P2P payment app development is the result of the fintech revolution, transforming how users make payments and transfer money. The emergence of P2P payment apps clearly shows that the financial world is moving towards a more advanced future where technology and finance are deeply connected. If you don’t want to miss out on this trend, keep reading our article to learn everything you need to know about developing a peer-to-peer payment app and how to build a P2P payment app successfully, like Venmo, PayPal, and others.

P2P payment app market trends

The P2P payment market has experienced rapid growth, increasing from $2.95 billion in 2023 to $3.4 billion in 2024. According to forecasts, the global P2P payment market size will reach $11.62 trillion by 2032, with a compound annual growth rate (CAGR) of 18.10% during the period from 2023 to 2032.

The COVID-19 pandemic is one of the key factors influencing the market’s development. As we move into 2025, keeping up with P2P payment trends will be transformative not only for consumers but also for businesses and developers. Current P2P payment apps are enabling higher accessibility and faster money transfers for consumers. Among these, people have a special tendency towards P2P payment apps, and it has made business leaders show interest in P2P payment app development.

Following are the two most highlighted P2P payment app market trends that are predicted: The first is Cross-Border P2P Payment Service. Due to globalization and improved connectivity, this trend will rise powerfully. While traditional banking systems take high fees and consume a great deal of time in the case of international settlements, P2P payment platforms, using blockchain technology, offer faster, cheaper, and more transparent cross-border payment solutions. Seamless cross-border payments result in enhancing the user experience and opening new markets for the providers of P2P payment services.

The second important trend in peer-to-peer app development is the integration of cryptocurrency payments such as Bitcoin, Ethereum, and others. Among the first to take this direction are platforms like PayPal and Cash App, offering a way of paying that is much quicker and less expensive than traditional fiat currency transactions. This trend contributes not only to the expansion of the user base of P2P payment platforms but also to the growth of interest in digital assets and blockchain technology.

Examples of P2P payment apps

Currently, consumers are embracing existing P2P payment apps wholeheartedly, and such success with these apps is one of the major motives for business leaders to get into P2P payment app development:

- PayPal: PayPal is the leader in the field of P2P payments. The given platform is extremely popular and widespread, allowing its users and subscribers to send and receive online payments through the Internet. Not only is it very user-friendly, but PayPal provides security for online transactions, ensuring that unauthorized payments will not occur. If you aim to build a P2P payment app, PayPal is a model you should not overlook.

- Venmo: Owned by PayPal, has differentiated positioning based on social and mobile payments. This peer-to-peer payment application allows users to send and receive money in no time with the use of smartphones. Due to highly user-friendly social features, Venmo is considered one of the most trending P2P payment applications among the youth in the U.S.

- Cash App: Developed by Square Inc., Cash App is a mobile payment service celebrated for its simplicity and the intuitive nature of its app; users can easily share, receive, and manage digital money on it. It can also be used to pay for Bitcoin transactions and directly deposit cash.

- Square Cash: A P2P payment application developed by Square Inc., Square Cash enables users and businesses to send, receive, and request money through a mobile application. Its ease of use and simplicity are some of the major factors that have made it stand out among the crowd.

>> See more: Top Fintech Applications

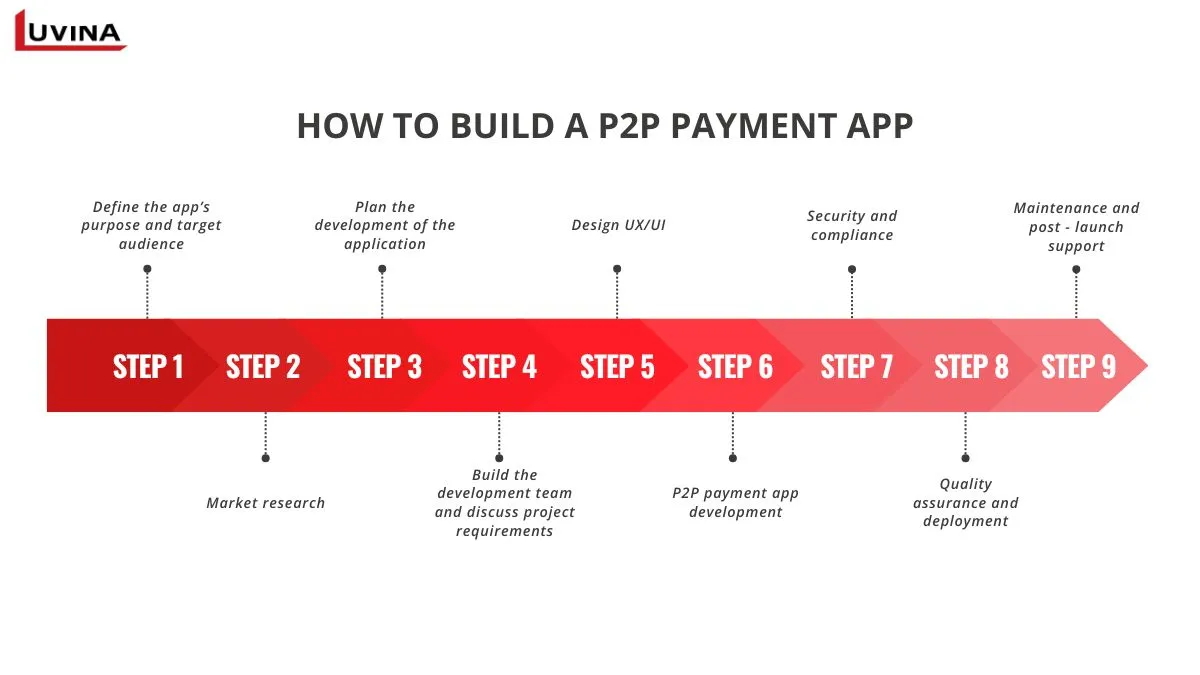

How to build a P2P payment app

To build a p2p payment app, you have to be very strategic. That is why a properly detailed plan for it is needed. Therefore, we have underlined the necessary steps of P2P payment app development to support the creation of an application that answers your business needs.

Step 1 – Define the app’s purpose and target audience

The first stage of the development process involves defining the purpose of the peer-to-peer application and its target audience. In this stage, you have to very clearly define the main goal that you want to achieve while developing the application. It might be optimizing peer-to-peer transactions, enabling online purchases, and serving international transactions, among others. Secondly, you can conduct user surveys and interviews to understand the issues they experience and their preferences.

Step 2 – Market research

Market research is a necessary step to create a P2P payment app that meets the demand for users. You should make sure of thorough market research on current trends, study the applications of competitors, and understand what users expect. The market research will also help you identify the main trends that can greatly benefit your app, like cryptocurrency integration, contactless payments, and more.

Step 3 – Plan the development of the application

During this stage, you will have to complete many tasks to outline the key aspects that relate to P2P payment app development. Some important tasks to consider include:

- Application type of P2P: The decision should be made whether the application will be a stand-alone application or integrated into banking apps. You have to consider whether the application will be an independent solution or part of a large financial ecosystem.

- Choosing the platform: As your budget is limited, you may choose to develop either an Android or iOS app. The best choice would be developing a P2P payment application for multiple platforms so that it will be used by more people.

- Identify USPs: Once you have an idea of user difficulties and how you want the app to cater to those challenges, you can propose USPs. The USPs will help to explain why users must select your app over any other existing solution. You may consider including criteria like security, speed, user-friendliness, and other unique features.

- Monetization model: You can use one or several models: transaction fees when you take some fee for each transaction performed, subscription packages, when the application’s additional features are offered in subscription packages; ad revenues and so on. Here, the model chosen will be based on the user base and positioning of an application in the market.

- Determine key features to include: Start with basic features before moving on to advanced ones. The features of the P2P payment app must meet the needs of the target audience.

- Select the technology stack: Research the latest fintech trends such as biometrics, NFTs, and face ID payments. List the tools and technologies that are convenient to use to increase the app’s success rate.

Step 4 – Build the development team and discuss project requirements

When building a team to create a P2P payment app, you need to look for experts with experience in payment app development, effective communication skills, and the ability to quickly adapt to changes. Research beforehand and consider outsourcing peer-to-peer app development to areas with lower hourly rates for developers to save costs.

After identifying the development team, you need to work closely with them to clarify the essential project requirements. This step will lay the foundation for P2P payment app development, ensuring the application aligns with your vision and meets user expectations.

Step 5 – Design UX/UI

While developing a P2P payment application, the UI/UX design should be intuitive and really simple to understand. You would not want your users to be in the dark while trying to work out how the application works. Investing time in designing the user interface and user experience will enhance usability and engagement throughout P2P payment app development. The UX/UI design for a peer-to-peer payment app should meet the following criteria:

- – Multiple visual paths for users to easily navigate through the app.

- – Responsive design on mobile devices.

- – Design for various screen sizes and orientations.

- – Continuous feedback collection from users to improve the app’s design and functionality.

Step 6 – P2P payment app development

To build a P2P payment app, we recommend starting with a Minimum Viable Product (MVP). The MVP focuses on implementing the essential core features needed for the peer-to-peer payment app. This allows you to test the app’s feasibility and gather valuable user feedback.

While developing the MVP of the payment application, first focus on the integration of most important features, such as account creation, money transfer, and basic security. In this way, you can put the app into the market quickly, test it there, and improve it continuously based on user feedback.

Step 7 – Security and compliance

Security and legal compliance is also an important point in peer-to-peer app development. For this, implement strong security measures in the form of multi-factor authentication and data encryption. Make sure to conduct audits frequently enough that user data and all monetary transactions stay secure.

Finally, follow legal regulations to prevent legal headaches and gain trust among end-users. Examples of well-known regulations that must be followed include GDPR and PCI-DSS. Improve security for your applications by building suspicious transaction detection systems. This approach not only makes the system more secure but also makes the application more compliant with Anti-Money Laundering legislation.

Step 8 – Quality assurance and deployment

Quality assurance is one other important step in the p2p payment app development process. Herein, expert teams do rigorous and continuous testing to find and fix bugs. The earlier bugs are detected and the more regular updates are made, the more refined the application will get.

When testing is complete, and the app meets legal and performance requirements, it will be ready for release across platforms. We recommend that after launching, a good marketing strategy be made to attract users and guarantee the success of the app.

Step 9 – Maintenance and post-launch support

It’s time to check on an already-released application continuously, bug fixes, user support, and overall ongoing monitoring that keeps the software working right. Due to regular updating and enhancement, your peer-to-peer solution will be trusted, reliable, secure, and meet user expectations.

P2P app legal compliance

All FinTech applications handle sensitive financial transactions and thus must be performed within the limits of strict adherence to legal frameworks. As a subtype of the FinTech solution, P2P payment apps aren’t an exception in any way. Your P2P payment app development will necessarily be expected to follow certain regulations, which are predetermined for the specific region you targeting to address.

For example, if you plan to build a payment app for the Asia-Pacific region:

- – You shall be required to get your approvals in China from the FinTech Committee of the PBOC.

- – In South Korea, you must collaborate with the FinTech Center under the Financial Services Commission (FSC).

- – In Australia, legal matters should be addressed with the Innovation Hub of the Australian Securities and Investments Commission (ASIC).

If your target market is the United States, legal compliance becomes significantly more complex. There are more than eight federal agencies involved in financial regulations, and each of the 50 states has its own set of financial rules. A proper plan is needed to wade through this challenging regulatory landscape.

For the European market, all P2P paying applications and FinTech solutions need to follow the EU Directive of EU 2015/2366. Additionally, if your application processes personal data concerning any EU citizen, then GDPR compliances are necessary.

Challenges in P2P payment apps and how to overcome

Financial applications are responsible for sensitive data and transactions, so users expect a lot from P2P payment applications. Nobody wants their data to be leaked. To deliver a better experience and build customer loyalty, consider these 7 challenges during the P2P payment app development process.

1. Geographical limitations

As mentioned earlier, different regions have their own rules and regulations related to financial applications. Currently, only some apps can meet all financial standards.

- Solution: Carefully research the legal regulations related to financial applications in general and P2P payment apps in particular for the region where you plan to launch the app or use user data.

2. Transaction disputes

Issues with financial transactions are not uncommon. For example, you may send money to another user, but they do not receive it. This issue can result from technical errors or other problems.

- Solution: Provide financial support during the peer-to-peer app development process by creating a dedicated team to handle these issues and ensure full refunds to the recipient.

3. Security

Ensuring security in financial transactions is extremely important. Since P2P payment apps handle highly sensitive data and transactions, they are frequent targets for cyberattacks.

- Solution: Implement strong encryption methods, authentication systems, and fraud prevention measures to protect against potential threats.

4. Payment infrastructure

Maintaining payment infrastructure during P2P payment app development is both costly and complicated.

Solution: Ensure the safety and compliance of third-party payment gateways, especially when handling large transaction volumes. Build backup and failover mechanisms into the infrastructure to ensure smooth transactions and minimize disruptions.

5. Consumer skepticism

In as much as the adoption rate for P2P apps is high, these services have not won all consumers’ trust yet. New joiners, individuals not familiar with using new technology, or the elderly would probably prefer cash payments.

Solution: Establish a marketing campaign to educate customers about its benefits in order to secure a great number of end-users who will ultimately trust the application.

How much does a P2P payment app cost?

By now, you’ve likely gained some understanding of how to build a P2P payment app. But what about the cost to create a P2P payment app? Many factors can influence the final amount, with the following being the most significant:

- Complexity of the app: The number of in-app features contributes to a great extent to the cost of making an app. The lower amount and capability make for a more budget-friendly creation, whereas advanced features build up a better user experience; instead, they are expensive too. Advanced features take some time to develop and cost resources in maintenance.

- Design and user experience: Good design for a P2P payment application will raise the level of user interaction, while high-quality design and intuitive interfaces require more significant resource investment, which is a cost driver.

- Security measures: Strong security measures, such as data encryption, strict user authentication, and fraud prevention techniques, are required to make the system reliable and compliant. However, they increase the development expenses.

- App compatibility: It costs less to develop an application on a single platform either on iOS or Android, rather than cross-platform. While the former would certainly raise the development costs, it also widens your reach to more and more users.

- Technology stack: The cost of P2P payment app development is influenced by the choice of programming language, frameworks, and third-party integrations. The usage of some technologies requires developers with a higher level of skills, which consequently means higher per-hour rates.

- Development team location: The cost of a development team depends on the region. For example, in the US or Western countries, the development is usually more expensive than in regions such as Central-Eastern Europe or Asia.

With the factors discussed above, the cost estimation to build a P2P payment app varies in a wide range. On average:

- – A simple P2P payment app with limited features and simple operations costs between $40,000 to $120,000. These applications mainly handle monetary transactions between users.

- – A P2P payment application of medium complexity, with additional features and services included, may cost around $120,000 to $200,000.

- – Highly complex P2P payment applications, including a great number of features, are developed for long-term use and can cost more than $200,000 to $300,000 or even more.

Luvina’s expertise in creating P2P applications

With two decades of experience in developing applications and software for companies representing a wide range of business industries, including many financial organizations, Luvina perfectly knows how people pay, purchase, and invest. It enables us to deliver appropriate and high-quality fintech app development services that respond to a wide array of business needs, providing secure and varied financial transactions.

Luvina maintains full security compliance when providing an enterprise with digital payment solutions. We have internationally recognized standards for the security infrastructure, are certified under ISO 27001, and commit to maintaining state-of-the-art security strategies throughout the development process. This will certainly provide maximum protection for your sensitive financial data and intellectual property.

By choosing Luvina as your partner to build a P2P payment app, you are guaranteed top services supported by ISO 9001 and CMMI Level 3 certifications. For the most unique fintech application innovations, our solution connects your financial business to technologies and tools that answer the needs of today’s rapidly transforming digital economy. We put our full effort into bringing the delivery of peer-to-peer payment apps to users for safety and reliability.

Contact Luvina today for customized solutions on P2P payment app development and other fintech applications development to suit your needs.

Conclusion

If you’re wondering how to successfully build a P2P payment app like PayPal or Venmo, this guide should give you a clear idea about the journey. It’s not easy to enter the peer-to-peer app market, but once you catch up with the trend, the results will be just awesome.

Don’t miss the chance to make your mark in the fintech industry with P2P payment app development. Contact us today to assemble a development team and get started on your project!

FAQ

What Are P2P Payment Apps?

A P2P payment application is any fintech application developed to help in the ease of sending money online by making a transaction both swift and smooth.

How Do P2P Money Transfer Apps Work?

It enables users to make financial transactions by selecting the recipient’s name, putting in the amount of payment, the reason for the payment, and the amount to be transferred after creating an account and linking their card or financial institution to the app. Sending and receiving money can take anywhere from a few seconds to a few minutes, depending on the bank’s server and the type of service used.

What are the Features of Peer-to-Peer Payment App?

Peer-to-peer payment apps typically include a wide range of features, with some essential ones like: Digital wallet; Send and request money; Invoice generation; Push notifications; Unique OTP (One-Time Password); Bank account transfers; Chat; Transaction history,…

In addition, these apps can integrate advanced features to enhance the user experience, such as Two-factor authentication; End-to-end encryption; Support for multiple payment methods; Social media integration; Currency conversion; QR code scanning,…e to contact Luvina for advice. We will always be in service!

Related Posts:

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter