Considering the technology transforming different industries, robo-advisor development is considered one of the most remarkable advancements in financial technology. Such advanced technology changes how we approach investment and plays a crucial role in changing the financial sector. Statistics from the fintech industry highlight the remarkable growth of robo advisors in recent years. According to Statista, the robo-advisor market size is projected to grow to $2,274.00 billion by 2027, at a CAGR of 5%.

As businesses are now using innovative solutions to stay in the lead in the race for reform, investment in robo-advisor development is no longer an option; it is strategic. The following article provides an in-depth guide that will help you understand the development of a robot investor, its benefits, key features, and the future trends of technology that you should be well aware of. This and many other aspects will be discussed in detail in the sections below.

What is a Robo-adviser and how does it work?

First, it is important to explain what a robo-advisor is and how it works before providing the in-depth process for robo-advisor development. A robo-advisor is an automated online investment platform powered by AI and machine learning algorithms; through it, financial planning services, investment advice, and portfolio management are rendered with the least human supervision. Its main purpose is to automate investment management in finance, which will be most helpful for beginners and those with small portfolios.

The general concept of how it works follows this outline:

- Data collection: It is going to ask the user about fundamental information like the purpose of investment, tolerance towards risks, and so on. The robo-advisor collects this financial data of users to commence the process.

- Analysis and advice: Based on the collected information, the robo-advisor uses algorithms to analyze the user’s financial data and generate tailored investment recommendations. These suggestions align with the user’s financial objectives and risk tolerance.

- Portfolio management: The robo-advisor uses algorithms to construct tailored investment portfolios that suit the needs of a particular investor. It will then automatically invest the user’s money into diversified portfolios, normally comprising several asset classes, such as stocks, bonds, and real estate through exchange-traded funds. On top of that, the robo-advisor follows the investments and the portfolios continuously, making adjustments where necessary to maintain the correct asset allocation.

- Tax optimization: Most of the Robo advisors provide tax-loss harvesting service and selling of security at a loss to offset the income and gains against taxes. These optimizations ensure maximum financial benefit to the user.

Benefits of Robo-advisor development

Investment in robo-advisor development can yield immense benefits, especially in the case of an enterprise planning to leave an indelible mark within the industry of financial services. Accordingly, among the major advantages accruable are those seen below.

1. Cost efficiency

As a result, robo-advisors have become much more affordable compared to human financial managers. Their charges range from 0.2% to 0.4% of a customer’s balance, due to automation and the use of AI. This cost-effectiveness lets financial companies adopt competitive pricing models and attract a wider audience. For software development firms, robo-advisor platform development is a highly scalable and low-operating entry point into the investment management sector.

2. Technological innovation

Robo-investor development allows financial firms to leverage the latest technological advancements, such as data analytics, blockchain, machine learning, and AI. Such avant-garde technologies help implement diversified and dynamic investment strategies that change with the fluctuation of market conditions and user demand, resulting in innovative solutions for your clients.

3. Real-time analysis and advice

Robo-advisors are excellent at real-time analytics and recommendations. Because the human financial manager cannot follow the market on a continual basis, robo-advisors run 24/7 in accordance with minute-by-minute changes in the market, rebalancing client portfolios when necessary. In technology companies, robo-advisors gather important data on user preferences, financial goals, and behaviors to further personalize investment strategies for increased user satisfaction, platform loyalty, and more.

4. Emotion-free decision-making

Examples of this are robo-advisors, which stand out for investment recommendations not emotionally biased. This advantage is crucial because emotions could take financial decisions to a very wrong turn. The recommendations they give are based on objective analyses, so every investor is guaranteed rational and well-thought-out advice.

5. Regulatory compliance

The financial services industry is one of the most closely regulated, with strict requirements for compliance. Regulatory compliance is a major selling point when it comes to user acquisition and retention. Making compliance a priority in robo-advisor development – including data security and transparency can position your brand as a trusted name in the world of fintech. Following the regulations concerning financial technology will also ensure that your platform is stable and reliable in the long run for your company and its end-users.

Key features of the Robo-adviser platform

Robo-Advisor Development will help companies in the financial sector manage the complexity of the financial landscape and adapt flexibly to the changing needs of their customers. To meet user demands and generate profits for financial firms, robo-advisor platforms need to include essential features. Below are some core features you should integrate into robo-investor development:

| No. | Features | Description |

| 1 | Automated rebalancing | Continuously monitor and adjust investment portfolios; regularly reassess asset allocation to ensure alignment with client goals, risk management, and desired returns over time. |

| 2 | Portfolio management | Generate diversified investment portfolios aimed at client objectives, then continuously monitor and automatically rebalance for maximum returns with reduced risks. |

| 3 | Risk tolerance assessment | Assess the attitude of clients toward risks and their financial goals to create investment plans that would suit their comfort levels. |

| 4 | Asset allocation | Achieve the best risk-return trade-off by selecting the right assets, allocating them appropriately, and creating diversified portfolios. |

| 5 | Investment analysis | Process large volumes of information to aid clients in making prudent portfolio rebalancing and changing the asset mix to achieve goals. |

| 6 | Tax-loss harvesting | Realize and sell those investments that generate less revenue and are about to fail shortly to set off capital gain. This results in decreasing a fund investor’s overall tax burden. |

| 7 | Diversification | Permit investors to diversify investments across sectors, industries, and geographical regions. |

| 8 | Investor education | Provide facilities with which the customers can set objectives, understand the market basics; have better knowledge, and hence higher activity in investing while increasing knowledge about money management. |

While the above core features meet the minimum requirement, advanced features set your robo-advisor platform apart and make your presence unique in the automated investment world. Here are some of the advanced features of the robo-advisor platform development.

| No. | Features | Description |

| 9 | Direct indexing | Allow ownership of single securities inside an index and allow optimized tax potential by selling off single securities. |

| 10 | Socially responsible investment options | Offer investment choices that align with social, environmental, and governance criteria, helping users invest according to their ethical values. |

| 11 | Dynamic risk adjustment | Automatic adjustment of the investment risk, either due to market or financial situation changes in the user, within his/her limits of risk tolerance. |

| 12 | Market insights reporting | To use artificial intelligence in analyzing the market data to gain actionable insights for users. |

| 13 | Comprehensive retirement planning tools | Account for various income sources and expenses to create a thorough retirement strategy. |

| 14 | Access to alternative investments | Enable access to non-traditional investments like private equity or real estate to diversify portfolios further. |

| 15 | Multi-account integration | Efficiently manage investments across multiple accounts to optimize taxes and overall asset allocation. |

Robo Advisor Breakdown: Components & Technologies

For efficient development, a robo advisor capitalizes on the amalgamation of core components and technologies for successful addressing of individual needs on the part of every client. The central components of any robo-advisor platform are underlined as follows:

- User interface (UI): The user interface serves as the interaction point between the robo advisor and its users. It should be user-friendly, typically including a web dashboard, web application, and mobile app. Through questionnaires, the UI gathers personal and financial information from users, enabling them to review and manage their investments.

- Money management algorithms: At its core, a robo advisor is a machine learning platform powered by AI algorithms. These algorithms carefully analyze customer information, goals, risk tolerance, and investment capabilities to build and manage optimized portfolios. They also support additional functions like student loan management and tax-loss harvesting, adding further value and services.

- Financial APIs: To operate smoothly, a robo-advisor platform requires robust APIs. APIs will help in performing very important functions such as transactions, portfolio rebalancing, and integration with other financial systems. Financial APIs form the backbone for robo-advisor development, ensuring seamless functionality.

- Back-end system: A strong back-end forms the base for any efficient robo-advisor platform. It provides a financial advisor with the facility to refine and validate strategies, rebalance portfolios, and monitor investment algorithms for better performance and compliance.

- Partner portal: The partner portal is an essential element in a competitive robo-investor development. It allows the employer to track payrolls, balances, incomes, and all other metrics associated with these areas for a complete perspective on employee performance and engagement. This feature can help manage retirement plans along with other financial wellness initiatives effectively.

- Security and compliance layer: To safeguard user data and assets, robo advisors must incorporate security measures such as encryption, secure login mechanisms, and compliance features. These ensure adherence to financial industry standards and build user trust.

- Customer education and support: A robust customer support system includes online FAQs, chatbots, and access to human financial advisors. This support helps users understand investment principles and the platform’s features, enhancing their overall experience and confidence in managing finances.

Technology is an essential factor in robo-advisor development. Typically, a robo-advisor uses the following technologies to offer the full range of features needed to meet user requirements:

- Artificial intelligence (AI) or machine learning: AI and machine learning are used to enhance the algorithm tools, allowing them to learn from user interactions and market conditions to improve recommendations over time.

- Data analytics: This technology will process big data of financial markets and user information to create personalized investment portfolios.

- Cloud computing: Most robo-advisors are built on a cloud platform that can scale with the number of accounts and their extensive financial data.

- APIs: APIs will be integrated for stock exchanges, ETF providers, and other financial services to enable the robo-advisor to execute transactions and display real-time market data. Blockchain and cryptography: These technologies are used to enhance security, especially in the verification of transactions and protection of user data.

- Blockchain and cryptography: These technologies enhance security, particularly in areas such as transaction verification and protecting user data.

- Natural Language Processing (NLP): NLP is utilized in customer support and education components to provide high-quality chatbots and other interaction tools, enabling the robo advisor to understand and respond to customer queries in natural language.

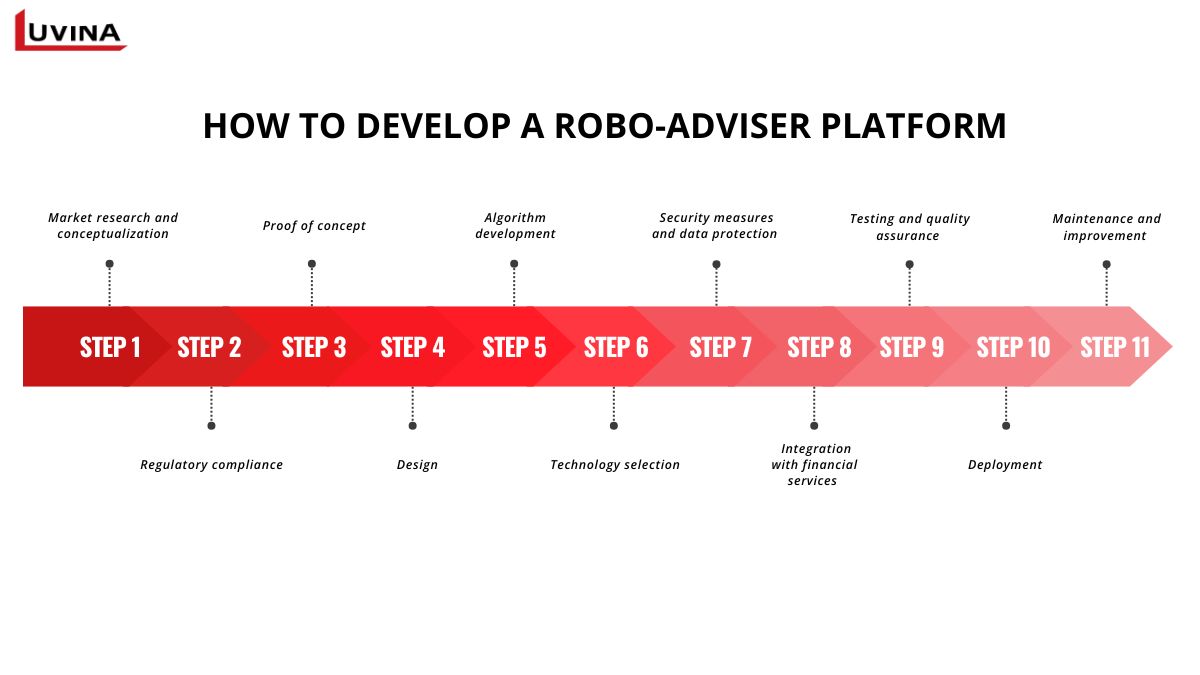

How to develop a Robo-adviser Platform

The main objective of the discovery phase is market research, setting objectives of ROI, and determination of the foundational elements that are required to build the platform. This includes meetings for the alignment of priorities, linking of business goals, and establishment of a technical architecture required for robo-advisor development.

1. Discovery phase

The primary goal of the discovery phase is market research, setting ROI objectives, and establishing the foundational elements necessary to build the platform. This phase involves meetings to align priorities, link business goals, and set up the technical architecture required for the robo-advisor development.

- Step 1 – Market research and conceptualization

The first step of a robo-advisor development is conducting in-depth market research regarding the requirements and preferences of your targeted audience and, of course, studying the competition. Market research plays an important role in finding the loopholes in the products that are already on the market and presenting value propositions unique to your robo-advisor.

- Step 2 – Regulatory compliance

Understanding the financial regulations in the legal regions where you will be offering your services is key to creating an effective robo advisor. You shall receive licenses in this step, assuring that your platform complies with all relevant laws and standards regarding investment advice, cybersecurity, and data protection.

- Step 3 – Proof of concept

Create a proof of concept that can allow assessment of the performance of machine learning algorithms on your robo-advisor. This will go a long way in assuring the viability of the product and that the algorithms will work as expected before full-scale development is commenced.

2. Design phase

The design phase is the stage where you focus on creating the user interface for both the web application and mobile devices. It falls as the 4th in line in the robo-advisor development process, where major emphases shall be laid on the creation of an intuitive and engaging user experience. This stage will deal with the work concerning the user flow, designing the integration process, and investment portfolio management dashboard, and addressing every user interaction with the platform.

An effective UI design should ensure that complex investment processes are accessible to users with varying levels of financial knowledge. This phase requires collaboration with developers to ensure the practicality and feasibility of the design. We recommend creating interactive prototypes, conducting user testing, and refining the UI/UX based on user feedback to achieve a design that truly enhances the user experience.

3. Development phase

After the design and proof of concept are tested, the next step is the robo-advisor development phase. It consists of the writing of code by engineers and developing the application as planned, finding out issues, and solving problems to smooth operation. For seamless development, it needs a team that includes UI/UX developers, user transaction programmers, testers, UI/UX engineers, product managers, and project management experts.

- Step 5: Algorithm development

The algorithm forms the backbone of a robo-advisor development, whereby the former generates personalized investment advice and manages users’ portfolios. Based on Modern Portfolio Theory, risk assessment models, and several other financial theories, in this step, you’ll develop an algorithm with aspects of AI and machine learning to develop more intelligent capabilities and create personalized strategies in investments.

- Step 6: Technology selection

It’s high time to decide on using strong and scalable technology so it can bear all types of computational load and give outstanding performance. A combination such as but not confined or limited to is recommended:

Backend development: Node.js, Python, Ruby on Rails, Java, etc.

Frontend development: React, Vue.js, etc.

Data management: PostgreSQL, MongoDB, MySQL, etc.

Machine Learning: TensorFlow, PyTorch.

- Step 7: Security measures and data protection

Security protocols should be strict enough to let the robo-advisor platform bear the cybersecurity threat. The protection of user data and financial transactions is very important, and key security and data protection features you can implement include encryption, secure authentication methods, and regulatory compliance for data protection. You should also establish a regular security update plan to maintain the integrity of the platform.

- Step 8: Integration with financial services

To integrate with financial services like stock exchanges, banks, ETF providers, etc., you’ll need to utilize APIs. Integrating these services will allow access to real-time data, enable transactions, and facilitate money transfers.

- Step 9: Testing and quality assurance

The development process now proceeds to testing and ensuring the reliability and performance of the platform. Testing provides an important avenue for ascertaining the functionality of the algorithms, user interface, and acceptance, as well as detecting security vulnerabilities.

4. Deployment, marketing, and maintenance Phase

Once the development and testing are complete and the application meets performance standards, then it is time for the deployment.

- Step 10: Deployment

Deployment involves transitioning the platform to a production environment or uploading the mobile app to the App Store or Google Play. After the app is launched, you need a strategic marketing plan for the rollout. This strategy should combine digital marketing, content marketing, partnerships, and public relations to attract users and raise brand awareness.

- Step 11: Maintenance and improvement

In the post-launch phase, the performance of the robo advisor, feedback from the users, and market trends should be continuously monitored. These will serve as valuable insights toward making improvements and launching new features with the intent of enhancing user experience and making the platform competitive in the market. Long-term success requires regular updates and maintenance.

Future trends in Robo-investor

Technology plays a crucial role in the financial sector, and its dependence is expected to deepen in the future. Below are some prominent future trends, including technological trends in the development of robo-advisors, which we believe will shape the future of financial investment.

1. AI (Artificial Intelligence)

In the future, robo-advisors will be closely related to AI technology in enhancing decision-making algorithms through the ability of AI to process a great amount of information. The support of AI means that algorithms will have the ability to find investment opportunities, better analyze data, and offer services more tailored to the clients’ needs. In essence, AI has the potential to change the robo-advisor from rule-based tools into dynamic and agile investment strategists that can respond remarkably to changes in the market

>> Read more: Artificial intelligence in fintech

2. Blockchain technology

Having been designed as a secure and transparent ledger system, blockchain holds immense potential for fundamentally changing how the process of fractional ownership of assets is treated. Whereas previously it was often a high minimum investment to purchase a whole share of a traditional asset, blockchain technology allows those assets to be divided down, enabling the customer to invest in real estate activity or high-value stocks via robos. Enhanced transparency using blockchain also lowers administrative burdens on investors’ shoulders, while it is much easier for regulatory bodies to monitor and check compliance and reporting.

>> Read more: Blockchain Technology in Fintech

3. Changes in financial regulations

As technology continues to advance, regulation changes will continue to change toward becoming more robo-advisor-specific. Industry regulations are expected to provide a standardized and transparent system related to white-label robo-advisor platforms for protecting investors. One of the most prominent changes will surely be the increased auditing and reporting requirements for robo-advisors to ensure this process falls into compliance with regulatory standards. Building trust in these platforms goes hand in hand.

FAQs

How Much Does It Cost To Build A Robo Advisor Platform?

The development of a robo advisor can cost anywhere from $35,000 to over $300,000. The exact figure will be influenced by several factors, such as whether a white-label solution or a custom-built platform is used, the infrastructure requirements, the number and type of user interfaces, and the specific features to be integrated.

What is the ROI of robo-advisor?

The return on investment (ROI) for a robo advisor can vary significantly based on factors like its market position, pricing model, operational efficiency, and user base. Typically, the ROI of a robo advisor comes from the percentage of assets under management (AUM), subscription fees, cost-effectiveness, and scalability.

How do robo-advisors generate revenue?

Robo advisors often generate revenue through management fees, typically ranging from 0.25% to 0.75% of the assets under management. These management fees are generally lower than those charged by traditional financial advisors, making robo-advisors an attractive and cost-effective option for investors seeking lower fees while maintaining a personalized investment experience.

Related Posts:

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter