Generative AI in Banking is quietly redefining modern finance. What once required teams of analysts and months of data work can now be done in minutes. These algorithms don’t just analyze data; they generate new insights, risk models, and personalized customer experiences. Generative artificial intelligence could generate about $340 billion in yearly value for the international banking sector, according to McKinsey. IBM also claims a ten-fold increase in adoption, from 8% of banks in 2024 to 78% in 2025. These numbers show more than a trend; they signal the start of a radical change in banks’ operating, competing, and customer interaction approach.

We’ll investigate in this article how generative artificial intelligence is changing the banking scene from creative applications and clear commercial results to risk management, governance, management, and the technologies driving this change.

What is Generative AI for Banking?

Generative AI in banking is an advanced form of artificial intelligence that enables financial institutions to go beyond traditional automation by generating new text, insights, and solutions tailored to complex financial operations. Instead of merely analyzing data, it creates – drafting financial reports, summarizing regulatory documents, and producing human-like responses through natural language processing. Big language models (LLMs) and deep learning algorithms trained on enormous databases of financial data provide the power for these features.

Generative AI acts as a powerful engine, transforming how banks deliver efficiency and value. It enables human teams to shift their focus to strategic decision-making by automating recurring but high-value processes in banking, such as loan underwriting, credit approval, and fraud detection.

Apart from customer contact, generative AI in financial services improves operational resilience and regulatory compliance. Millions of transactions in real time can be examined by artificial intelligence systems, which can also identify suspect behavior and guarantee compliance with difficult financial rules.

The emergence of generative AI in banking signals a significant move toward smarter, more flexible financial environments as it can speed analysis, automate compliance, and humanize digital banking.

Generative AI Use Cases in Banking & Financial Services

At an unmatched level, generative AI in banking is supporting automation, personalization, and strategic decision-making. The rise of generative AI use cases marks a shift from reactive to proactive intelligence. It accelerates digital transformation, efficiency, and innovation across financial sectors.

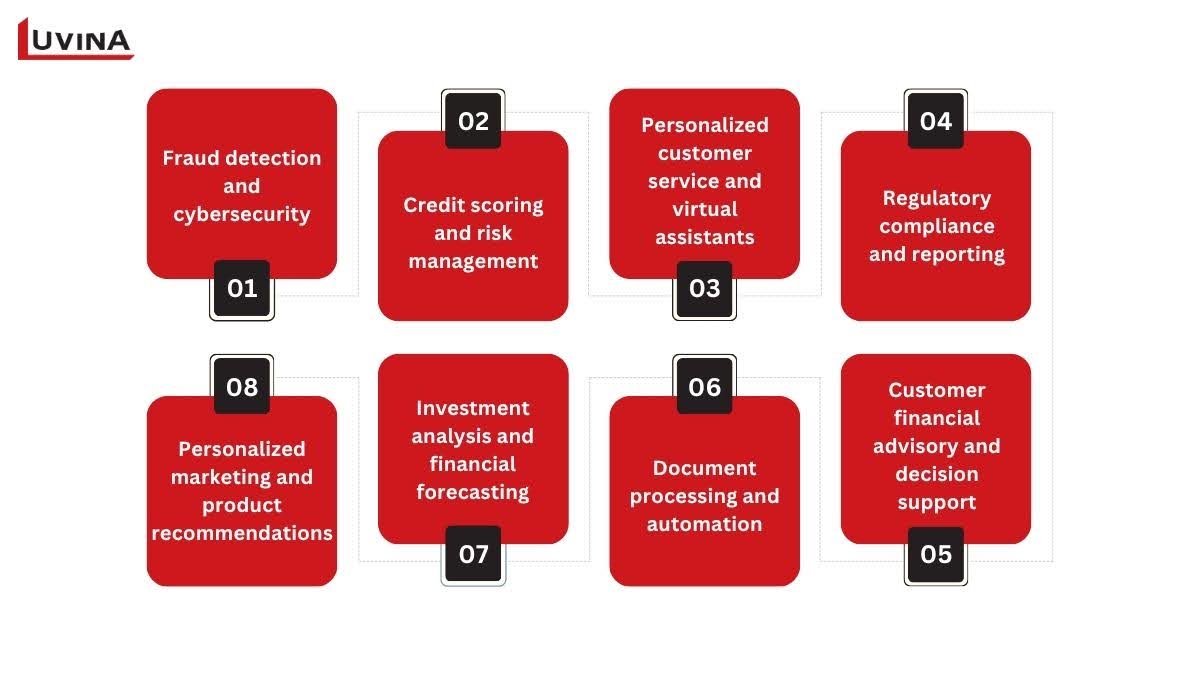

The most revolutionary uses of generative AI in banking are listed here:

Fraud detection and cybersecurity

Fraud detection and prevention is one of the most important applications of generative AI in banking. Artificial intelligence models allow for real-time analysis of millions of transactions to detect anomalies and activities that don’t make sense, such as sporadic spending or unauthorized individuals accessing accounts.

Credit scoring and risk management

Smart credit assessment and portfolio management are made possible with Gen AI in banking. Using historical and real-time data, artificial intelligence algorithms predict likely loan defaults more precisely than conventional systems by evaluating creditworthiness and projecting market volatility.

Personalized customer service and virtual assistants

With the support of innovative AI in banking, chatbots and digital assistants can immediately respond to customers’ inquiries, provide real-time financial advice, and even deliver related personalized product suggestions, thereby emulating the interaction you would experience with a human client representative. These technologies handle thousands of customer engagements daily, with an array of NLP (natural language processing) capabilities, resulting in increased satisfaction while reducing overall operating costs.

Regulatory compliance and reporting

Compliance remains a major challenge in finance. Generative AI simplifies the process by automating document preparation and summarization. Faster and more correctly to fulfill compliance obligations, artificial intelligence tools extract, arrange, and format massive datasets, hence greatly lowering the time devoted to manual documentation.

Personalized marketing and product recommendations

Through customer behavior data, generative AI can produce targeted campaigns and personalize products for financial goals, spending habits, and risk tolerance. This data-centric personalization enhances engagement and conversion rates while developing increased customer loyalty for banks.

Investment analysis and financial forecasting

Generative artificial intelligence can run simulations, find market trends, and produce predictive insights by means of training models on unique and historical financial data. Banks and investment firms use these tools to construct ideal portfolios, improve wealth management offerings, and predict possible risks or opportunities in real time.

Document processing and automation

Generative AI helps to effectively handle the massive documentation needed in banking – loan applications, credit memorandums, and KYC forms. Reducing administrative burden and speeding approvals, the system gathers, condenses, creates draft reports, and highlights variances.

Customer financial advisory and decision support

From customized financial counseling ranging from budgeting recommendations to long-term investment strategies, generative artificial intelligence can compile client information. It helps advisors to design customized financial strategies balancing chance and risk, therefore producing a hybrid model of human knowledge aided by artificial intelligence accuracy.

Benefits for business

Generative AI in banking provides evident benefits in terms of productivity, decision-making, and customer experience. Important generative AI benefits for business that are changing the financial services industry are listed here.

Operational efficiency and cost reduction: Automates repetitive tasks like data entry and compliance checks, reducing risk, manual effort, and operational costs.

Enhanced customer experience: GAI enables 24/7 chatbot-style support through text or voice, instantly responding to customer queries with personalized, real-time assistance. This improves satisfaction while freeing employees to handle more complex issues.

Faster decision-making: Generative artificial intelligence systems enable rapid credit assessments, prevent fraud, and conduct market research, facilitating the timely processing and interpretation of large datasets in seconds.

Active risk and fraud management: Artificial intelligence technology is already used to detect risks and fraudulent activity early, utilizing the continual analysis of transactional behavior to detect anomalies and issues.

Tailored product development: Generative artificial intelligence allows for creating tailored financial products based on behavioral and preference data for individual customers, allowing for relevancy and competitive products to market.

Innovation and agility: Generative AI helps to produce constant innovation by identifying unsatisfied consumer demands and projecting upcoming financial trends. This flexibility allows banks to remain ahead in a fast-changing fintech environment.

Risks, Limitations & Governance of AI Usage

Generative AI in banking offers tremendous automating potential, while also posing complex issues that need to be addressed thoughtfully. An awareness of limited risk is an essential part of examining how to balance trust, accountability, and innovation.

Data privacy and security risks: Protecting sensitive financial information is probably the biggest challenge that needs to be addressed in generative AI in banking. Because generative AI in banking can process massive amounts of consumer information, banks may become vulnerable to breaches or compromised information. Organizations must take meaningful actions to prevent the misuse of sensitive customer data, including access control, data anonymization, and advanced encryption.

Regulations and ethics: Adhering to data regulations (e.g., GDPR, CCPA, local bank regulations) is extremely important. AI procedures of operations and regulations need to ensure that there are no biases, discriminatory actions, or misuses of client data based on consumer data, and in all processes, should include documentation and auditing regularity for compliance.

Data quality and model accuracy: Generative artificial intelligence algorithms need precise and comprehensive data. Bad data quality can create “AI hallucinations,” therefore providing inaccurate insights and incorrect financial advice. To guarantee model accuracy, banks should use thorough data validation and ongoing retraining.

Problems with legacy systems and integration: Many banks rely on outdated systems that struggle to communicate with AI-powered systems, which can therefore lead to problems with integration. Usually, transitioning to generative AI in financial services will require substantial expenditure on modernization, the cloud, and employee training to maintain cohesive system interoperability.

Over-reliance on automation and under-reliance on human checks: Automation can promote efficiencies and greater utilization of AI in high-stakes decisions. However, relying on AI tools in these contexts without formal human checks has caused ethical and operational issues. Human checking of processes must always be prioritized for fairness and accountability.

Governance and transparency: Robust governance systems of AI are also necessary to track model performance over time, ensure explainability, and delineate responsibility and accountability through governance and transparency.

Generative AI in banking should be used with a mix of creativity, openness, and governance.

Reference Architecture & Tech Stack

Creating a strong technical basis for generative AI in banking calls for a well-coordinated architecture guaranteeing scalability, security, and compliance. The following chapters present the main elements of this reference architecture and the underlying tech stack powering contemporary AI-driven financial systems.

End‑to‑end reference architecture

Building an excellent generative AI in financial services architecture calls for core flexibility, security, and compliance. Enabling financial institutions to implement artificial intelligence capabilities without sacrificing governance or control, an end-to-end reference architecture acts as a consistent plan supporting both on-premise and cloud systems.

This architecture guarantees that fundamental systems, including monitoring tools, model management, and data pipelines, may flow easily among contexts. The framework remains flexible as companies develop in artificial intelligence maturity; it scales seamlessly to enable changing business objectives, tighter compliance requirements, and ongoing innovation inside the financial environment.

RAG vs. fine‑tuning decision guide

One of the most crucial architectural decisions when applying generative AI in banking is between fine-tuning and retrieval-augmented generation (RAG). Though they approach data, knowledge, and scalability differently, both strategies seek to improve model performance and domain understanding.

- Fine-tuning helps a pre-trained language model to incorporate domain-specific knowledge.

- RAG dynamically retrieves a model at runtime by linking it to outside knowledge sources.

For applications needing accuracy, brand consistency, or strict regulatory compliance, fine-tuning fits most well. It incorporates institutional knowledge straight into the model, therefore lessening reliance on outside data retrieval. It demands, nevertheless, considerable computer resources, specialized training datasets, and frequent retraining to remain abreast.

RAG, on the other hand, offers scalability and agility. It finds pertinent data from reliable repositories or APIs rather than reeducation, therefore making it perfect for financial organizations that often modify data or paperwork. Faster deployment and simpler maintenance are made possible by this technique, but to protect sensitive financial data, it calls for strong access control and data governance.

Many banks take a hybrid approach, applying RAG for real-time flexibility and fine-tuning for mission-critical applications. Knowing how every strategy assists the other is vital for creating a balanced, future-ready artificial intelligence strategy, even if the best choice depends on business goals, data sensitivity, and current infrastructure.

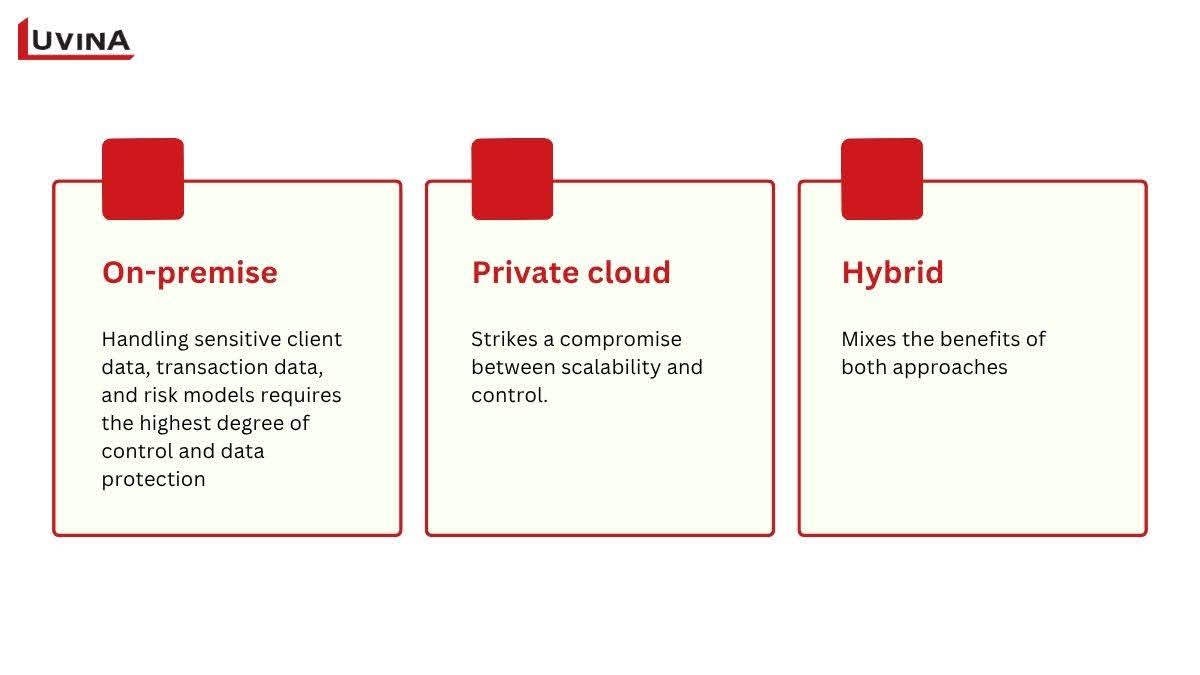

Deployment options (on‑prem, private cloud, hybrid)

Organizations must strike a fine balance of security, performance, and scalability when introducing generative AI in banking. Depending on the sensitivity of financial data and the regulatory environment, several deployment methods- on-premise, private cloud, and hybrid – provide unique benefits.

- On-premises: Best for institutions handling highly sensitive data such as transactions or risk models. It offers maximum control, compliance with data residency rules, and strict access management. The trade-off is high cost and complexity in maintenance, scaling, and infrastructure upgrades.

- Private cloud: Best for banks seeking flexibility without sacrificing governance. It supports faster deployment, elasticity, and centralized management while keeping data protected. However, it may not meet the strictest compliance standards for highly confidential workloads.

- Hybrid architecture: One of the rising trends in gen ai in banking, hybrid architecture mixes the benefits of both approaches. This kind of deployment is the best for banks seeking flexibility without sacrificing governance. It supports faster deployment, elasticity, and centralized management while keeping data protected. However, it may not meet the strictest compliance standards for highly confidential workloads.

Prompt engineering patterns for banking

How generative AI in financial services generates correct, context-aware, compliant results depends much on effective prompt engineering. Well-built prompts serve as the control layer guiding artificial intelligence behavior in banking, where accuracy and regulatory coordination are paramount, hence guaranteeing it generates outputs that are relevant, reliable, and ethically acceptable.

Typical patterns of common prompt engineering in banking are:

- Instructional prompts: Ensuring clarity and consistency in generated content, instructional prompts help to produce organized outputs, including financial summaries, legislative reports, or credit memos.

- Contextual prompts: Embed client or transaction information inside the query for customized responses for applications like fraud alerts or personalized financial advice.

- Chain-of-thought prompts: Encouragement of step-by-step reasoning for risk assessments, loan judgments, or investment advice helps to validate artificial intelligence logic.

- Template-based prompts: Standardize interactions among internal advisors and customer-facing chatbots using template-based prompts to guarantee compliance and tone alignment.

- Constraint-driven prompts: Constraint-driven prompts help to reduce legal or moral concerns by specifying limits or compliance requirements (such as “exclude personal data” or “adhere to Basel III standards”).

Evaluation & monitoring

One of the most important governance approaches for generative AI in banking is assessing and tracking artificial intelligence performance to guarantee that every model behaves properly and ethically across its life cycle. Unlike conventional systems, generative models generate probabilistic and often non-deterministic outputs; hence, the same prompt can produce many valid answers. This natural volatility requires constant evaluation in delicate financial situations to ensure compliance, justice, and accuracy.

Banks have to establish measurable performance metrics that correspond with company goals, including operational efficiency, contextual coherence, and response correctness, to reach this. Real banking situations backed by both expert review and automatic validation should be covered by comprehensive test datasets.

Monitoring continues beyond implementation. Financial institutions need strong real-time monitoring of model drift, bias emergence, latency, and inference costs via observability pipelines.

Performance & cost optimization

Because generative models can produce variable results, even from identical inputs, continuous monitoring is essential, not a one-time task.

Financial institutions should specify strict evaluation indicators suited to their particular use cases, such as accuracy in risk projections and bias control, reliability in customer communication tools. Frequent testing and validation against these benchmarks let banks identify possible problems early and keep performance steady.

Beyond the first evaluation, ongoing monitoring systems should be developed to watch model drift, operational latency, inference expenses, and ethical hazards.

Implementation Roadmap

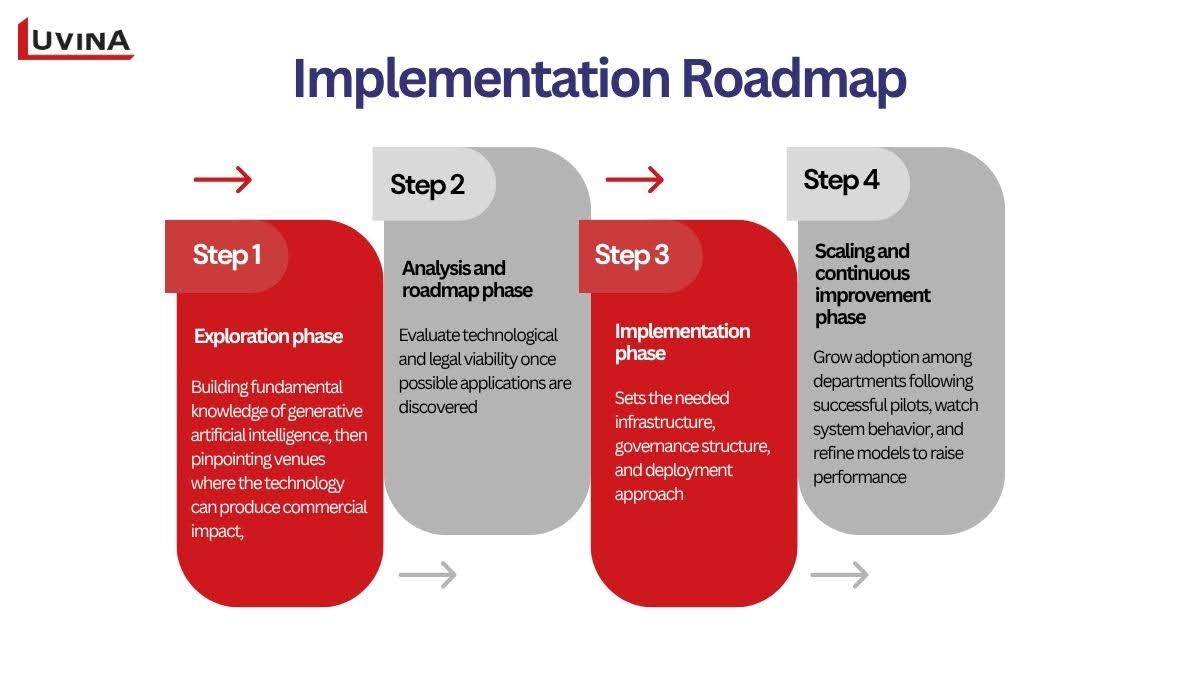

Normally, four main stages make up a roadmap for integrating generative AI in banking, each building on the one before it to guarantee a safe, compliant, and value-driven transformational path.

Exploration phase

Banks start by building fundamental knowledge of generative artificial intelligence, then pinpoint venues where the technology can produce commercial impact, including credit analysis, fraud prevention, or customer service automation. Raising inside awareness and matching leadership around artificial intelligence goals are also part of this stage.

Analysis and roadmap phase

Banks evaluate their technological and legal viability once possible applications are discovered. Cross-department cooperation guarantees alignment across IT, compliance, risk, and data governance operations; proofs of concept (POCs) are performed to confirm hypotheses.

Implementation phase

The company sets the needed infrastructure, governance structure, and deployment approach at this point. Before scaling up, pilot projects are initiated to evaluate the performance and dependability of artificial intelligence systems in actual banking processes.

Scaling and continuous improvement phase

After successful pilots, banks expand adoption across departments. They monitor system behavior and continuously refine models to improve performance. Regular assessment guarantees conformity, precision, and flexibility to meet changing corporate and legal demands.

Financial organizations must combine technical execution with deliberate governance and long-term vision for a viable generative AI in banking strategy. This calls for setting precise commercial goals, creating current data and cloud systems, implementing strong artificial intelligence governance frameworks, and fostering a culture of responsible innovation.

Case Studies & Real‑World Examples

The adoption of generative AI in banking is no longer experimental; it’s actively transforming how financial institutions interact with customers, manage compliance, and optimize internal workflows. The following real-world examples highlight how innovation and regulation can coexist, proving the tangible value of applications of generative AI in modern finance.

Wells Fargo – Redefining customer experience with Fargo

Built on Google’s PaLM 2 model, Fargo is a generative artificial intelligence-powered virtual assistant that Wells Fargo introduced. Fargo has managed more than 20 million customer interactions since its debut in 2023, enabling consumers to evaluate spending patterns, access transaction history, and pay bills – all through conversational banking. Improving consumer happiness and lowering manual service volumes depend on the tool’s cornerstone.

Bunq – AI-driven personal finance management

European neobank Bunq integrated Finn, an AI assistant designed to streamline app navigation and simplify financial management. Instead of relying on static search tools, customers can now interact naturally to plan budgets, track spending, and locate transactions – an innovation that positions Bunq as one of Europe’s most forward-thinking digital banks.

OCBC Bank – Internal efficiency through generative AI

Following a six-month trial of an inside artificial intelligence assistant, OCBC Bank of Singapore saw a 50% rise in productivity. By automating call transcription, report summarization, and document translation, the solution lets workers concentrate on more valuable activities. This use case shows how generative artificial intelligence in finance may propel operational excellence beyond consumer-facing uses.

Citigroup – Accelerating compliance analysis

Citigroup used a generative artificial intelligence tool to review more than 1,000 pages of new U.S. capital regulations to deal with the complexity of changing rules internationally. The tool not only simplifies legislative language but also compares differences between jurisdictions and increases compliance teams’ ability to compare regulatory systems. It significantly reduces research time and risk.

Morgan Stanley – AI-powered financial advisory

Morgan Stanley gave its 16,000 financial advisors an AI assistant giving immediate access to more than 100,000 research papers. Investment data is synthesized by the system, which then provides client-specific insights in seconds, hence facilitating quicker advisory reactions and better educated choices.

Pictet Group – Knowledge management and internal search

A generative artificial intelligence chatbot now helps staff in retrieving HR rules, IT guidelines, and corporate directions at the Pictet Group by integrating with the company’s knowledge base. Using retrieval-augmented creation (RAG), the system customizes answers depending on access levels, hence increasing both data security throughout the company and accuracy.

Standard Chartered – AI in compliance and trading

Standard Chartered introduced an artificial intelligence-powered compliance and trading assistant in 2025 that offers real-time regulatory advice and market insights. By dramatically reducing decision turnaround times, the system allows compliance personnel and traders to act more quickly and with more assurance.

Future of AI in Banking & Fintech

The next chapter of digital transformation in finance will be driven by intelligent automation, data integration, and human-AI collaboration.

In the coming years, generative AI in banking will become an invisible yet essential part of every banking function. Generative AI’s ability to synthesize vast amounts of structured and unstructured data enables banks to move beyond reactive decision-making toward predictive and advisory operations. Imagine loan approvals that adapt dynamically to customer behavior or digital assistants that offer investment recommendations tailored to life stages and financial goals – this is the future being built today.

Fintech companies are also utilizing these advancements to enhance their innovation capacity. Rapidly emerging markets like India are also embracing this wave – with organizations such as SBI Card implementing a combination of generative AI and machine learning technologies for more intelligent credit analysis and personalized customer engagements at scale.

However, with all advancements come hurdles. The integration of artificial intelligence within financial ecosystems brings risks around data privacy, model interpretability, and ethical governance. As the financial sector fully benefits from these innovations, financial institutions will need to construct a robust framework around compliance, risk management, and accountability of algorithm-based decision making – through automation, efficiency and trust as key outcomes.

FAQ

What type of AI is used in banking?

Generative artificial intelligence is being used more and more in banking for credit scoring, fraud detection, and custom customer insights.

How does AI transform the banking industry?

AI raises efficiency and consumer happiness by enabling banks to automate regular processes, speedier fraud detection, and more customized services.

What are some real-world applications of AI in banking?

Chatbots employ artificial intelligence for customer service, algorithms simplifying loan approvals, and predictive models finding possible fraud or credit risks, and many more.

Will AI replace bankers?

No. Although artificial intelligence mechanizes data-driven activities, banking still demands ethical monitoring, interpersonal management, and human judgment. AI assists bankers rather than replacing them. However, with the expected improvement in individual productivity, a corresponding decrease in the demand for human labor should also be anticipated.

Is Generative AI secure for banking applications?

Yes, so long as it is done under strong data security and governance policies. Encryption, restricted access, and adherence to rules like GDPR help guarantee compliant and safe artificial intelligence activities.

Conclusion

As a new era of automation and intelligence emerges for the financial sector, generative AI in banking is at the forefront of change. To unlock the full capabilities of generative AI, banks must adopt a strategic approach to programs that balances innovation with conflicting interests around compliance, scalability, and ethical use. The banks that successfully blend GenAI into their processes and are early in the development of their digital plans will be better positioned to be leaders in the new digital economy.

Partner with Luvina to accelerate your AI transformation. Our experts design secure, compliance-ready generative AI solutions that help banks innovate faster while maintaining trust and transparency.

Glossaries

- Generative AI (GenAI): An advanced form of artificial intelligence that creates new content or insights from data, driving automation, fraud detection, and personalized banking services.

- Machine Learning (ML): A branch of AI that learns from data to improve tasks like credit scoring and risk prediction.

- Predictive analytics: Uses data and algorithms to forecast outcomes such as loan defaults or customer trends.

- Risk assessment: Evaluates financial and operational risks to guide lending and compliance decisions.

- AI governance: A framework that ensures ethical, transparent, and secure use of AI in financial systems.

- Prompt engineering: Crafting and refining inputs to help generative AI produce accurate results.

Resources

- https://www.ibm.com/think/topics/generative-ai-banking

- https://aisera.com/blog/generative-ai-in-banking/#generative-ai-use-cases-in-banking

- https://cloud.google.com/discover/ai-in-banking#what-is-generative-ai-in-banking

- https://www.ideas2it.com/blogs/generative-ai-in-banking#real-world-applications-of-generative-ai-in-banking-and-finance

- https://www.swissbanking.ch/_Resources/Persistent/2/0/3/b/203b937e175f25819ea271c883a095fe1dfa1ee0/SBA_Generative-AI-in-Banking_EN.pdf

- https://medium.com/@HazlanRozaimi/generative-ai-reference-architecture-example-for-enterprises-260e95986da2

- https://appinventiv.com/blog/rag-vs-fine-tuning

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter