Examples of Generative AI Application in Finance may sound like a buzzword, but it’s quickly becoming one of the most transformative forces in the financial world. In an era where milliseconds can determine million-dollar outcomes, financial institutions are racing to harness Generative AI not just as a tool, but as a strategic differentiator. According to a Google Cloud study, 82% of organizations already exploring GenAI believe it will fundamentally transform their industry – a prediction that’s proving truer every quarter.

In this article, we’ll explore a practical, real-world example of how generative AI is applied in finance, unpack the system integration blueprint behind it, and examine the risks and limitations financial leaders must navigate. If you’ve read our article on Generative AI in Banking, consider this your next deep dive – where theory meets tangible results.

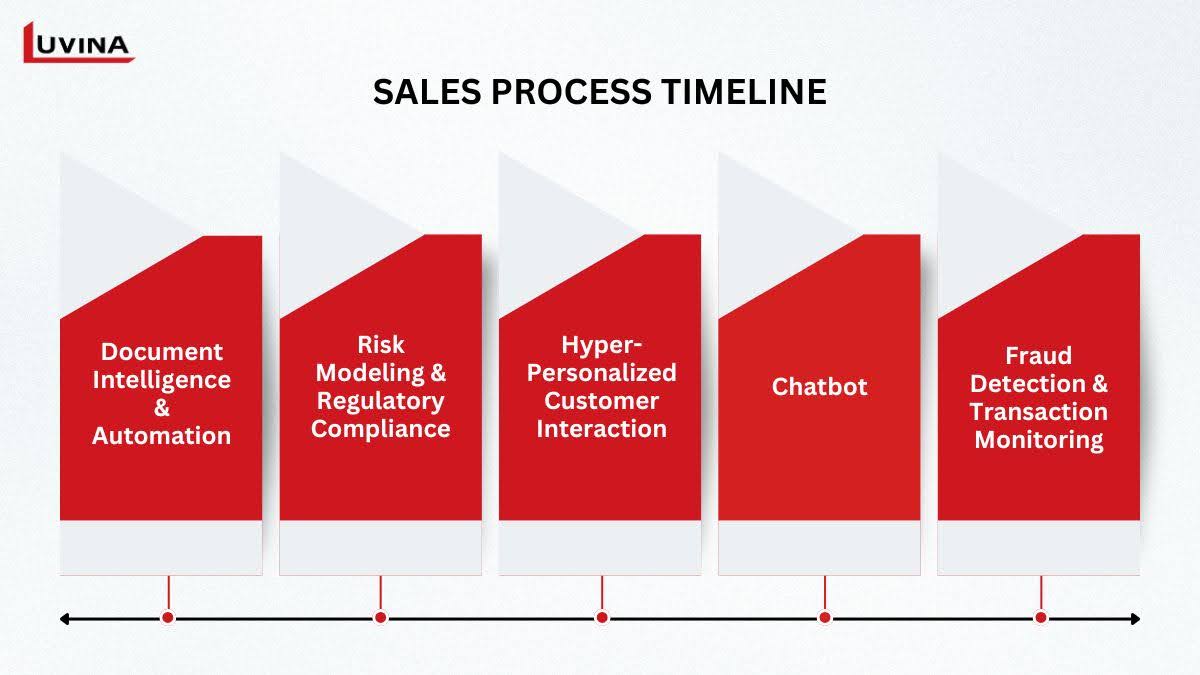

Real-World Examples of Generative AI Application in Finance

The fusion of Generative AI and finance is redefining how institutions analyze data, manage risk, and engage customers. What was once a domain ruled by static models and manual interpretation has now evolved into an ecosystem driven by intelligent automation and adaptive learning.

In this section, we’ll explore a real-world example of a generative AI application in finance. Each case reveals how GenAI is not just enhancing existing systems but reshaping the very foundation of financial operations.

Document Intelligence & Automation

One of the most notable AI use cases in finance and accounting is the enhanced emergence of document intelligence and automation. Financial professionals would spend hours producing, reviewing, and editing text-heavy reports such as regulatory filings, investment summaries, and loan applications. Reduces human effort and mistakes, today’s AI systems can automatically extract, organize, and synthesize data from erratic sources.

Modern GenAI-powered solutions surpass basic automation. From simple data inputs, they may produce unique financial documents, guarantee compliance with institutional criteria, and even highlight anomalies or possible hazards in contracts and credit reports.

Combining natural language understanding with process automation, document intelligence not only raises finance teams’ ability to concentrate on strategic analysis but also increases output rather than monotonous administrative chores, decision-making.

Risk Modeling & Regulatory Compliance

A powerful example of a generative AI application in finance lies in how institutions are transforming risk modeling and regulatory compliance through intelligent automation. Traditional systems rely heavily on historical data and manual oversight, but today’s generative AI models finance functions by synthesizing vast, dynamic datasets and ensuring adherence to complex regulatory frameworks with remarkable accuracy.

These models provide contextual interpretation in addition to identifying anomalies. GenAI can find delicate differences that could point to fraud, credit exposure, or compliance breaches by examining spending patterns, trading patterns, and client activity. Systems for retrieval-augmented generation (RAG) help to further develop this capacity by providing immediate access to institutional knowledge bases, therefore empowering risk teams to interrogate data, create audit-ready reports, and view in real time danger trends.

AI-driven solutions may automatically update internal policies to match the newest regulations and legal texts on the compliance front by consistently monitoring them. This guarantees that banks and financial companies stay active rather than passive in their compliance plans.

Hyper-Personalized Customer Interaction

Among the most significant Gen AI use cases in finance is the development of hyper-personalized customer experiences that transform financial institutions’ interactions with their customers. Generative artificial intelligence may create individualized financial advice, predict client needs, and suggest products that fit just with personal objectives by using enormous volumes of consumer data.

To assess opinion towards financial products and services, GenAI systems now examine real-time input from social media, chat logs, and emails. These ideas enable organizations to change their marketing plans, perfect their product line, and proactively address consumer complaints.

Chatbot

One outstanding example of a generative AI application in finance is the contemporary chatbot, which has gone from a basic FAQ tool into an intelligent assistant able to recognize intent, emotion, and nuance. This advancement draws attention to one of the most effective Gen AI use cases in banking, changing how financial organizations engage with their customers around the clock.

GenAI chatbots can compile pertinent insights from vast datasets, provide tailored answers in natural, conversational language, and, unlike conventional bots restricted to programmed responses. Besides answering regular questions like checking balances or scheduling payments, they also support consumers in more complicated scenarios, such as navigating fraud with amazing precision and compassion, reports, or credit conflicts.

Leading banks are already proving the power of this technology. For instance, Bank of America’s “Erica” has facilitated over two billion interactions, showcasing how GenAI can deliver scalable, always-on service while freeing human agents to handle more strategic or emotionally sensitive cases.

Fraud Detection & Transaction Monitoring

Among the most critical generative AI use cases in financial services is fraud detection and transaction monitoring – an area where the technology’s adaptive learning capabilities are proving invaluable. Conventional rule-based systems frequently have difficulty matching the fast-changing methods of fraud, yet generative artificial intelligence thrives on complexity. It can find little irregularities, odd spending habits, and growing fraud patterns long before they turn into major financial dangers by constantly learning from massive historical and real-time datasets.

Modern GenAI systems use deep learning together with predictive analytics to evaluate transactions in milliseconds, therefore differentiating genuine behavior from probably fraudulent activity. A credit card issuer, for instance, may automatically detect suspicious purchases such as unexpectedly large-value transactions initiated overseas, and potentially identify or halt the transaction before the loss occurs.

In addition to detection, generative artificial intelligence is useful to support proactive risk management methods by identifying underlying behavioral changes related to consumer spending patterns or economic trends.

How to Integrate Generative AI into Financial Systems

Building on our first example of a generative AI application in finance, it is clear that the real struggle is not just about deploying the technology; it is on deftly incorporating it inside sophisticated financial systems. Every company must choose whether to develop its own artificial intelligence systems or invest in outside solutions; we will examine the major decision point below. We will then lay out the plan for deployment, scaling, and governing generative artificial intelligence.

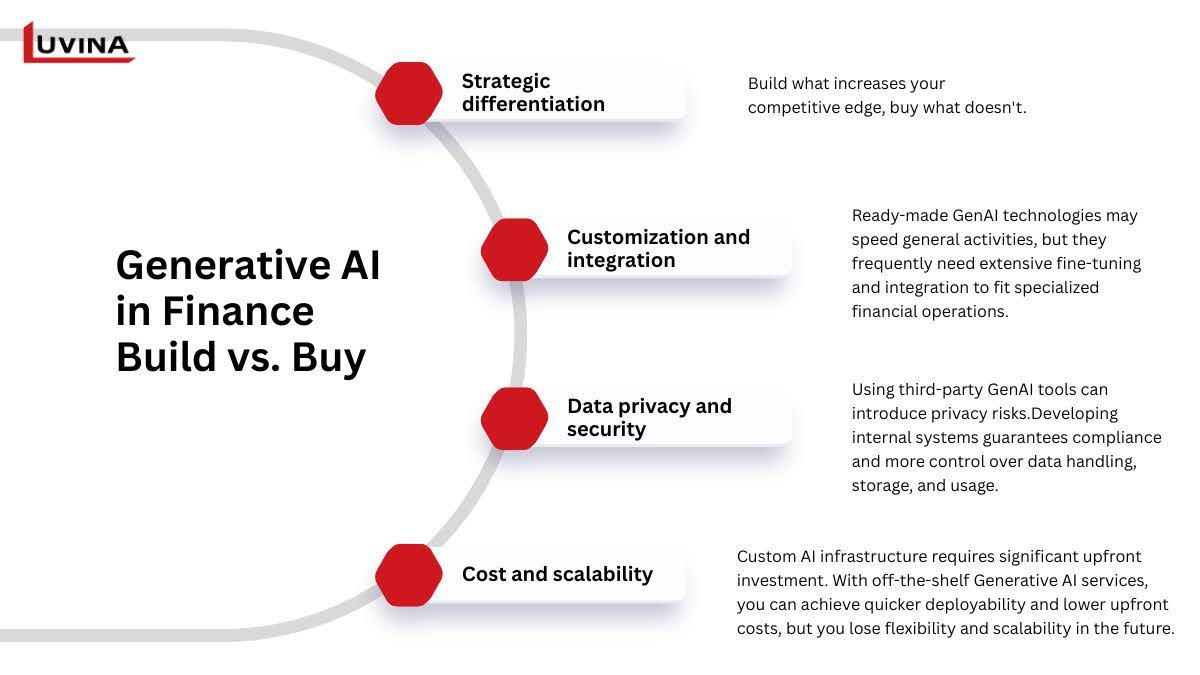

Key Decision Point: Build vs. Buy

Institutions face one of the most important strategic decisions regarding the implementation of generative artificial intelligence in financial operations: whether to develop custom solutions internally or purchase current products from outside suppliers. GenAI use cases in banking are expanding, from customer service to risk modeling. Understanding the trade-offs between build and buy strategies is crucial.

Below are the key factors to consider when it comes to choosing between build and buy:

Strategic differentiation

Build what increases your competitive edge, buy what doesn’t. A proprietary transaction-matching engine taught on your institution’s internal data, for instance, would be a great example of a generative AI application in finance worthy of developing in-house. Unlike off-the-shelf solutions that competitors can easily access, it lets you create special features tailored to your data and compliance procedures.

Customization and integration

Each bank has unique data architectures, procedures, and legal requirements. Although ready-made GenAI technologies like Microsoft Copilot or OpenAI’s ChatGPT may speed general activities, they frequently need extensive fine-tuning or Retrieval-Augmented Generation (RAG) integration to fit specialized financial operations. Though it calls for technical knowledge and continuous maintenance, building in-house enables smooth integration and data quality control.

Data privacy and security

Under tight regulatory systems, financial organizations manage extremely sensitive information. Using third-party GenAI tools can introduce privacy risks as external models might expose proprietary information. Developing internal systems guarantees compliance and more control over data handling, storage, and usage.

Cost and scalability

Custom AI infrastructure requires significant upfront investment in data pipelines, processing capacity, and human skills in AI. With off-the-shelf Generative AI services, you can achieve quicker deployability and lower upfront costs, but you lose flexibility and scalability in the future. You should consider the total cost of ownership given the current need and ongoing growth.

In practice, the best strategy is a hybrid approach by purchasing generative AI tools that are pre-trained for repeatable workflows and developing bespoke models for use cases that are sensitive and have high stakes. This hybrid approach allows organizations to be innovative, maintain data fidelity, and receive a better return on investment over time from their AI spend.

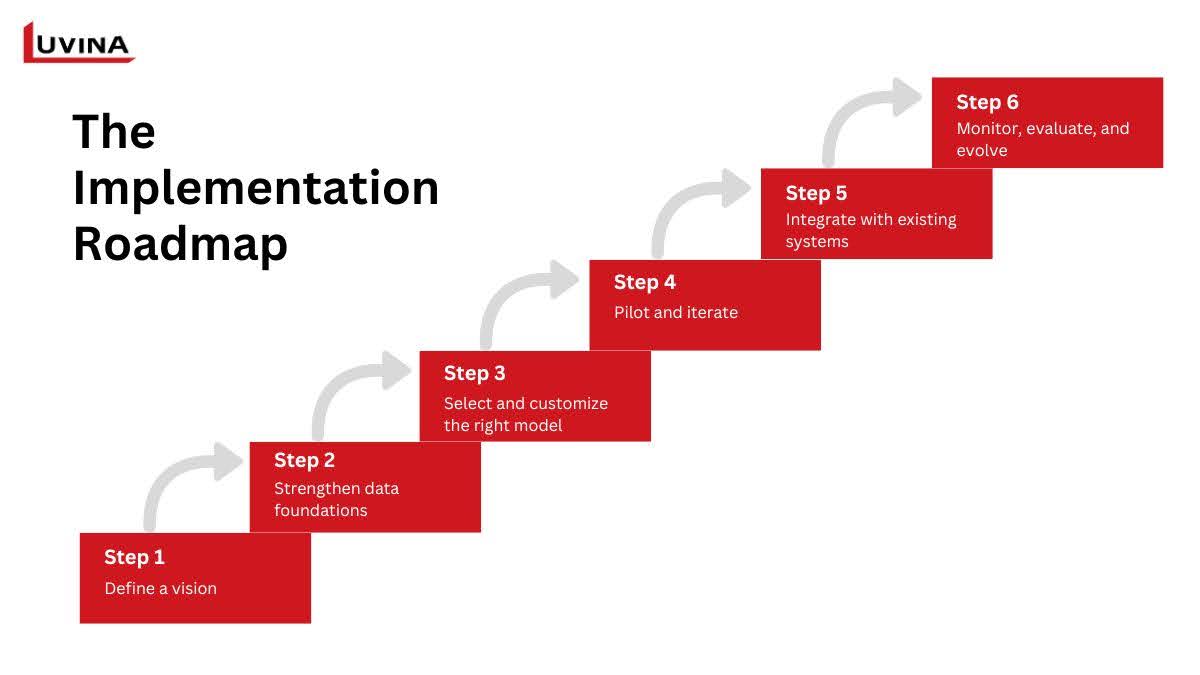

The Implementation Roadmap

Turning AI use cases in finance from ideas into results requires a structured, iterative method combining data, technology, and oversight.

Step 1: Define a vision

Start by defining a precise artificial intelligence vision that is consistent with corporate needs. Leaders must determine which systems or judgments may be improved by means of generative intelligence or automation. One example of a generative AI application in finance would be automating credit risk evaluations or maximizing investment recommendations using AI-driven models.

Step 2: Strengthen data foundations

The performance of artificial intelligence depends on data quality. While guaranteeing compliance with rules including GDPR and Basel III, financial institutions should give top importance to compiling, sanitizing, and securing data from many sources. Establishing a good model training and trustworthy insights depend on a strong data architecture.

Step 3: Select and customize the right model

The decision on whether to use open source, patented, or hybrid generative AI models is based on the organizational goals, types of data available, and amount of customization external to the pre-trained state. If general automation is the aim, there is an argument for a financial organization to deploy pre-trained models that have been customized for specific use cases (e.g., financial reporting, transaction monitoring).

Step 4: Pilot and iterate

Pilot the model in a regulated environment before starting scaling. This lets groups verify compliance, performance, and correctness under actual circumstances. Iterative testing guarantees the model fits operating objectives and ethical standards, helps to improve outputs, and reveals possible biases.

Step 5: Integrate with existing systems

Integration is key for adoption. To avoid workflow interruption, generative Artificial Intelligence (AI) technologies must integrate into existing digital banking systems, Customer Relationship Management (CRM), or analytics platforms without interruption. When merged well, it ensures that people can utilize the AI solution without added complexity.

Step 6: Monitor, evaluate, and evolve

After implementing the solution, it’s imperative to continuously monitor and review results. Constant training and optimization will ensure accuracy and compliance as data shifts and market trends evolve.

Risks, Limitations, and Mitigation Strategies

Though generative artificial intelligence presents transformational possibilities for financial institutions, its use also presents particular operational, ethical, and regulatory difficulties. Well-designed systems – such as an example of a generative AI application in finance for automated loan approvals or fraud detection – can have problems with model drift, data bias, or transparency gaps. The following parts investigate these hazards and restrictions, then offer practical mitigating measures to guarantee responsible and sustainable AI adoption.

Risks and limitations

The following constitute the main risks of AI use cases in banking today:

- Data privacy and security risks: The consistency of & secure management of sensitive financial data puts banks at risk of data breach or intrusion as they train, store, and infer AI without adequate encryption and access restrictions, resulting in data privacy and security risks.

- Model hallucination and bias: When generative AI returns biased or incorrect outputs, mistakes can be made in lending decisions, credit ratings, or risk assessments.

- Lack of explainability: The “black box” design of many artificial intelligence systems makes it difficult to follow or defend choices, hence creating regulatory and audit problems.

- Cybersecurity risks: The use of AI could create new attack surfaces for bad actors looking to manipulate models or obtain secrets.

- Third-party security risks: Relying on third-party AI vendors may further expose institutions to misuse of data as well as supply chain compromises. Moreover, the security of third-party systems may be at risk, which involves less accountability, as security methods may not be comparable across all of its vendors.

Resource-intensive: Building and sustaining complex artificial intelligence systems requires significant financial investment and specific expertise, which makes it difficult for smaller financial institutions to scale.

Effective mitigation strategies

Organizing innovation with strong governance will enable businesses to properly grow generative AI use cases in finance and accounting. Without the appropriate safeguards in place, even an example of a generative AI application in finance – automated risk scoring – can have negative consequences. These are important ways financial institutions may use artificial intelligence ethically to minimize risks and maintain compliance.

Enhance data governance and security practices: Apply data governance and security protocols, such as encryption, anonymization, and multiple-layer cybersecurity standards of multiple layers, to protect sensitive financial and personal information. Also, utilize the use of audit trails and sampling to detect and deter unauthorized access or unauthorized modification of that information at the same time.

Establish ongoing monitoring and auditing: Continuously monitor artificial intelligence systems to ensure conformity, accuracy of performance, and the prevention of undesirable results.

Engage human oversight and accountability in decisions: Establishing mechanisms for human review of significant AI outputs, and giving governance boards (or ethics boards) the opportunity to conduct reviews of substantial decisions, while involving the disclosure of AI execution of financial activity and accountability, is necessary.

Efforts should proactively identify and mitigate bias: Fairness audits and bias detection tools should be employed to assist in mitigating adverse kinetical dualities. Diverse quality data sets should be utilized for the training of AI systems to assist in justifying the treatment of customers across different populations and demographics.

Encourage interdisciplinary collaboration: Promote communication among compliance, Information Technology, Data Science, and legal teams to get the assurance that the artificial intelligence systems are compliant and responsible when implemented. Use external artificial intelligence consultants for more guidance on ethical and technical best practices.

Create a culture of education for instructors: Provide people with the most updated and appropriate knowledge about responsible AI practices, model governance, and compliance procedures. Continuous education prepares individuals to identify and mitigate risks and improve institutional accountability.

FAQ

What is an example of a generative AI application in finance?

Automated report generation – where financial data is used by artificial intelligence systems to produce real-time performance summaries – is a standard example of a generative AI application in finance, or risk analysis documents with little human contribution.

Is generative AI safe to use in financial services?

Yes, when implemented with strong data governance, transparency, and compliance controls. Financial firms must regularly audit AI models, mitigate bias, and ensure decisions can be explained to meet regulatory standards.

Can generative AI assist in financial forecasting and modeling?

Absolutely. Generative AI models can generate realistic financial forecasts by analyzing historical data, market trends, and economic indicators.

What are future trends for generative AI use in finance?

Future trends include customized financial advising tools, automated investment strategy creation, and sophisticated fraud detection models, all using generative artificial intelligence to provide speedier, more accurate, and more scalable services.

Conclusion

Success with generative artificial intelligence in the quickly changing financial technology landscape depends not only on creativity but also on accuracy, compliance, and ethical use. Every example of a generative AI application in finance shown above underlines how true business value can be driven by creativity combined with robust governance and security.

Financial organizations can unleash the advantages of artificial intelligence without sacrificing trust or compliance by setting out explicit goals and using safe, task-specific models inside regulated settings.

Resources

- https://cloud.google.com/blog/topics/financial-services/five-generative-ai-use-cases-financial-services-industry

- https://appinventiv.com/blog/generative-ai-in-finance/

- https://www.ai21.com/knowledge/generative-ai-in-finance/

- https://www.ibm.com/think/topics/artificial-intelligence-finance

- https://www.getdynamiq.ai/post/generative-ai-and-llms-in-banking-examples-use-cases-limitations-and-solutions

- https://www.prismetric.com/generative-ai-in-finance/#ai-enabled-portfolio-optimization-and-personalized-financial-advice

- https://research.aimultiple.com/generative-ai-finance/

- https://www.dataversity.net/articles/answering-the-build-vs-buy-question-for-generative-ai/

- https://medium.com/@vangelis_34955/genai-in-banking-build-vs-buy-why-making-the-right-decision-matters-c825bd4eab60

Read More From Us?

Sign up for our newsletter

Read More From Us?

Sign up for our newsletter