a number of extensions on the Magento Marketplace. This means you can take advantage of services like Stripe, Authorize.Net, Razorpay, Square, and Shopify Payments with little development costs. Among these, Stripe payment gateway Magento integration is especially popular because it has a very modern interface, good payment recurring billing feature, and advanced fraud prevention (which is a great advantage when expanding to the global markets).

- International and local payment solutions: Magento also supports a range of regional and international gateways to cater to various markets. Options like Mastercard Payment Gateway, Onepay, Axis, NGenius, and CardSave let merchants integrate a payment gateway in Magento to local banking infrastructure and currency demands.

How Do Payments Work in Magento 2?

Every successful eCommerce store transaction depends on a seamless and safe flow of information among the financial institutions involved, your site, and the customer. This process is precisely arranged with Magento 2 payment gateway integration to guarantee accuracy, speed, and most importantly, security.

A consumer enters their payment information on the frontend as they go to checkout in your Magento 2 store. This would typically involve the payment method of their choice, billing address, credit or debit card numbers, etc. After they submit this form, it is encrypted and sent to the payment processor. The processor then uses that information to verify against the consumer’s issuing bank the transaction amount and starts the authorization process.

When the transaction is approved, the funds are transferred through the selected gate to the merchant account, completing the transaction. Magento online payment integration enables this whole backend procedure by managing real-time data transmission and authentication, hence guaranteeing that every payment is quick and frictionless.

Direct payment processing is not done by Magento. Rather, some are bundled like Stripe or PayPal and others that permit more flexible setups like Authorize.Net rely on third-party payment processors and gateways. Selecting the proper configuration is critical for a fully operating Magento secure payment integration, especially if you’re trying for minimum transaction failures, regulatory compliance, and worldwide scalability.

Magento 2 Payment Gateway Integration Approaches

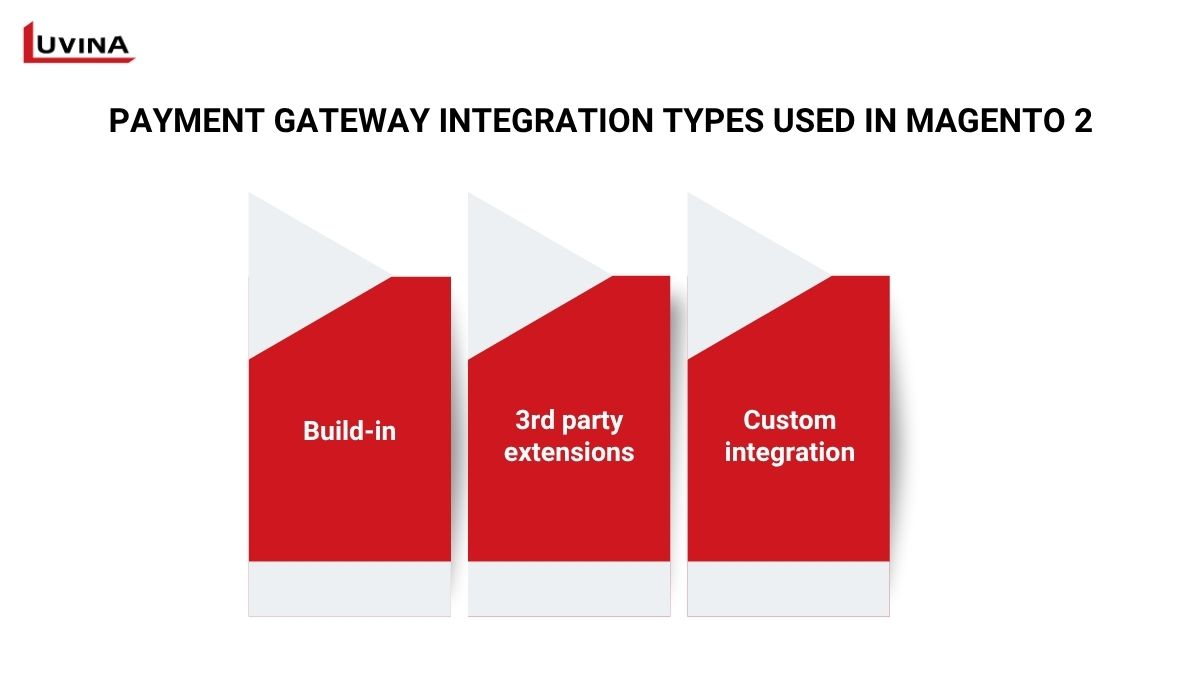

Magento 2 offers flexible integration options. These can be tailored to different business sizes and technical capabilities. You can go with built-in payment options, outside plugins, or completely bespoke integrations, depending on the size, clientele, and technical capacity of your store. Magento secure payment integration relies on every choice; it ensures that every transaction is secure, scalable, and meets consumer expectations.

1. Built-in

Three prominent gateways – PayPal, Braintree, and Authorize.Net – are out-of-the-box supported in Magento 2. These vendors are noted for their strong security, worldwide dependability, and perfect Magento architecture. With Magento 2 PayPal payment integration (Express Checkout), merchants can enable several PayPal options without the need for extra extensions. Likewise, Magento 2 Authorize.Net integration provides store owners a strong means of straight credit card processing while adhering to PCI compliance and fraud prevention.

Via the Magento Admin Panel, all of the built-in gateways may be quickly set up, therefore fitting small to medium-sized companies looking for a quick and reliable payment system. This technique reduces development time while nevertheless allowing a completely working checkout experience that satisfies current e-commerce requirements.

Use case: Built-in gateways in Magento payment integration are ideal for startups and SMBs that need a fast, low-maintenance solution to start processing payments right away. Speed and simplicity take priority here, with minimal setup and dependable support out of the box.

2. 3rd party extensions

Third-party extensions provide the flexibility for Magento retailers wanting to enter regional or international markets to include a variety of local payment methods. Native choices that fall short of supporting particular currencies, nations, or banking systems benefit especially from these add-ons. Businesses may customize their checkout experience to fit consumer expectations everywhere by using the Magento Marketplace or trusted developers to provide access to the best payment gateways for Magento.

The Magento 2 Stripe integration, for example, allows merchants to accept payment through more than 135 currencies, accompanied by many features like subscription billing, fraud screening, and compatibility with digital wallets such as Apple Pay and Google Pay. Other extensions like Paya, Barclaycard, Worldpay, Alipay, and Moneris fulfill specific local requirements throughout North America, Europe, and Asia.

Merchants have also been known to use custom modules when ready-made extensions do not fit their needs. In those situations, Magento payment extension development becomes vital to share payment logic and store structure, especially in the case of a merchant who has volume or merchants operating in specific markets.

Use case: 3rd-party extensions are well-suited for growing businesses entering new or regional markets.

3. Custom integration

Custom integration provides the greatest control and flexibility in setting payment processes for highly specific need stores or companies with enterprise-level requirements. Unlike built-in solutions or external modules, custom setups enable developers to establish a direct link between Magento 2 and a selected gateway, often one that isn’t formally supported or needs a nonstandard transaction flow.

When your store needs specialized features like multistep authentication, dynamic currency conversion, or regional banking protocol support, this kind of Magento payment integration is ideal. In many situations, it becomes the only practical solution if current extensions cannot offer the features, performance, or security needed by your infrastructure.

Custom integration has the potential to enable merchants to free themselves from restrictions and tailor every payment experience to their unique business model; best for complex Magento setups, specialized markets, or multigateway scenarios.

Use case: Custom integration is the go-to option for enterprises operating at scale, with complex needs such as dynamic pricing, loyalty program tie-ins, or multi-vendor setups. It’s especially valuable when no existing extension can meet the performance, compliance, or logic required.

Businesses looking to integrate can book a free consultation to explore Stripe, PayPal, or other options.

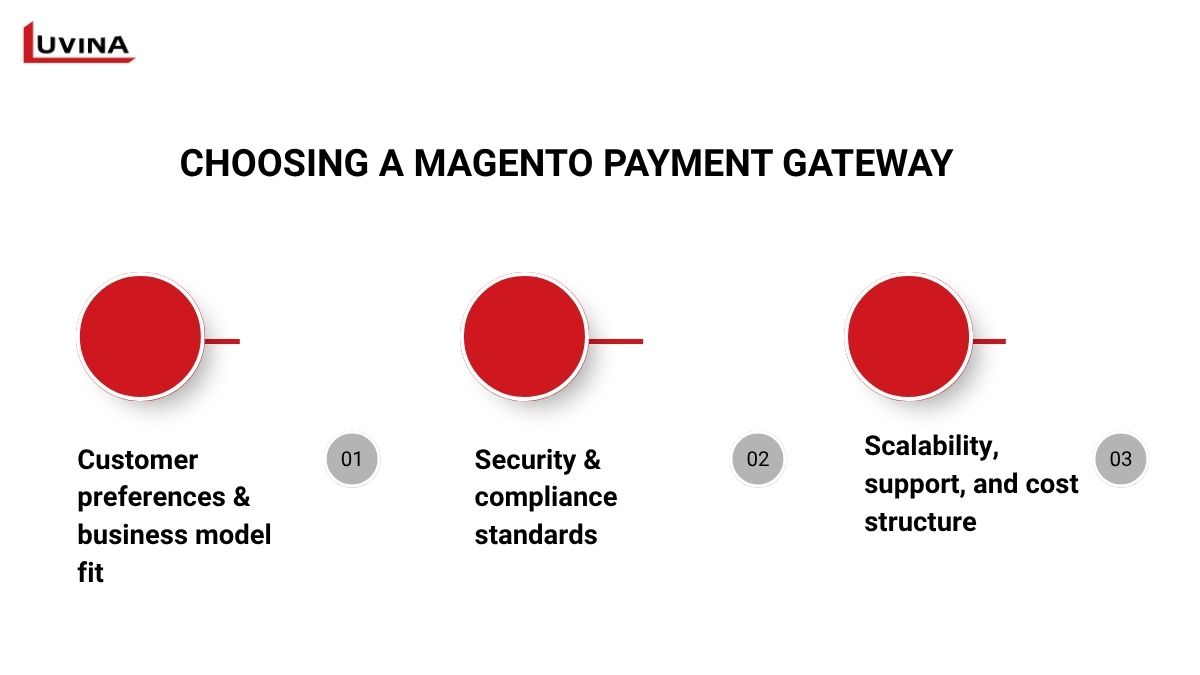

Key Factors to Consider When Choosing a Magento Payment Gateway

Choosing the best Magento payment integration depends on matching your business objectives, consumer demands, and long-term scalability. The main points to assist your decision are presented below:

- Customer preferences & business model fit

First, get to know what your clients anticipate: favored payment options, refund frequency, and acceptable currencies. Particularly for cross-border or subscription-based stores, the better your gateway is geared to your audience, the more frictionless the experience is. For instance, the gateway should allow for automated and flexible billing schedules if you use recurring billing.

- Security & compliance standards

In Magento payment API integration, security should never be an afterthought. Find PCI DSS Level 1 compatible gateways with end-to-end data encryption.

- Scalability, support, and cost structure

Considering your transaction volume, accepted payment kinds, and coverage areas, assess the cost of each gateway. Select companies with clear pricing and no secret costs.

Round-the-clock client service is also essential, especially for Magento stores where payment interruptions might seriously impact sales. Last but not least, give features like multicurrency support, language localization, and flexible APIs top priority if you’re working worldwide in order to future-proof your Magento payment integration.

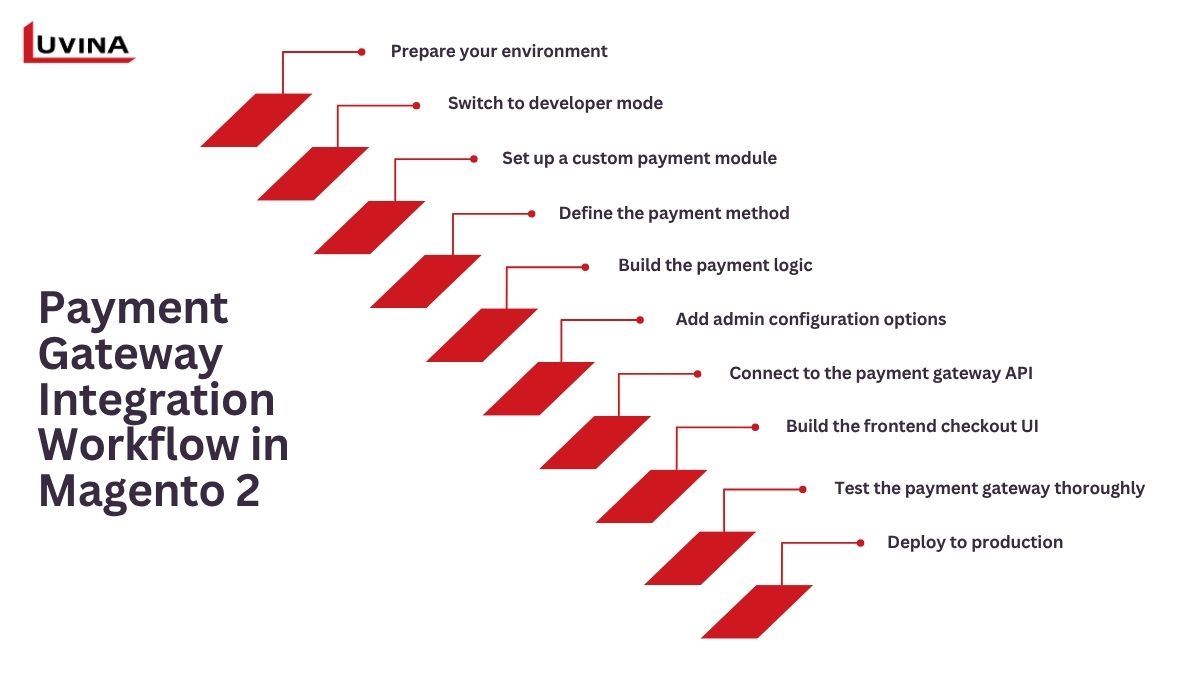

Payment Gateway Integration Workflow in Magento 2

Starting needs a functional Magento 2 installation configured within a compatible development environment. Check the PHP version, that you have the required PHP extensions installed, and server configurations, so you do not run into stability problems.

What Business Leaders Need to Know:

- Dev time: 1–5 days per gateway (depending on method)

- Testing is essential: sandbox mode catches 80% of errors

- Post-launch KPIs: conversion rate, payment success %, fraud rates.

- Step 1: Prepare your environment

Make sure your Magento 2 instance is properly installed and that your development environment is compatible with performance and configuration requirements. Check the version of PHP you’re using, relevant extensions, and server configurations to avoid stability issues.

- Step 2: Switch to developer mode

Set Magento to developer mode to enable real-time error messages. This is essential during integration to catch and resolve issues early.

- Step 3: Set up a custom payment module

Create a custom module folder structure. Then, add required files such as registration.php, module.xml, and composer.json. Register and enable the module using Magento CLI tools.

- Step 4: Define the payment method

Inside your module, create payment.xml and config.xml to declare your new Magento payment method setup. Make sure all references are accurate to avoid visibility issues during checkout.

- Step 5: Build the payment logic

In the model class, implement the core logic for handling payment requests. Ensure the method extends the correct base class so Magento can properly recognize it.

- Step 6: Add admin configuration options

Allow merchants to configure your payment method by defining the fields in system.xml. These settings will be accessible in the Magento admin panel.

- Step 7: Connect to the payment gateway API

Use the gateway’s API documentation to create integration services. Implement request handling, success/failure response logic, and secure token management. Solid error handling at this step is critical to prevent transaction failures or inconsistencies.

- Step 8: Build the frontend checkout UI

Design the frontend user interface using KnockoutJS components and custom templates. Ensure the payment method appears during checkout by correctly registering and loading the component via RequireJS.

- Step 9: Test the payment gateway thoroughly

In Magento payment integration, you will want to enable your module and test multiple transaction scenarios (valid, invalid cards, refunds, etc.) to confirm stability and correct behavior across edge cases.

- Step 10: Deploy to production

Make the switch to production mode for Magento, enable caching, and confirm the system works efficiently. Look into the server and logs to make sure there are no hidden issues that might derail your buyers post-launch.

Best Practices for Magento Payment Gateway Integration

Successful Magento payment integration calls for more than just programming. It also calls for long-term optimization and strategic planning. Following established standards can make a big impact on performance and dependability, whether you are doing a full Magento payment plugin development or just fine-tuning configs.

- Select payment gateways depending on the scope of the market: choose PayPal, Stripe, Braintree, Authorize.net, or Amazon Pay according to the market needs; presenting multiple options can lead to better user engagement and less cart abandonment in Magento payment method setup.

- Rigorously test in the sandbox environment before going live: ensure that you mimic different payment scenarios – including successful payments, failed attempts, partial payments, refunds, and others – in a sandbox environment, to confirm its readiness and thus eliminate compromising the experience for users post-going live.

- Be security and compliance conscious: use HTTPS, ensure PCI DSS compliance, and never retain sensitive payment information to maintain security and compliance. To maintain security and reliability, it is also critical to be continuous in updating the Magento core and any installed extensions.

- Plan for easy scalability and flexibility: Plan the solution regardless of whether you’re building a native integration or a complete Magento payment plugin development, so that as much as possible you can account for local providers, multiple gateways, or changes in the future without too large of a refactoring.

- Good error management and logging: Ensure that both your frontend and backend of Magento payment integration handle errors gracefully, while logging all events to assist debugging and support.

- Document your integration: Keep good records of all configuration and changes on your integration. This is very important for collaboration, upgrades, and maintenance somewhere down the road.

Checklist for CTOs:

- PCI-DSS Level 1 compliance?

- Local gateways for each key market?

- Fraud prevention in place?

- Multigateway fallback to avoid downtime?

Looking to optimize your Magento checkout process? Our experts can help you integrate the most effective payment gateways, from Stripe to Alipay. Schedule a free consultation to get started.

FAQ

Can I use multiple payment gateways in Magento 2?

Yes, Magento 2 allows you to configure and use multiple payment gateways simultaneously.

How Magento 2 Supports Multiple Payment Gateways?

Magento 2 provides a flexible architecture with built-in support and extension points, enabling seamless integration of various payment methods through core settings or third-party modules.

How long does it take to integrate a payment gateway in Magento?

It typically takes a few hours to a few days, depending on whether you’re using a ready-made extension or developing a custom integration.

Also read:

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter